Perhaps there are two key questions of investment: what to buy and at what price? Software provider Adobe (ADBE) is a great business.

The company has maintained a double-digit growth rate for many years, and its profitability is very high. I believe the growth potential has not been exhausted yet. The Total Addressable Market is quite large and growing. Adobe has a very strong positioning – many of the company’s products are rated by users as “default.” In addition, ADBE continues to dig up its competitive moat by buying up smaller competitors that could pose a threat in the future.

However, in my opinion, the price is still high. I am neutral on the stock but would add the company to the watchlist.

Company Profile

Adobe Inc. is one of the largest and most diversified software companies in the world. The company operates in three segments: Digital Experience, Digital Media, and Publishing & Advertising. Its clients are creative professionals, communicators, and businesses of all sizes.

The Digital Experience segment delivers intelligence for businesses of any industry. In the Digital Media segment, the company provides desktop tools, mobile apps, and cloud-based services for designing, creating, and publishing content. ADBE’s Publishing & Advertising segment offers products and services such as web application development and high-quality printing, and the publishing needs of technical, commercial, and original equipment manufacturers printing companies.

Most of the revenue comes from the Digital Media segment.

High Growth and Profitability

It is difficult to find a company that has consistently increased revenue at double-digit rates over the years. It is even more difficult to find a company that combines growth and high profitability. Adobe is one of them. Over the past five years, the company’s revenue has grown by an average of 21.9% per year. According to its Fiscal Year 2021 results, sales are up 22.67% year-over-year.

The key question for investors is, how long can a company maintain a high growth rate? In my opinion, the potential of the company is still great. Management estimates its total addressable market at $147 billion, and Adobe’s competitive positioning is very strong. As stated earlier, many of the company’s products are the default options for users, and ADBE is buying up smaller competitors.

Importantly, Adobe becomes more profitable as revenue grows. Management effectively manages costs. In 2015, gross and operating margins were 84.5% and 18.8%; by the end of 2021, the figures reached 88% and 36.8%, respectively.

Despite the activity in the M&A market and the growth of goodwill, asset turnover has always grown and reached its maximum by the end of the year. Revenue is growing faster than the balance of assets. Frequent takeovers don’t burn shareholder value; they create it.

Due to the growing net profit margin and asset turnover in the last reporting period, ROA reached 17.7%. Due to its asset-to-equity ratio of 1.8, Adobe generates a 32.5% return on equity for its shareholders. A very high rate, even for SaaS companies.

Adobe shows high profitability primarily due to the high net profit margin. In my opinion, this is the most important indicator of a deep competitive moat. A company that is forced to compete will not be able to maintain a higher margin than the industry as a whole. Apple (AAPL), Meta (FB), Microsoft (MSFT) are great companies with an important common feature – incredibly high profitability. Adobe is also part of this club.

Valuation

Within the DCF model, I made several assumptions. I expect revenue growth in line with the Wall Street consensus. Margins and other relative indicators are predicted based on historical dynamics and the current trend. The terminal growth rate is 4%. My assumptions are presented below:

Based on the assumptions, the expected dynamics of key financial indicators are presented below:

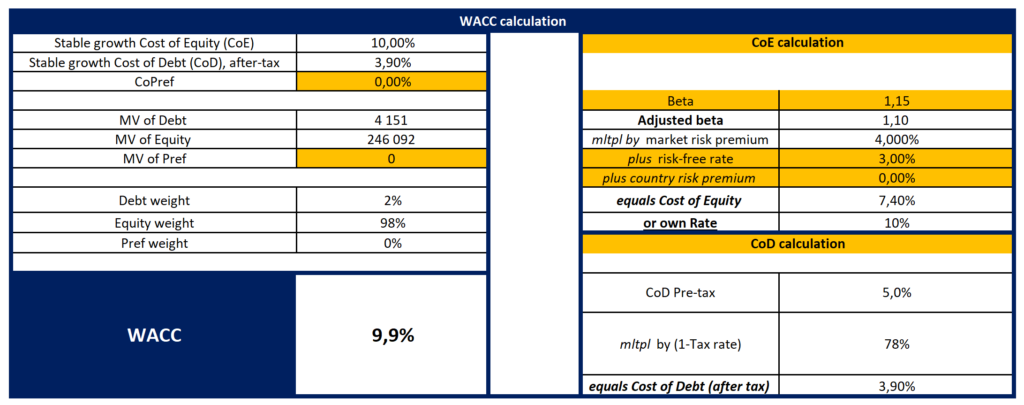

With a stable-growth cost of equity equal to 10%, the weighted average cost of capital (WACC) is 9.9%.

With the terminal EV/EBITDA of 18.92x, a fair market value is $229.9 billion, or $483 per share. Thus, with ADBE’s stock price currently around $528, it is trading at a premium to its fair price. On an EV/sales multiple, Adobe is trading above the last five years’ average (15.8x versus 14.8x average).

Wall Street’s Take

Turning to Wall Street, Adobe earns a Buy consensus rating based on 17 Buys and six Holds assigned in the past three months. At $670.15, the average Adobe price target implies 26.6% upside potential.

Conclusion

Adobe is a great, highly profitable business with good potential. However, as is often the case with companies of this quality, the current price is too high. My estimate is more conservative than Wall Street’s.

Perhaps bulge-bracket analysts expect higher profitability or a higher terminal growth rate. I am guided by the principle of prudence in the valuation process. In my opinion, the current price does not provide a sufficient margin of safety. Thus, I am neutral.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure