E-commerce giant Amazon (AMZN) is set to release its Q122 financial results on Thursday, April 28.

AMZN stock is supported by ongoing digital transformation, strong fundamentals, and financial stability. However, supply chain problems, rising labor costs, and inflationary pressures have continued to wreak havoc on the company’s bottom line.

Amazon announced mixed earnings in the fourth quarter. Topline growth of 9% year-over-year fell short of the $137.56 billion average projection. Earnings of $27.75, on the other hand, beat average estimates of $3.61 per share.

Let’s examine how the company is expected to fare in the first quarter of 2022.

Q1 Expectations

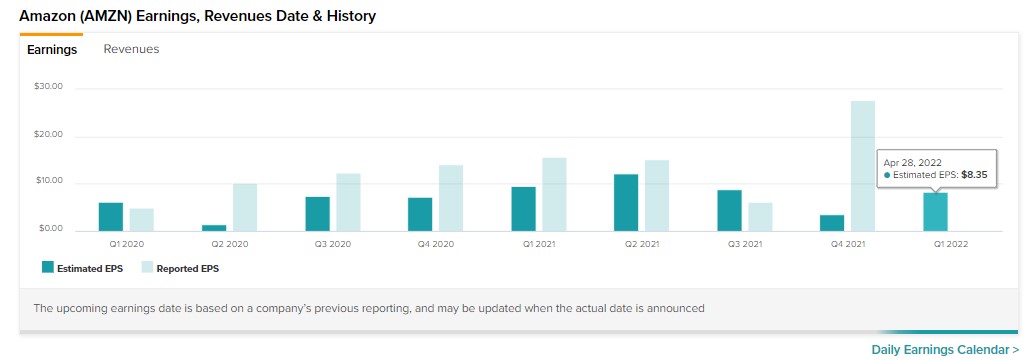

According to analysts, Amazon is expected to report adjusted earnings of $8.35 per share. The Q1 EPS estimates reflect a decrease of 47% in earnings from the year-ago quarter.

Website Traffic Reflects an Upward Trend

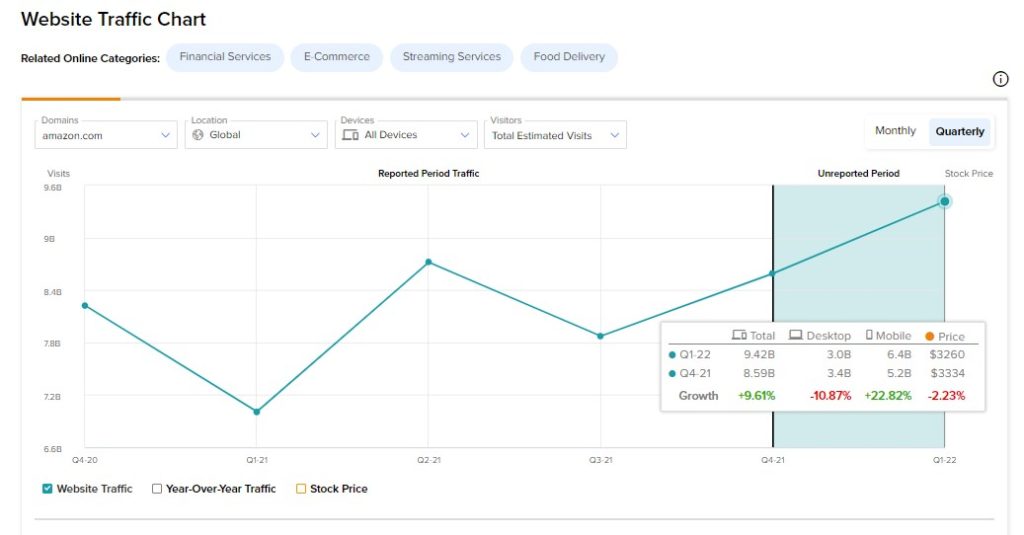

For an e-commerce firm like Amazon, total website visits are a good indicator of user involvement on Amazon’s platform. The company’s main website, amazon.com, focuses on the buying and selling of goods.

Therefore, we used TipRanks’ new Website Traffic Tool to learn more about Amazon’s performance ahead of the Q1 report.

We discovered through the tool that overall projected visits to Amazon’s core platform, amazon.com, increased in Q122. More precisely, we see that total visits to amazon.com increased by 9.6% sequentially to 9.4 billion.

Wall Street’s Take

Ahead of the Q1 earnings results, Monness analyst Brian White is upbeat about the company’s expansion across various verticals, namely “the e-commerce segment, AWS, digital media, advertising, Alexa,” among others. He also feels that Amazon’s business model will benefit from the push toward faster digital transformation.

However, the analyst told investors, “We expect antitrust investigations to carry on, the geopolitical environment is growing more dangerous by the day, and the impact of inflation remains a wildcard.”

As a result, White maintained a Buy rating on the stock and a price target of $4,500 per share. This implies 54% upside potential from current levels.

The Street is optimistic about Amazon, with a Strong Buy consensus rating based on 35 Buys, one Hold, and one Sell. At $4,100.26, the average AMZN price target suggests 40% upside potential from current levels.

Bottom Line

AMZN stock appears to be a good choice, with a market capitalization of $1.49 trillion and gains of around 5% over the past three months, backed by double-digit upside potential, growing monthly visits, and bullish analyst commentary.

It’ll be interesting to see how the company does in the first quarter of 2022, given its long-term global supply chain difficulties and inflationary pressures.

Learn more about the Website Traffic tool in this video by Youtube sensation Tom Nash.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure