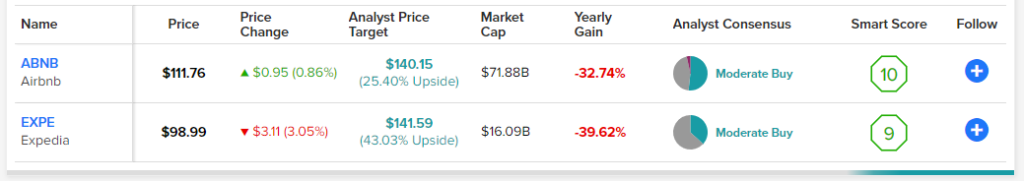

In this article, we’ll compare Airbnb (NASDAQ: ABNB) and Expedia (NASDAQ: EXPE), which seem like two relative travel bargains to give another look while most investors overweight recession risks and discount the industry’s post-pandemic recovery trajectory. From an upside potential perspective, EXPE looks more promising, but let’s dig deeper.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The stock market’s strong start to October goes to show that it’s likely a terrible idea to time your exit out of the markets. Even with the many negative factors weighing down the market, sometimes it doesn’t take much, if anything at all, to catch a bid higher.

Eventually, investors will come to terms with a looming recession and begin to look beyond it. The market already seems to be looking past the Federal Reserve’s rate hikes to come. Whether the Fed pauses, hikes further, or takes its hawkish tone down a notch remains to be seen. Regardless, the beaten-down discretionary and cyclical firms are starting to look enticing.

At this juncture, the travel scene looks quite intriguing after dealing with wild swings for most of the year. Accommodations and bookings may hit a bit of a snag as the economy begins to sag into 2023. Though less money in the pockets of consumers doesn’t bode well for travel and leisure plays, I do think investors are losing sight of the post-pandemic recovery, which, I believe, could fuel immense demand through and after the recession.

Over the nearer term, recessionary headwinds could overpower the post-pandemic travel recovery, but likely not for long. In a prior piece covering theme parks, I noted that consumers are far more likely to postpone their hefty travel experiences rather than cancel them forever. In that regard, there’s still a lot of COVID-era pent-up demand that could take a bit longer (think over the next three years) to be met. Without further ado, let’s take a look at ABNB and EXPE.

Airbnb (ABNB)

The market for accommodations may be poised to take a dip after its impressive recovery from those lockdown lows. Still, it’s hard to bet against Airbnb, which has disrupted the stays and experiences market profoundly over the past decade.

With such a vast network of hosts and guests, the flywheel is still very much spinning, and it’s one that rivals have had a tough time trying to replicate. Expedia’s vacation rental marketplace Vrbo could give Airbnb a run for its money, but at the end of the day, Airbnb continues to command the most options for hosts and guests.

Indeed, Airbnb has become the Uber (NYSE: UBER) of the alternative accommodations space. The network is the main source of its moat and could keep rivals at bay.

Yesterday, Airbnb stock soared over 5.5% on a risk-reversal day for the broader markets. Though it’s hard to tell if this rally represents a turning point for the stock that’s suffered a 57% peak-to-trough haircut, I do see Airbnb as continuing to improve its business amid these uncertain times.

With such a commanding network and an asset-light business model, I’d look for Airbnb to further increase its number of experiences. More options will likely translate into more guests.

Before the pandemic, Airbnb was quite active on the acquisition front, with deals such as HotelTonight scooped up for more than $400 million. As valuations contract across the board, I’d look for Airbnb to start wheeling and dealing again.

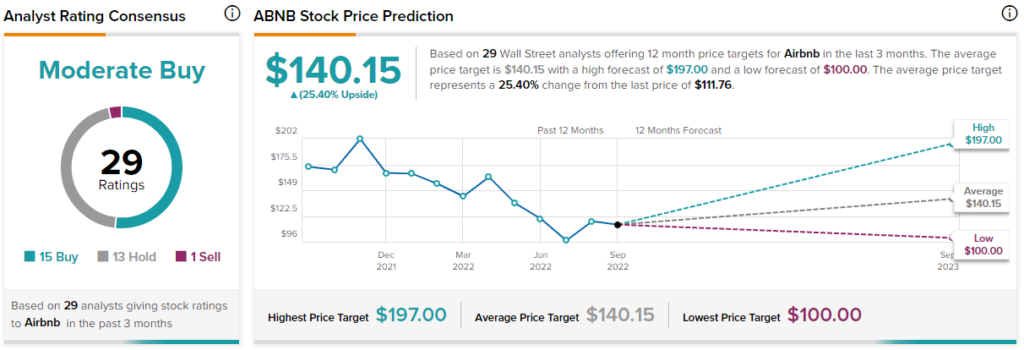

What is the Price Target for ABNB Stock?

Wall Street continues to like ABNB stock, giving it a Moderate Buy rating based on 15 Buys, 13 Holds, and one Sell rating assigned in the past three months. The average ABNB stock price target of $140.15 implies 25.4% upside potential.

Expedia (EXPE)

Online travel firm Expedia stock got pummelled 55% from peak to trough. Shares are far cheaper than Airbnb at 1.3x sales multiple and 4.2x cash flow. Though Expedia seems like a relative bargain in the booking scene, it’s cheaper for good reasons. Its growth profile is far less enticing than the likes of Airbnb.

Of late, Expedia has slowed its pace of M&A. Given the high price paid for many past deals, I do think a focus on marketing and organic growth is the best course of action.

Though many past deals were questionable, I am a fan of the HomeAway (now known as Vrbo) acquisition. It gives Expedia a foot in the door of one of the “growthiest” areas of bookings. With rampant ad spending, Expedia could draw some users away from the likes of Airbnb.

In any case, both Vrbo and Airbnb will need to stay on their toes as firms look to spend increasing amounts of innovation. Expedia is undergoing a tech-driven transformation that hopes to harness the power of its data. Indeed, it will be interesting to see how a tech-focused Expedia can stack up against Airbnb.

If Expedia can disrupt such a disruptive force, the upside could be considerable.

What is the Price Target for EXPE Stock?

Despite the drastic fall, Wall Street is sticking with a “Moderate Buy” rating. The average EXPE stock price target of $141.59 also implies a massive 43% in upside potential over the next 12 months. Undoubtedly, Expedia stock seems to be a glimmer of value, with growth prospects that may yet be appreciated by the market.

Conclusion: Analysts Expect More Upside from EXPE Stock

Airbnb and Expedia will continue to duke it out in alternative accommodations. Investors may wish to book their stays in either stock ahead of time for a shot at outsized gains. At this juncture, analysts expect more upside from Expedia. It’s the cheaper stock, and it has a competing product that could have more disruptive potential.