Shares of the internet giant Amazon (NASDAQ: AMZN) have dropped nearly 39% from the 52-week high. Its slowing top-line growth amid normalization in demand trends, cost headwinds, and overall selling in the high-growth tech stocks are to blame for this decline.

For context, Amazon’s net sales growth rate has decelerated over the past four consecutive quarters. Notably, Amazon’s net sales growth slowed to 7% in Q1 of 2022 compared to the 9% growth in Q4 of 2021.

While AMZN’s revenue growth slowed, it faced multiple cost pressures, including productivity and inflation (higher wages and shipping costs).

Now What

Amazon’s short-term guidance suggests that the company continues to face headwinds that would impact its net sales growth and hurt margins.

It projects 3-7% growth in its net sales in Q2, implying a further slowdown in growth rate. Uncertainties regarding customer demand and spending, and inflation remain a drag. Meanwhile, Amazon expects to incur $4 billion in incremental costs in Q2 due to the cost inefficiencies and inflationary pressure.

Deutsche Bank analyst Lee Horowitz termed AMZN’s Q2 revenue outlook as disappointing. However, the analyst highlighted that with “Prime Day moving out of the 2Q and into the 3Q in 2022, there is a fair amount of noise in the 2Q guide. In fact, we believe that Prime Day drove $3.6bn in revenue in 2Q21, suggesting that ex-Prime Day, the high end of guidance implies 10% underlying growth in the 2Q.”

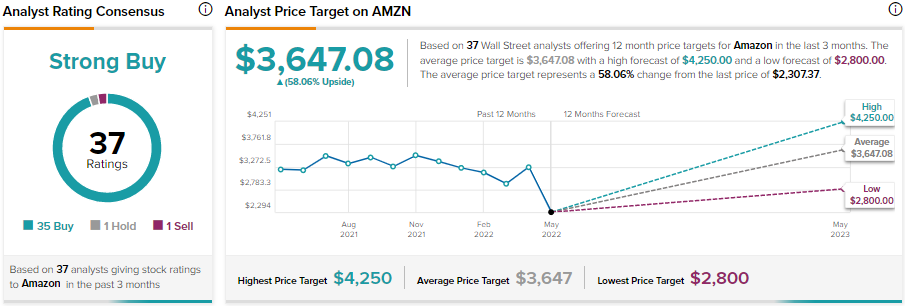

Horowitz lowered his estimates and price target on AMZN stock due to the slowdown. However, he maintained his bullish outlook. Including Horowitz, 35 analysts have recommended a Buy on Amazon stock. One analyst recommends Hold, and one has a Sell rating.

Further, the average Amazon price target of $3,647.08 implies 58.1% upside potential to current levels.

Bottom Line

Amazon’s long-term prospects remain intact. Its strong capital investments (about $61 billion in the trailing 12-month period) and expansion of its fulfillment network (it doubled the size of its fulfillment network in the last 24 months) provide a solid foundation for growth.

Further, the ongoing momentum in its high margin AWS business, reflected through its growing customer base and accelerated pace of digital transformation, bode well for growth.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure