Alibaba (NYSE:BABA) will announce its Q3 (December ended quarter) financials on February 24. However, continued macro weakness and competitive headwinds suggest that Q3 results could fail to lift its stock price.

It’s worth noting that several analysts have lowered their price targets on Alibaba stock ahead of the Q3 print citing ongoing macro headwinds. Among them is Vincent Yu of Needham, who reduced his price target to $180 from $230.

Yu stated, “China’s macro continue to exhibit weakness on the consumer spending side,” which could weigh on Alibaba’s financials. Citing these challenges, Yu reduced his Q3 revenue estimate by 1%. Further, he cut his operating income, EBITA, and net income estimates by 17%, 13%, and 10%, respectively.

China’s GDP and consumption growth have slowed, negatively impacting Alibaba’s retail sales. Moreover, regulatory headwinds and heightened competitive activity in the e-commerce space continue to remain a drag.

During the last quarter’s conference call, Alibaba’s CFO, Maggie Wu, stated that China’s GDP and consumption have slowed, which will have a major impact on Alibaba as the biggest player.

While Alibaba’s commerce business could remain challenged, Yu also lowered his revenue estimate for cloud computing. Yu stated that Alibaba’s clients in the internet, gaming, and education sectors are seeing weakness in their own business and are cutting their budgets, which will impact BABA’s cloud revenues.

Nevertheless, Yu is bullish about Alibaba’s long-term prospects and expects it to increase its market share gradually.

Wall Street’s Take

The ongoing macro and regulatory headwinds weighed on Alibaba stock, reflected through a 54% correction in its price over the past year. Further, TipRanks’ Hedge Fund Trading Activity tool indicates that hedge funds have been offloading BABA stock and sold 45.9M Alibaba shares in the last quarter.

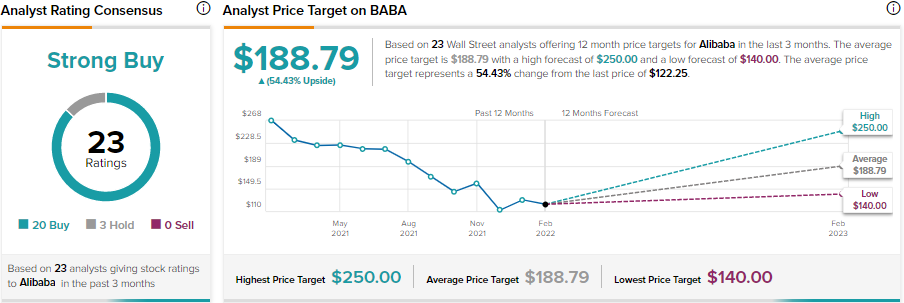

Due to the correction, BABA’s stock price forecast on TipRanks shows significant upside potential. The average Alibaba price target of $188.79 implies 54.4% upside potential to current levels.

Meanwhile, most analysts are bullish about BABA stock. On TipRanks, Alibaba has a Strong Buy consensus rating based on 20 Buy and 3 Hold recommendations.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.