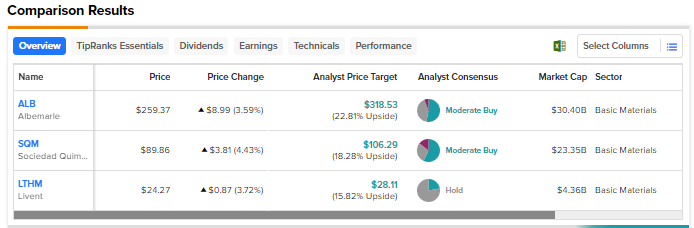

The rising use of lithium batteries in electric vehicles (EVs) and energy storage systems has triggered a huge demand for lithium. At the recently held investor day, a Tesla (TSLA) executive stated that the company has already broken ground on its new lithium refinery in Corpus Christi, Texas. In fact, last year, during the Q2 earnings call, Tesla CEO Elon Musk urged entrepreneurs to enter the lithium refining business, saying “It’s licensed to print money.” With that thought in mind, we used TipRanks’ Stock Comparison Tool to place Albemarle (NYSE:ALB), Sociedad Quimica Y Minera SA (NYSE:SQM), and Livent (NYSE:LTHM) against each other to pick the most attractive lithium stock.

Albemarle (NYSE:ALB)

Albemarle is a global specialty chemicals company that boasts leading positions in lithium, bromine, refining catalysts, and applied surface treatments. The company’s sales jumped 120% to $7.3 billion in 2022, fueled by a tremendous rise in lithium sales. Adjusted EPS skyrocketed to $21.96 in 2022 from $4.04 in 2021.

Albemarle intends to increase its capital expenditure from the range of $1.7 billion to $1.9 billion in 2023, to about $4 billion to $4.4 billion in 2027. The company stated that about 50% of the increase in capital expenditure would be toward “geographic diversification to support customer demand for regional lithium conversion and supply.”

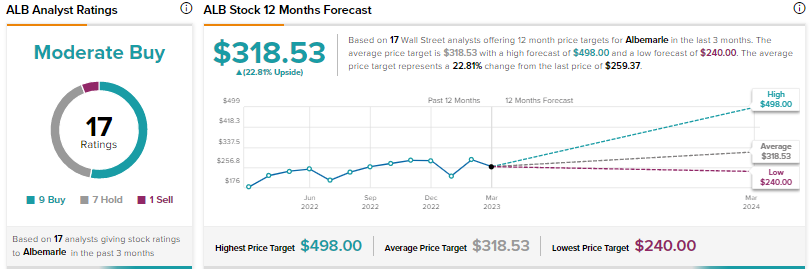

Is Albemarle Stock a Buy or Sell?

Recently, Piper Sandler analyst Charles Neivert raised his price target for Albemarle to $330 from $310 and reiterated a Buy rating. Neivert contended that the company’s “robust” cash flow will support its “aggressive” investments.

The analyst feels that that while Albemarle’s significant level of capital spending would be concerning normally, he expects the company’s profitability to remain solid.

Wall Street’s Moderate Buy consensus rating for Albemarle is based on nine Buys, seven Holds, and one Sell. The average ALB stock price target of $318.53 suggests nearly 23% upside. Shares have risen nearly 20% since the start of this year.

Sociedad Quimica Y Minera SA (NYSE:SQM)

Sociedad Quimica y Minera de Chile is a Chilean company that is one of the world’s largest producer of potassium nitrate, iodine, and lithium. It also produces specialty plant nutrients, iodine derivatives, lithium derivatives, and other chemicals.

SQM’s revenue surged 274% to $10.7 billion in 2022 and earnings per ADR jumped to $13.68 from $2.05 in the prior year. The 2022 results reflected the strong demand for lithium and lithium derivatives. The company expects continued growth in EV sales to drive lithium demand to nearly 1.5 million metric tons by 2025. It expects global lithium demand to rise at least 20% in 2023.

The company intends to expand its lithium capacity further and expects capital expenditure to reach about $3.4 billion in 2023-2025, including nearly $1.2 billion in 2023.

Is SQM a Good Investment?

Following the Q4 print last week, BMO Capital analyst Joel Jackson reiterated a Buy rating on SQM stock and a price target of $130.

“We expect near-term volatility to be replaced with a more bullish environment later this year and continue to see SQM as attractively valued high-quality lithium exposure with strong FCF (and special dividend) potential,” said Jackson.

Overall, Wall Street is cautiously optimistic about SQM, with a Moderate Buy consensus rating backed by four Buys, two Holds, and one Sell. The average price target of $106.29 implies 18.3% upside potential. Shares have advanced over 12% year-to-date.

Livent Corporation (NYSE:LTHM)

Livent is a U.S.-based pure-play lithium company. Its primary products include battery-grade lithium hydroxide, lithium carbonate, butyllithium, and high purity lithium metal. Its revenue grew 93.4% to $813 million in 2022. Adjusted EPS surged to $1.40 from $0.18 in the prior year, driven by higher average realized prices across all lithium products.

Livent expects higher average realized pricing across its portfolio of lithium products in 2023 and anticipates revenue in the range of $1.0 billion to $1.1 billion. The company stated that it is on track to deliver its announced capacity expansions and has substantially completed the first 10,000 metric ton expansion of lithium carbonate in Argentina.

Overall, Livent projects nameplate lithium carbonate capacity to be double that of 2022, nearing 40,000 metric tons by the end of 2023. Further, it expects to have a global lithium hydroxide capacity of 45,000 metric tons by the end of this year.

Is LTHM a Good Stock to Buy?

Last month, Bank of America analyst Matthew DeYoe raised the price target for Livent to $29 from $26 but downgraded the stock to Hold from Buy, saying, “Following a sharp rebound in shares of LTHM year to date, we see less room for upside.” DeYoe sees risk to earnings from the market price of lithium and company execution.

Overall, Wall Street is sidelined on Livent, with a Hold consensus rating based on two Buys and seven Holds. The average LTHM stock price target of $28.11 implies nearly 16% upside potential. Shares have rallied 22% so far in 2023.

Conclusion

While Lithium prices have declined from the elevated levels seen over the past year and a half, the long-term demand for Lithium remains strong. Wall Street currently sees more upside potential in Albemarle than SQM and Livent stocks.

As per TipRanks’ Smart Score System, Albermarle scores a nine out of 10, indicating the stock has the capability to outperform the broader market average.