Investing strategies often pit the long-term view against the need for short-term results. Looking for quick gains requires a different mindset from that of an investor content to let a long-term story unfold. Avid street watchers will be aware recent times have been no bed of roses for Alibaba. (BABA). But assessing the Chinese ecommerce giant’s prospects, Baird’s Colin Sebastian tells investors the long-term is key here, as fundamentals “remain intact.”

“Importantly,” the 5-star analyst went on to say, “With the stock trading at near record-low multiples, we believe shares already price in headwinds from ongoing political tension, regulatory issues, and higher near-term opex spending, which may begin to moderate given healthy underlying business fundamentals.”

First though, Alibaba needs to navigate some choppy waters. In fact, looking ahead to the company’s June quarter earnings (August 3rd), Sebastian has made some downward revisions based on “modestly lower physical retail growth expectations.”

That is despite the fact Alibaba’s e-commerce platforms continue to gain share, causing Sebastian to estimate F1Q21 (June) revenue growth will “accelerate sequentially.” Additionally, the post-pandemic macro environment has “largely stabilized.” However, recent NBS (National Bureau of Statistics of China) data suggests retail sales through the quarter have modestly decelerated.

Despite relatively easy comps – June 2020 retail sales were down 1.8% year-over-year – in June, total retail sales of consumer goods grew by 12.1%, below the 12.4% uptick in May and the 17.7% growth exhibited in April.

Moreover, the data showed total year-to-date online retail sales growth of 18.7% through June, compared to the 19.9% year-to-date growth reported through May.

Accordingly, Sebastian lowered his June quarter revenue estimate of ¥220.1 billion at 43% year-over-year growth to ¥212.2 billion, which reflects a 38% increase from the same period last year.

Nevertheless, looking ahead, the moderating trends are of no serious concern to Sebastian.

“Despite these near-term headwinds,” the analyst wrapped up, “We continue to view the ongoing expansion of physical infrastructure (retail stores and fulfillment/logistics) as key longer-term drivers of retail growth and TAM expansion.”

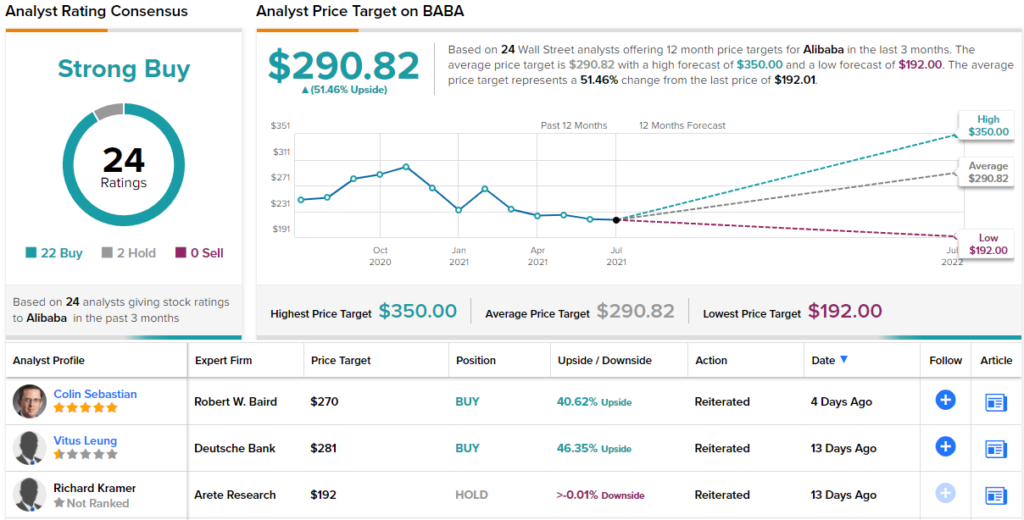

To this end, Sebastian reiterated an Outperform (i.e. Buy) for BABA shares backed by a $270 price target. This figure implies ~40.5% from current levels. (To watch Sebastian’s track record, click here)

So that’s Baird’s view, what does the rest of the Street have in mind for BABA stock? Barring 2 Holds, all 22 other reviews say Buy, resulting in a Strong Buy consensus rating. There’s plenty of upside projected too; at $290.82, the average price target suggests shares will be trading for a 41% premium, a year from now. (See Alibaba stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.