Alphabet (GOOGL) is a holding company, with Google, the Internet media giant, as a wholly owned subsidiary.

Google accounts for 99% of Alphabet’s revenue, of which substantial revenue is generated from online ads. We are bullish on the stock.

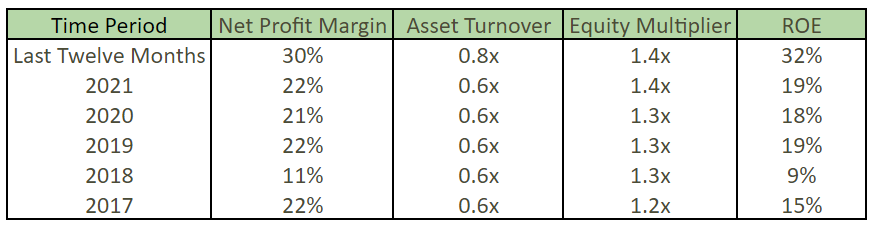

DuPont Analysis

Alphabet is a very profitable company because it is very efficient at using resources. A quick look at the company’s historical return on equity (ROE) trend highlights this efficiency. In the last five fiscal years, ROE has grown from 22% in 2016 to 30% in the last 12 months.

This improvement in efficiency is even more impressive when breaking down the ROE trend into a DuPont analysis, separating it into three different parts: net profit margin, asset turnover, and equity multiplier. An increase in ROE is ideal when it is driven by increases in profit margins and asset turnover as opposed to leverage (equity multiplier).

When looking at the chart above, we can see that although the equity multiplier increased (meaning the company took on more leverage), the net profit margin grew as well. Another way to look at it is that GOOGL took on 16.6% more leverage to grow its profit margin by 36.4% more.

This suggests that the management team is highly effective at allocating capital and creating value for shareholders.

Alphabet Has Strong Global Influence

With its search engine, Google Pay, and YouTube, there is no doubt that Alphabet has the power to influence nations. In fact, the company is using its clout to influence Russia following the invasion of Ukraine.

It has limited the use of Google Pay in Russia for customers or merchants that use a sanctioned bank. Furthermore, it has stopped selling online advertising in Russia while also demonetizing and blocking Russian state-owned media YouTube channels.

Fortunately for investors, Russia only accounts for about 0.5% of total revenue. Therefore, the impact will be minimal for Alphabet. Nonetheless, this level of influence is undoubtedly a strong competitive advantage that very few companies will ever be able to accomplish.

This places Alphabet in a position to continue seeing strong growth for many years to come.

Valuation

To value Alphabet, we will use the H-Model, which is similar to a three-stage discounted cash flow model. The H-Model assumes that growth will decelerate linearly over a specified period of time.

We believe this is a reasonable assumption as companies gradually slow down as they mature.

The formula is as follows:

Stock Value = (CF(1+tg))/(r-tg) + (CFH(hg-tg))/(r-tg)

Where:

CF = free cash flow per share

tg = terminal growth rate

hg = high growth rate

r = discount rate

H = half-life of the forecast period

For Alphabet, we used the following assumptions:

CF = $100.96 per share

tg = 2.394% (using the 30-year U.S. Treasury yield)

hg = 19.7% (based on analysts’ estimates)

r = 7.0%

H = five years (we are assuming it will take 10 years to reach terminal growth)

As a result, we estimate that the fair value of Alphabet is approximately $4,141.07 under current market conditions.

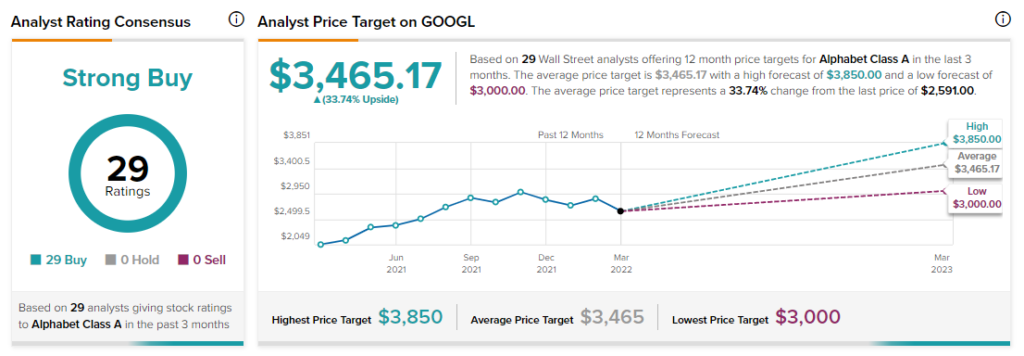

Wall Street’s Take

Turning to Wall Street, Alphabet has a Strong Buy consensus rating, based on 29 Buys assigned in the past three months. The average Alphabet price target of $3,465.17 implies 33.7% upside potential.

Final Thoughts

Alphabet is obviously one of the best companies in the world with unanimous support from Wall Street. It will be interesting to see how inflation and the Russia/Ukraine conflict will impact both its top and bottom lines in 2022.

Although GOOG stock is currently in a downtrend and may see more short-term downside or sideways action, we are bullish on the stock in the long term based on its fundamentals.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure