Shares of Adobe (NASDAQ: ADBE) have dropped 10.7% in the past month, despite the publishing software company reporting upbeat Q2 results. Investors’ concerns about the stock have primarily been sparked by the company’s tepid guidance for FY22.

On its Q2 earnings call, Adobe’s management outlined the reasons for the cautious outlook. In March, the company indicated that it intended to stop all new software sales in Russia and Belarus. The company’s management stated on its fiscal Q2 earnings call that this move could result in the company taking a hit of $75 million in terms of revenues when it comes to its digital media business.

More worryingly, the software company also anticipates a headwind of $175 million across its revenues in fiscal Q3 and Q4 due to the strengthening of the U.S. dollar.

Dan Durn, Adobe’s EVP, and CFO further pointed out that while demand for its products continues to remain strong, “we now expect the second half of the fiscal year to show more pronounced summer seasonality in Q3 and the enterprise business with a stronger sequential increasing Q4.”

As a result, ADBE is now targeting Q3 revenues of around $4.43 billion, with net new digital annualized recurring revenue of $430 billion. Furthermore, adjusted earnings are anticipated at $3.33 per share in the third quarter.

For FY22, total revenue is projected to be $17.65 billion, while adjusted earnings are anticipated to be $13.50 per share, significantly less than analysts’ expectations of $13.67. For the third quarter and full year, Adobe expects double-digit revenue growth across all segments.

However, while investors were concerned about the bleak guidance, Deutsche Bank analyst Brad Zelnick was of the view that ADBE’s “guidance approach was prudent, improves Adobe’s negotiating (pricing) posture in large enterprise deals, and benefits from F4Q renewal seasonality that comes with an associated Creative pricing uplift.”

While Zelnick believes that ADBE will not be immune to macro headwinds, he does expect the company to “fare better than most given its leverage to a more digital future, consistent innovation, pricing power, solid execution, and category leadership.”

The analyst is also upbeat about Adobe’s growth prospects considering the total addressable market (TAM) of $205 billion for its products and reiterated a Buy rating on the stock. However, Zelnick lowered his price target to $500 from $575, implying upside potential of 37.7% at current levels.

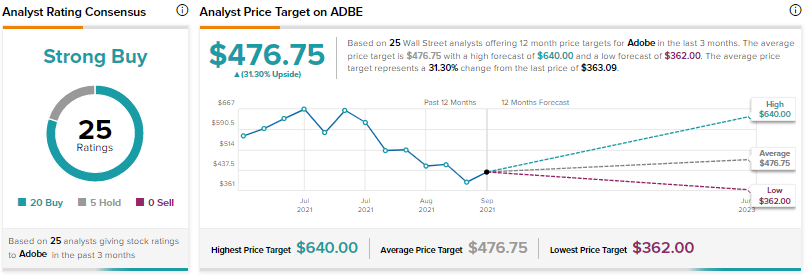

Adobe also gets a resounding Buy from other Wall Street analysts besides Zelnick, with a Strong Buy consensus rating based on 20 Buys and five Holds. The average Adobe price target of $476.75 implies 31.3% upside potential.

Bottom Line

Overall, judging by Wall Street analysts’ bullish stance on the stock and strong demand for ADBE’s products, the company seems to be set for success even in a tough macroeconomic environment.

Investors on TipRanks continue to be very positive about the stock as indicated by the TipRanks Crowd Wisdom tool. This tool indicates that 15.6% of the best-performing portfolios on TipRanks have increased their holding of ADBE in the past 30 days.