Shares of Chinese tech titan Alibaba (NYSE: BABA) have continued to tumble further into the abyss amid the perfect storm of headwinds. China’s macroeconomic headwinds and government-placed hurdles have weighed most heavily on Alibaba stock’s multiple. Though Alibaba stock may seem more like a value trap than a deep-value play through the eyes of American investors, I do think that shares are likelier to fall into the latter category for investors with investment horizons beyond five years.

It’s the government-related risk of Chinese stocks that makes it difficult for investors and analysts to formulate accurate financial models. Alibaba is a wonderful and dominant business that rivals the likes of the most powerful American FAANG stock. Still, Alibaba stock and other Chinese tech giants deserve to trade at a discount relative to the harsh regulatory environment it has little to no control over.

After shedding 72% of its value from peak to trough, I think regulatory risks are now more than baked into the share price. At the end of the day, Alibaba is an original innovator building great things. As Alibaba’s management team becomes better at following strict rules laid out by the Chinese government, I think the impact of stiff penalties and growth-stunting new measures can be mostly avoided.

In essence, management is just getting accustomed to the harsh new realities that could take away its long-term growth rate and margins. Even with a less-than-ideal regulatory environment, Alibaba seems like a firm that can continue powering higher over time. I remain incredibly bullish on BABA stock, even though much greater uncertainties are involved with betting on Chinese tech stocks at this juncture.

On the surface, Alibaba looks like a ridiculously cheap stock.

Profitability-Preservation Mode Could Steady BABA’s Sails in a Downturn

It’s been the perfect storm of headwinds for Alibaba stock over the past year and a half. Management noted that macro headwinds could continue to take a stride out of the firm’s step. In response to macro question marks, Alibaba is looking to do everything it can to steady the sails. The company is looking to trim away costs across the board. Undoubtedly, many American tech firms have been doing the same in recent weeks in response to macro storm clouds that seem to be closing in.

Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL) is just one firm looking to make the most of the recession to lean out and improve productivity by 20%. CEO Sundar Pichai may accomplish his goal of improving per-employee productivity as Alphabet looks to take a step back to “simplify.”

Alphabet isn’t the only firm that could make the most of a bad macro situation. The Chinese tech giants, Alibaba in particular, seem to be focused on driving company efficiencies. Like Alphabet, Alibaba has its hands in many hot growth markets, from digital commerce to the cloud. Looking ahead, Alibaba is looking to keep its foot on the pedal with businesses that show “long-term potential” while looking to wind down money-losing businesses or segments that aren’t pulling their own weight.

Indeed, being a tech behemoth comes with its perks going into a downturn and rate-tightening cycle: they have the agility to swiftly pivot towards margin-driving initiatives and away from expensive, forward-looking, unprofitable endeavors. Once credit is easy and the economy is booming again, firms like Alibaba and Alphabet can easily allocate funds back to “moonshot” non-core growth drivers and away from their profitable core.

In the meantime, Alibaba will be busy re-evaluating its business divisions to maximize profitability in a time when operating efficiencies matter more than growth stories. I think Alibaba’s pivot toward greater efficiencies has yet to be factored into the share price.

Though the turbulent Chinese tech scene will always be subject to wild swings, I think the stock has overswung to the downside. Alibaba is taking its foot off the gas with certain non-core areas of its business while it continues to invest in its core growth drivers like e-commerce.

At writing, shares of Alibaba trade at a low 1.7x price-to-book (P/B) ratio and at a 2.1x price-to-sales (P/S) ratio, both of which are a far cry below five-year historical averages of 5.7x and 8.2x, respectively.

Is BABA Stock a Buy, Sell, or hold?

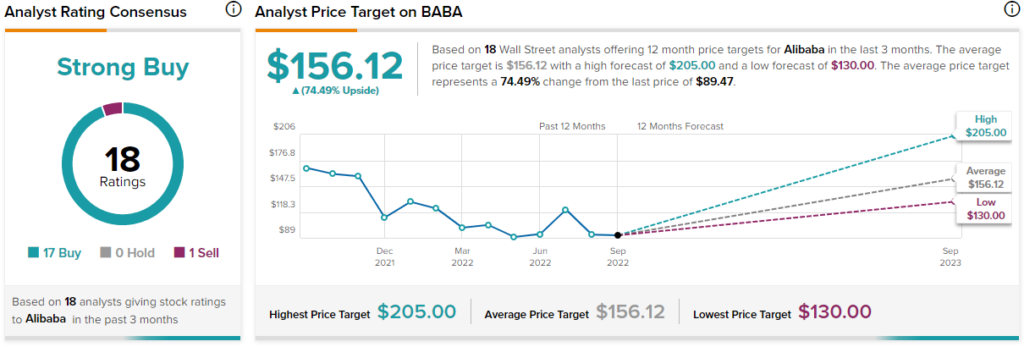

Turning to Wall Street, BABA stock comes in as a Strong Buy. Out of 18 analyst ratings, there are 17 Buys and one Hold recommendation. The average Alibaba price target is $156.12, implying an upside of 74.5%. Analyst price targets range from a low of $130.00 per share to a high of $205.00 per share.

Conclusion: BABA Stock Looks Cheap

Historically, Alibaba’s depressed multiples suggest the stock is close to the cheapest it’s ever been. Even with regulatory unknowns, macro headwinds, and delisting threats, the stock seems like a prime pick-up for a long-term investor willing to endure considerable pain over the near-to-medium term for a shot at potentially outsized long-term gains.