Many innovative products come from America’s software industry, and some of the best ones are designed and commercialized by Adobe (NASDAQ: ADBE). I am bullish on Adobe stock because investors haven’t yet factored in the company’s resilience in 2022 and comeback potential for 2023.

Based in California, Adobe provides a variety of software products, including ones focused on publishing, visual media, and advertising. Late last year, Adobe was in the hot seat as the Department of Justice scrutinized the company’s proposed $20 billion acquisition of creative software company Figma.

This unfortunate development, along with the market’s general anxiety about technology stocks, may have clouded investors’ judgment about ADBE stock. In reality, Adobe performed well during a tough quarter and year, and there’s data to prove it.

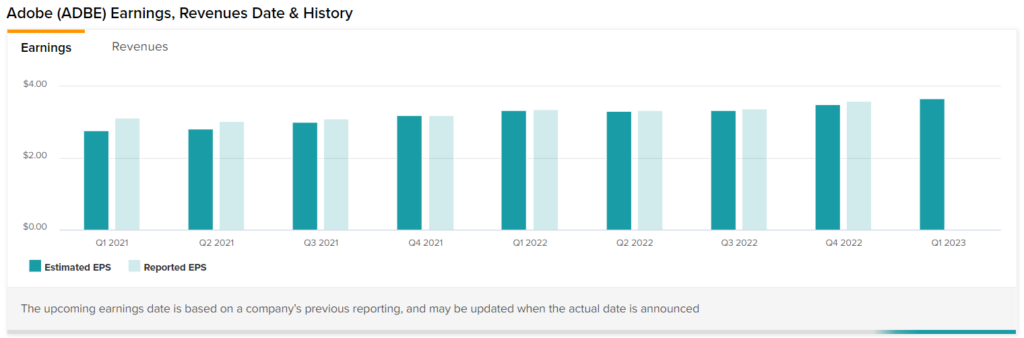

Adobe is a Consistent EPS Achiever

Since ADBE stock is much closer to its 52-week low ($274.73) than its 52-week high ($541.59), one might assume that Adobe has failed in its mission to deliver positive earnings numbers. However, that’s actually not the case, as Adobe’s track record is quite impressive.

Before you write Adobe off as a failure, consider this. In every fiscal quarter since late 2020, the company has either met or exceeded Wall Street’s earnings-per-share (EPS) forecasts. Nevertheless, financial traders dumped their ADBE shares throughout 2022.

Adobe currently has a P/E ratio of 32.5x, which doesn’t indicate a spectacular bargain but also isn’t extremely high. Value seekers can choose to wait until ADBE stock touches $300 before jumping into the trade, though it’s not necessary to wait. Adobe’s financial figures are strong enough that prospective investors can find reasons to start accumulating the shares right now.

Adobe Posted Excellent Quarterly Financial Results

The most bullish argument in favor of owning ADBE stock comes from the company’s financial data. 2022’s fourth fiscal quarter was particularly important for Adobe as investors undoubtedly wanted to see evidence that Adobe could deliver despite macroeconomic challenges. Fortunately, the company came through with strong quarterly results.

Starting with the top line, Adobe reported Q4-2022 revenue of $4.53 billion, demonstrating a roughly 10% improvement over the year-earlier result of $4.11 billion. This was in line with Wall Street’s forecast and slightly higher than Adobe’s estimate of $4.52 billion.

Subscription segment revenue is basically Adobe’s bread and butter, and the company fared well in this area. The company generated $4.23 billion in Subscription revenue during the fourth quarter versus $3.81 billion in the year-earlier period.

Moving on to the quarter’s bottom-line results, analysts and Adobe both expected that the company would report earnings per share of $3.50. The actual EPS result was $3.60, so Adobe’s investors should be pleased with this.

Demand for Adobe’s Products Drove Record Full-Year Results

Inflation was a consistent headwind for software businesses in 2022, but did it prevent Adobe from selling its top-of-the-line products? Not at all, as the demand for Adobe’s software remained robust despite the year’s persistent challenges.

Adobe Chairman and CEO Shantanu Narayen observed that his company “drove record revenue and operating income in Fiscal 2022.” Meanwhile, Adobe had operating cash flows of $7.84 billion for the full year.

Just to provide some specific data, Adobe reported revenue of $17.61 billion and GAAP operating income of $6.10 billion for the fiscal year. Dan Durn, ADBE’s CFO, cited that there was strong demand for ADBE’s offerings, among other contributing factors, and he expects that the company will be able to “capture the massive opportunities in 2023 and beyond.”

Looking toward the future, Adobe’s management targets $19.1 billion to $19.3 billion in revenue for Fiscal 2023, along with GAAP-measured EPS in the range of $10.75 to $11.05. As long as the economy doesn’t collapse, Adobe should be able to deliver another fiscal year of relative outperformance.

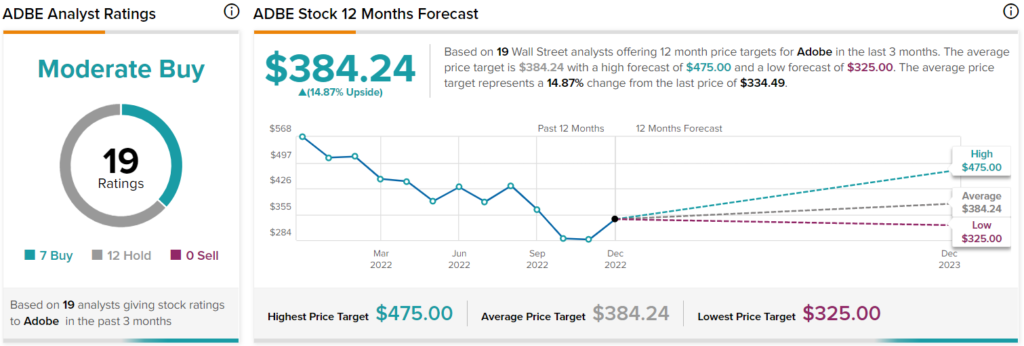

Is ADBE Stock a Buy, According to Analysts?

Turning to Wall Street, ADBE is a Moderate Buy based on seven Buys and 12 Hold ratings. The average Adobe price target is $384.24, implying 14.9% upside potential.

Conclusion: Should You Consider Adobe Stock?

If you’re anticipating a comeback in America’s software market, it makes sense to bet on a proven winner in that category. Quarter after quarter, Adobe has met or beaten the analyst community’s EPS forecasts – yet, ADBE stock is trading at a reasonable price. So, consider purchasing a few shares, as they’re likely to gain value if the company continues to deliver excellent results based on strong product demand.