Lighting and building management firm Acuity Brands, Inc. (NYSE:AYI) is set to release its fourth quarter and full year Fiscal 2022 results on October 4, before the market opens.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The Street expects Acuity to post adjusted earnings of $3.61 per share in Q4, meaningfully higher than its comparative prior year period’s figure of $3.27 per share. Meanwhile, revenue is pegged at $1.08 billion, representing a year-over-year jump of 8.8%, and a rise of 1.9% than Q3FY22 revenue of $1.06 billion.

Notably, Acuity Brands has consistently topped Wall Street expectations despite the pandemic lockdowns, supply chain snarls, and inflationary environment.

Nonetheless, the slowdown in construction, renovations, and retrofitting may have hampered the company’s performance in the quarter. Investors may want to await the fourth quarter details and management guidance to make informative investment decisions.

Blair Analyst Expects Acuity to Beat Earnings Estimates

Analyst Ryan Merkel of William Blair reiterated a Hold rating on AYI stock ahead of its Q4 print. The analyst expects Acuity Brands to beat earnings estimates yet again on the heels of solid summer lighting activity.

However, Merkel’s survey of manufacturers showed that increasing prices and a slowdown in project activity may impact its momentum going forward. Based on his survey, the analyst expects Acuity to forecast Fiscal 2023 net sales growth in the range of 5% to 7%.

Furthermore, Merkel stated that price hikes and large backlogs will fuel the sales growth in the first two quarters of Fiscal 2023. The second half of 2023 will feel the pinch from a slowing economy owing to high interest rates and waning business confidence. Also, increased competition on the pricing front in the electrical lighting and wiring sector may make it difficult to mitigate the impact of persistent cost inflation.

Is Acuity Brands Stock a Buy, Sell, or Hold?

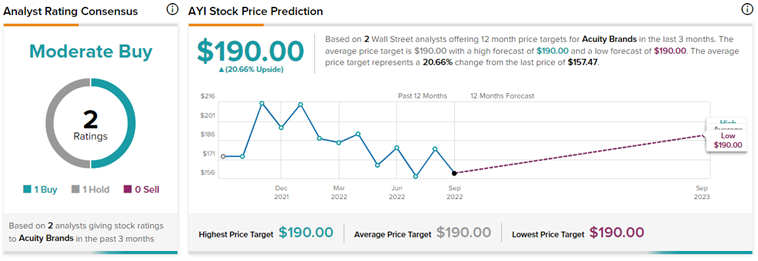

On TipRanks, Acuity Brands has a Moderate Buy consensus rating. This is based on one Buy versus one Hold rating assigned during the last three months. The average Acuity Brands price target of $190 implies 20.7% upside potential to current levels. Meanwhile, AYI stock has lost 25.9% so far this year.

Ending Thoughts

Acuity Brands may be poised for short-term turbulence owing to the tough macroeconomic backdrop. However, its long-term growth potential remains intact. Remarkably, Acuity Brands scores a “Perfect 10” on TipRanks’ Smart Score Rating system, indicating that the stock is positioned to outperform market expectations. Retail investors remain highly bullish about Acuity Brands and have increased their exposure to AYI stock by 23.6% in the last 30 days. Also, the company undertakes regular share buybacks as well as pays out a quarterly common dividend of $0.13 per share, representing a current yield of 0.33%.