The past couple of years have been very tough for Chinese equities, including for Alibaba (BABA). It all started with the Chinese government’s crackdown on Big Data, scaring international investors.

Fear remained with the ban on for-profit tutoring, which resulted in shares of New Oriental Education (EDU) and TAL Education Group (TAL) forfeiting more than 90% of their all-time high values.

Today, with tech stocks undergoing a valuation multiple compression as well as increased macro risks related to the ongoing Ukraine-Russia conflict, Alibaba shares continue to be under pressure.

On the one hand, there is no doubt that there are multiple risks attached to Chinese equities, which, apart from the above, include a lack of transparent communication with shareholders, foreign corporate governance culture, and the VIE structure. These can discourage investors from allocating capital to stocks such as Alibaba.

On the other hand, BABA stock has become increasingly cheaper, as its shares decline, but its revenues grow.

In my view, Alibaba’s growing financials continue to be robust, and I want to believe that at some point, this value will have to be reflected in the stock price. For this reason, I remain bullish on the stock.

Recent Developments

Alibaba’s latest quarterly results affirmed the company’s strength, despite the turbulent environment surrounding the market.

Revenues grew 10% year-over-year to $38 billion, with Alibaba’s worldwide Ecosystem reaching about 1.28 billion annual active consumers. This implies 42 million net user adds compared to the prior quarter.

EPS per ADS came in at $1.18, 75% lower year-over-year, but this was only due to Alibaba’s elevated investments in fundamental strategic areas, which should lead to robust ROI over time, in the same manner, we have seen the company execute in the past.

If Alibaba were to ease its CAPEX spending, its net margins could very well transcend 30%. Even the richest-margin American tech firms would be jealous of such margins.

Valuation

Based on Alibaba’s FY 2022 estimated EPS of $8.30, the stock is trading at a P/E of around 12.2. With analysts expecting a very believable EPS growth in the mid-teens through the medium term, the stock is clearly very cheaply valued

The stock’s trajectory persists to mismatch the company’s expansion and profitability prospects. At some point, the stock will hit a bottom, and that should be sooner than later.

Alibaba’s management is energetically taking advantage of this issue by repurchasing shares inexpensively in order to build equity value. Last quarter, it repurchased around $1.4 billion worth of stock, or $7.7 billion over the past three quarters.

Not a giant “buyback yield,” but surely another catalyst to help push the stock higher moving forward, particularly if the pace of buybacks accelerates.

Wall Street’s Take

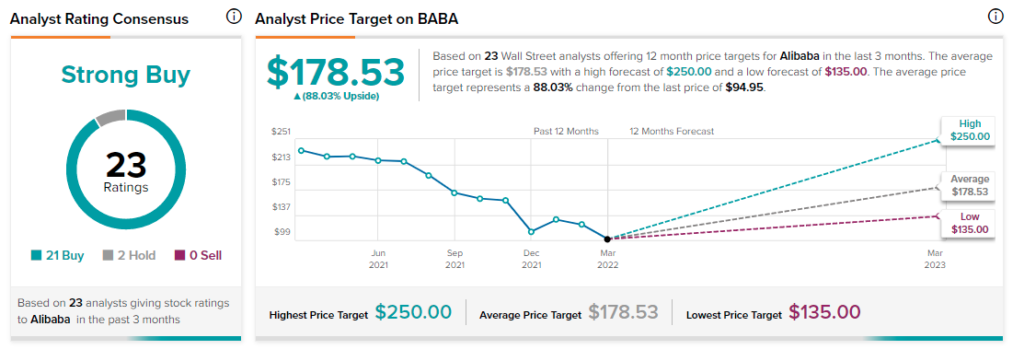

Turning to Wall Street, Alibaba has a Strong Buy consensus rating, based on the 21 Buys and two Holds assigned in the past three months. At $178.53, Alibaba’s stock forecast implies 88% upside potential.

Takeaway

While risks with Alibaba’s investment do exist, the company’s growth relative to its current valuation is hardly justifiable.

With the company starting to show some support to shareholders through its recent buybacks, it may be time for investors to start appreciating Alibaba more.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure