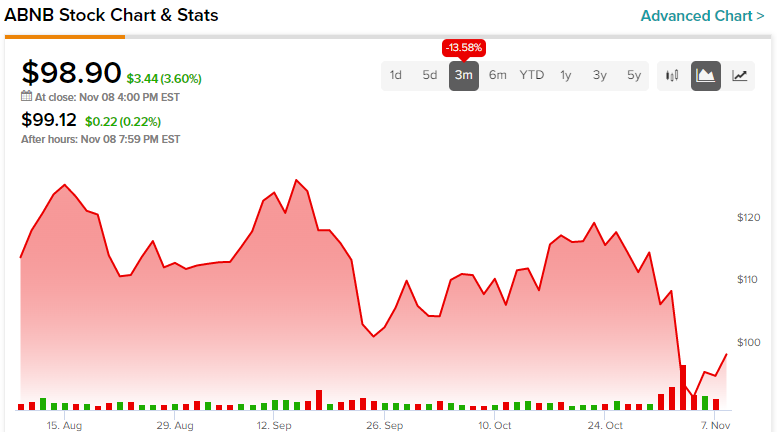

It’s hard not to be impressed with Airbnb’s (NASDAQ: ABNB) latest results. Without a doubt, they established the company’s ability to generate massive profits driven by its lean, margin-rich business model. Yet, Mr. Market’s reaction surprised most investors, with the stock falling since then. Considering the current mismatch between Airbnb’s net income growth prospects and valuation, I am bullish on the stock.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Q3 Was an Amazing Quarter. Here’s Why

To better understand why Airbnb’s Q3 results were impressive, let me provide some context. Firstly, Q3 makes for a significant quarter as it’s the high season of the tourism industry (summer); hence it’s worth using it as a benchmark for Airbnb’s performance.

Post-COVID-19 Euphoria Stays On

Now, as you remember, the COVID-19 pandemic adversely impacted the travel industry, including booking websites like Airbnb. Specifically, Airbnb’s revenues in Q3 of 2020 declined by 18.4%. Moving toward the third quarter of 2021, investors naturally expected a noteworthy rebound in revenues following the travel restrictions easing. In Q3 2021, the company didn’t just reclaim its past revenue levels but actually reported massive revenue growth of 66.7%.

Here’s why Airbnb’s Q3 2022 results were quite impressive. While flat revenues would have been just fine considering last year’s post-pandemic travel boost, Airbnb managed to increase its top line by a further 29% to $2.9 billion – a new record for the company, and that’s against a strong dollar. In constant currency, revenues actually grew by an impressive 36%.

Airbnb is Basically Printing Cash

What stood out the most in Airbnb’s quarterly report, however, is that it highlighted that the company has the potential to be a cash cow. Think about it – the company’s business model is quite lean, requiring no meaningful capital expenditures. Thus, most of the company’s operating profits end up in the bottom line. Specifically, Airbnb’s net income for the quarter came in at $1.2 billion, up 46% year-over-year (and pay attention here), representing a 42% net income margin on a per-share basis.

Few companies can claim such high net income margins, let alone ones which are technically still undergoing their rapid growth phase. Also, note that net margins include stock-based compensation expenses. Free cash flow margins are actually even higher.

Specifically, during the last 12 months, Airbnb generated ~$3.3 billion in free cash flow. This demonstrated that Airbnb is able to drive growth and profitability at scale, even against a challenging macroeconomic landscape.

Can Airbnb’s Momentum be Sustained?

I believe we can agree that Airbnb delivered very impressive top and bottom-line results. Now, the spotlight is turned on whether Airbnb’s momentum can be sustained in the coming quarter. In my view, yes, it can, due to several prominent tailwinds.

Firstly, based on the company’s bookings data, it’s evident that long-term stays and non-urban travel are here to stay. Following the pandemic, millions of people have maintained increased flexibility (e.g., remote work). Regardless, Airbnb’s recovery momentum remains strong in urban and cross-border travel too, which is especially encouraging during such a macroeconomic environment. If Airbnb can perform this well now, what will happen once economic conditions actually normalize?

Finally, just like during the Great Financial Crisis in 2008, people today are particularly interested in making extra cash via hosting, which should continue expanding the company’s global presence.

Management already appears confident regarding the company’s performance in the upcoming Q4, expecting revenues to land between $1.80 billion and $1.88 billion, suggesting year-over-year growth of between 17% and 23%. For context, these numbers suggest year-over-year growth of between 62% to 70% relative to Q4 2019 as well.

What is the Price Target for ABNB Stock?

Turning to Wall Street, Airbnb has a Moderate Buy consensus rating based on 13 Buys, 11 Holds, and one Sell assigned in the past three months. At $130.55, the average Airbnb stock forecast implies 32% upside potential.

It All Sounds Good, but is Airbnb Stock Fairly Priced?

I believe that ABNB has demonstrated that it can drive both growth and high profitability. Still, this doesn’t mean the stock is a buy unless we, the investors, pay a fair (and preferably cheap) price for it. Assuming the company can sustainably post net margins of 30% (lower than the 40%+ it can achieve during high season) and apply them on 2024 consensus revenue estimates of $11 billion, investors are currently paying 19x the company’s 2024 net income. Is this a fair multiple two years out in the current environment? Considering Airbnb’s momentum, lean business model, exciting growth drivers, and developing traction, I believe that the stock could be modestly undervalued as well.

The aforementioned consensus price targets indicate this as well. I will most certainly keep buying shares below $100/share.