It is Big Tech week on Wall Street, with the industry giants stepping up to the earnings plate. Facebook (FB) will go first and deliver its third-quarter results today after the close.

For anyone who has just climbed out from under a rock, the social media behemoth has rarely been out of the headlines recently, with issues ranging from service outages, accusations of ignoring violent rhetoric, a wonky newsfeed algorithm and whistleblower allegations that the company is prioritizing profit over users’ wellbeing.

You would think these would cause damage but Credit Suisse’s Stephen Ju believes the “negative data points” are having less impact than you assumed.

“Advertisers are not boycotting on these headlines and our checks continue to suggest that Facebook is benefiting from auction price inflation due to a multitude of factors including a relative slowdown in ad impression growth, demand acceleration from the return of existing and addition of new merchants/advertisers, as well as Shops/Instagram Shopping conferring higher conversion rate (due to decreasing need to click out and consummate transactions on-platform),” the 5-star analyst said.

The company usually provides an update on anticipated operating expenses with the Q3 print and Ju thinks investors are now expecting these to come in above $90 billion in 2022, although Ju’s estimate stays below that figure – at $88 billion. There is a change, however, to Ju’s EPS estimates for FY21 and FY22; these drop from $17.43 and $19.79, respectively, to $17.34 and $19.70.

Nevertheless, the analyst believes the Street is underestimating the “long-term monetization potential of billion-user properties” like Messenger and WhatsApp. Additionally, innovative products such as Facebook Shops and Search in Marketplaces have the potential to “drive better than-expected” ad revenue growth.

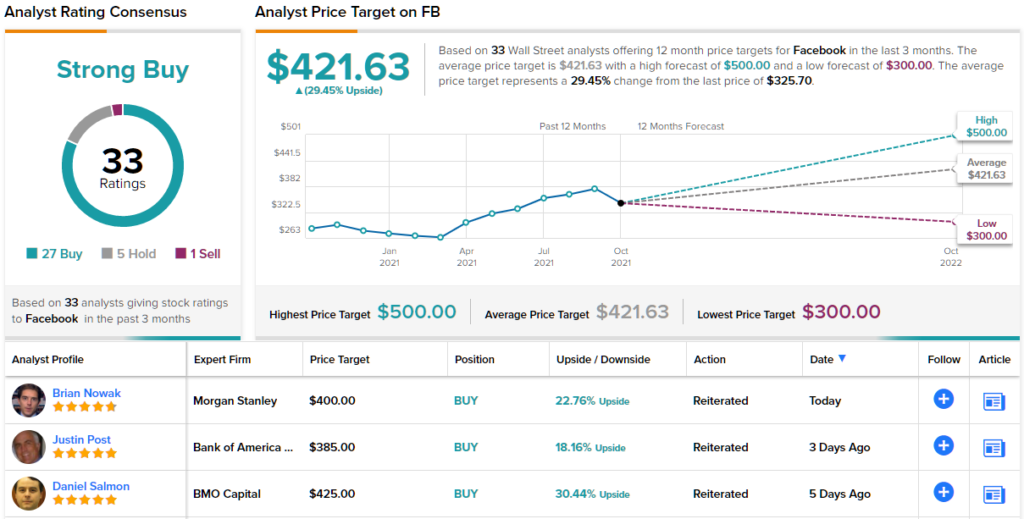

As such, ahead of the print, Ju reiterates an Outperform (i.e. Buy) rating on FB, backed by a joint Street-high $500 price target. The implication for investors? Upside of 54% from current levels. (To watch Ju’s track record, click here)

Most analysts agree with Ju. There are currently 33 Facebook reviews on record, which break down to 27 Buys vs. 5 Holds and 1 Sell, all culminating in a Strong Buy consensus rating. Going by the $421.63 average target, shares will appreciate by 29% in the year ahead. (See Facebook stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.