Despite macro uncertainty and higher fares, air travel demand remains strong, leading airline companies to post stellar financials for the September-ending quarter. American Airlines (NASDAQ:AAL), United Airlines (NASDAQ:UAL), and Delta Air Lines (NYSE:DAL) reported robust sales. Further, the ongoing momentum points to a further recovery in their stock price.

Let’s take a closer look to examine what’s on the horizon for these airline stocks.

Is American Airlines a Buy now?

Despite its strong performance, analysts remain sidelined on AAL stock due to the uncertain backdrop and pilot constraints. AAL stock has a Hold consensus rating on TipRanks based on one Buy, six Hold, and two Sell recommendations. Further, analysts’ average price target of $15.11 implies 12.26% upside potential.

TipRanks’ data shows that hedge funds bought 636K AAL stock last quarter. Meanwhile, insiders sold $189.9K shares last quarter. American Airlines stock has a Neutral Smart Score of six out of 10 on TipRanks.

Nevertheless, American Airlines delivered record third-quarter revenues that increased by about 13% from the same period in 2019 (pre-pandemic time). This growth comes despite having less capacity, which is encouraging.

Its CEO, Robert Isom, stated, “Demand remains strong, and it’s clear that customers in the U.S. and other parts of the world continue to value air travel and the ability to reconnect post-pandemic.” Thanks to the strong recovery in demand, American Airlines remains upbeat and expects to pay down $15 billion of its total debt by the end of 2025.

AAL expects its Q4 revenues to be 11% to 13% higher than in the same period in 2019. Further, it projects adjusted EPS to be between $0.50 and $0.70, much higher than the consensus estimate of $0.19.

Is Delta a Buy or Sell?

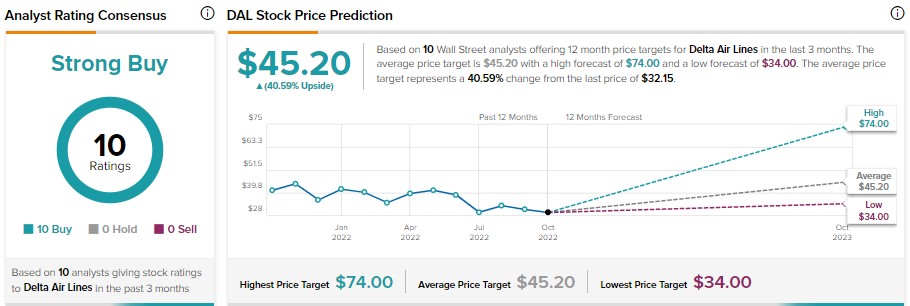

Delta Air Lines stock commands a Strong Buy rating consensus in TipRanks, reflecting 10 unanimous Buy recommendations. Further, DAL’s average price target of $45.20 implies 40.59% upside potential.

Besides analysts, DAL stock has a positive signal from hedge fund managers, who bought 4.7M shares last quarter. Further, DAL stock has an Outperform “Perfect 10” Smart Score on TipRanks.

In response to its September quarter performance, Delta’s president, Glen Hauenstein, said that Q3 marked “the highest revenue and unit revenue quarter in Delta’s history.”

With strong consumer demand, DAL expects its operating revenues to increase by 5-9% in Q4. Meanwhile, its EPS is projected to be in the range of $1.00 – $1.25, compared to the Street’s expectations of $1.08.

What is the Price Target for UAL Stock?

UAL stock has an average price target of $52.78 on TipRanks, implying 35.16% upside potential. Further, United Airlines stock has received six Buy, two Hold, and one Sell recommendations for a Moderate Buy consensus rating.

Insiders bought $1.2M worth of UAL stock last quarter. However, hedge funds sold 2.5M United Airlines stock during the same period. Overall, UAL stock has Outperform Smart Score of eight out of 10.

UAL delivered stellar Q3 financials that exceeded management’s revenues and adjusted operating margin expectations. Further, UAL’s management is upbeat and expects the recovery in travel demand to sustain in Q4 and overcome recessionary pressure.

Its Q4 operating margins are expected to exceed the pre-pandemic levels. Meanwhile, analysts expect the company to remain profitable in Q4 and deliver an EPS of 1.62.