Advance Auto Parts (NYSE:AAP) didn’t need to knock it out of the park with its just-released quarterly results. For a relief rally to happen, the company only needed to indicate that changes are coming. I am bullish on AAP stock because the generally neutral-to-bearish sentiment among investors has likely peaked and should subside over the coming months.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Advance Auto Parts is one of the most-recognized automotive parts suppliers in the U.S. While automotive dealers sometimes buy car parts from Advance Auto Parts, the company’s stores also cater to regular retail customers.

Some onlookers might be surprised that traders are buying Advance Auto Parts stock today. Yet, if you’re a contrarian investor, this should make perfect sense. After all, when there’s fear in the air but a catastrophe fails to materialize — and when there’s newfound hope for a brighter future — positive surprises can happen on Wall Street.

AAP Stock’s Dreadful Journey to the Bottom

Right now, if you’re not squeamish, I invite you to take a look at the chart of AAP stock. It’s the type of chart that some less-than-charitable market technicians might call “ugly.”

As you can see, Advance Auto Parts stock tanked after the company’s last three quarterly earnings releases (not including today’s report). One of those three earnings reports (Q4 2022) actually included an EPS beat. Nevertheless, investors simply weren’t in the mood to buy AAP stock.

For the most part, I found these sell-offs to be overdone. I figured that since new car prices are so high nowadays, people would want to hold on to their current vehicles longer. Thus, auto-part sales should be robust in 2023.

That logic might hold up for the auto-parts sector generally, but Advance Auto Parts’ critics have pointed to lackluster leadership under CEO Tom Greco as a major problem for the company. I don’t want to get into a debate about Greco’s competence as a CEO, but Advance Auto Parts’ wide EPS miss in this year’s first quarter provided the skeptics with plenty of fodder.

The company had a chance to redeem itself when it reported its second-quarter 2023 financial results this morning. I’ll be the first to admit that the company’s results weren’t perfect. As it turned out, Advance Auto Parts’ quarterly sales of $2.7 billion were in line with analysts’ projections. Meanwhile, the company earned $1.43 per share in Q2, missing Wall Street’s call for $1.69 per share.

Looking ahead to the full year of 2023, Advance Auto Parts raised its net sales guidance slightly to a range of $11.25 billion to $11.35 billion from the previous range of $11.2 billion to $11.3 billion. At the same time, Advance Auto Parts reduced its full-year diluted EPS outlook from $6.00 to $6.50 previously to a new range of $4.50 to $5.10.

New Leadership Means New Hope for Advance Auto Parts

I actually like it when companies lower their EPS guidance since this is often a setup for an upcoming earnings beat. Yet, what most likely prompted a rally instead of the usual dumpage in AAP stock today was Advance Auto Parts’ leadership transition.

If Greco was supposedly the problem, then at least now there’s hope that the problem will be fixed. Along with the earnings release this morning, Advance Auto Parts announced two executive-level change-ups. First, Tony Iskander was named interim chief financial officer at the company, and he will succeed Jeff Shepherd. Second and most importantly, Shane O’Kelly will replace Greco as CEO, effective September 11.

In other words, Greco will be out of the picture very soon. Moreover, O’Kelly has some pedigree as he previously served as served as the CEO of Home Depot (NYSE:HD) subsidiary HD Supply. Home Depot is highly respected in the financial markets, so maybe O’Kelly can help Advance Auto Parts navigate a turnaround this and next year.

Is AAP Stock a Buy, According to Analysts?

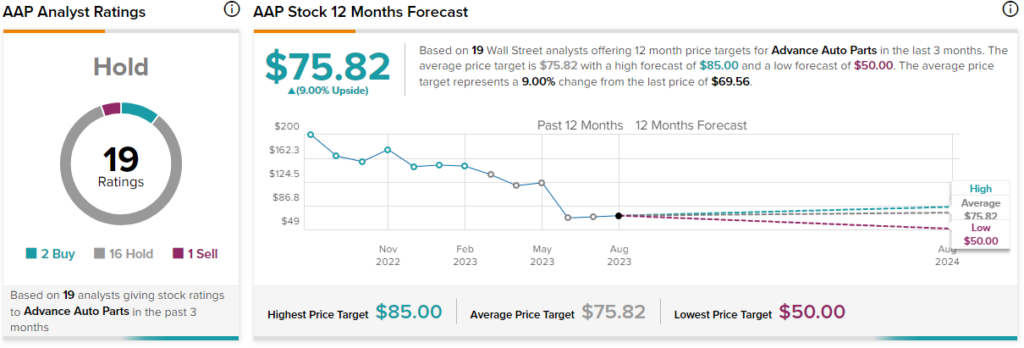

On TipRanks, AAP comes in as a Hold based on two Buys, 16 Holds, and one Sell rating assigned by analysts in the past three months. The average Advance Auto Parts price target is $75.82, implying 9% upside potential.

Conclusion: Should You Consider AAP Stock?

Changing a chief executive isn’t as simple as replacing a car part. It will take some time for Advance Auto Parts’ new CEO to settle in and prove himself.

Still, it appears that financial traders are glad to see Advance Auto Parts undergoing a transition with new leadership. After many months of negative sentiment, there’s hope for better days ahead. So, if you believe that a turnaround is afoot and hated companies can become Wall Street darlings, consider AAP a stock with tremendous upside potential.