Rivian Automotive (RIVN) hasn’t even come out with its quarterly update, but the earnings report of competing EV company Lucid Group was enough to send investors scurrying. RIVN stock plummeted nearly 16% this week, ahead of March 10 earnings release, which will provide concrete clarity on the company’s situation.

Part of the panic includes the supply chain and logistics issues that Lucid is facing in 2022, leading to speculation that Rivian will see similar challenges in the upcoming year. It’s hard for RIVN to stave off a negative outlook when it didn’t even make good on last year’s plans, promising the production of 1,200 vehicles, but delivering only 920.

Wells Fargo analyst Colin Langan weighs in on the company’s outlook with a “bullish” stance on “products and brand strategy,” although he sees “near-term headwinds including risk to Q1 delivery expectations, the negative impact from rising interest rates, increased BEV competition, and potential selling post the lock-up expiration in mid-May.”

Langan is lowering his FY21 estimated EPS to -$14.85 from a loss of $3.45. Looking ahead, he sets his earnings expectations for FY22 at a loss of $4.80 per share, “as the impact of lower expected deliveries is offset by diluted share assumptions.”

The current consensus is expecting Rivian to deliver 4,000 units in the upcoming quarter. However, production was out for 10 days to update the line around the new year, which suggests that RIVN will only hit ~2,300 vehicles by the quarter’s end. If that wasn’t enough to put a damper on things, management displayed some lack of confidence in acquiring semiconductor supply and admitted to production setbacks resulting from Covid. This leads the analyst to believe that Q1 will only bring around 2,000 finished vehicles.

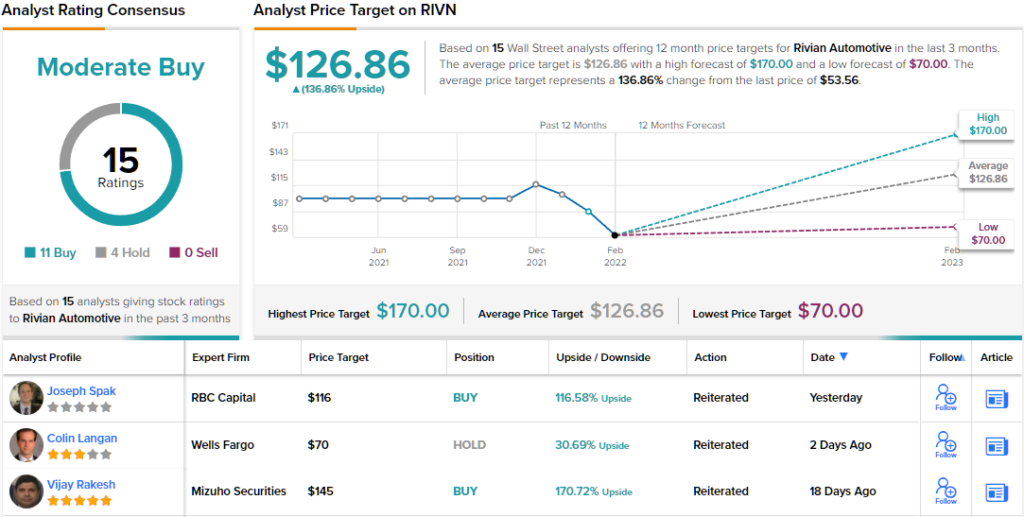

So what does Langan recommend to RIVN investors? He gives an Equalweight (i.e. Neutral) rating for the stock, while lowering his price target from $110 to $70. That being said, this price still implies a potential of ~31% gains for investors. (To watch Langan’s track record, click here)

The rest of the Street is far more bullish, with 11 analysts giving the stock a Buy rating and 4 recommending a Hold, adding up to a Moderate Buy consensus rating. The average price target remains a strong $126.86, optimistically suggesting a rise of ~137% over the next 12 months. (See Rivian stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.