Activision Blizzard (ATVI) is best known as a developer and manufacturer of video games. I am neutral on the stock.

For Activision Blizzard’s shareholders, the first half of 2021 was rather boring.

Then came 2021’s second half, and ATVI stockholders yearned for the boring times, as the share price plummeted. It was a domino effect, as one unfortunate event happened after another with Activision Blizzard.

So, what happened exactly, and is there hope on the horizon for Activision Blizzard’s downtrodden investors?

When all is said and done, the technical damage looks bad – and Activision’s reputational damage may be unmanageable.

A Quick Look at ATVI Stock

From a price-action perspective, things look pretty awful for ATVI stock. I love a bargain as much as anybody, but this is more of a falling rock than a buy-able dip.

As I alluded to earlier, ATVI stock was pretty boring during the first half of 2021. Month after month, the share price hovered between $90 and $100.

Then, everything seemed to go haywire. Starting in mid-June, the Activision share price slid relentlessly, breaking below the key $75 level in September.

It only got worse from there. November was particularly awful, as ATVI stock plunged below $60 by the first day of December.

Value investors might actually see a gem in the wreckage here, though, as Activision Blizzard’s trailing 12-month price-to-earnings ratio is currently 17.

See ATVI stock charts on TipRanks >>

Trouble Comes to the Surface

Be aware, though, that a low share price isn’t the same thing as a good value, especially when a company is really having problems.

It seems that Activision’s woes in 2021 became more evident when employees started leaving the company.

This was particularly problematic for Activision Blizzard, as the workers’ exodus was apparently related to alleged employee discrimination and harassment.

With fewer workers at Activision, the company ended up delaying the releases of the highly anticipated games Diablo 4 and Overwatch 2.

In the wake of this chain of events, Morgan Stanley analyst Brian Nowak downgraded ATVI stock from overweight to equal weight, and cut his price target from $120 to $65.

Similarly, MKM Partners analyst Eric Handler downgraded the stock from Neutral to Sell, and slashed his price target from $75 to $54.

From Bad to Worse

With that downgrade, Handler warned that he’s “not convinced all the bad news is out.”

Indeed, the procession of unfortunate events didn’t stop with the workers’ walk-out.

Reportedly, CEO Bobby Kotick knew about the harassment/misconduct at Activision Blizzard for years. Consequently, some employees have called for Kotick to be replaced.

In a more recent update, Kotick reportedly said that he would consider leaving Activision Blizzard if he can’t quickly fix the company’s culture problems. Only time will tell, but this conditional action may prove to be too little, too late.

For the time being, ATVI stockholders don’t seem to be in any mood to overlook what’s allegedly taking place at Activision Blizzard.

Wall Street’s Take

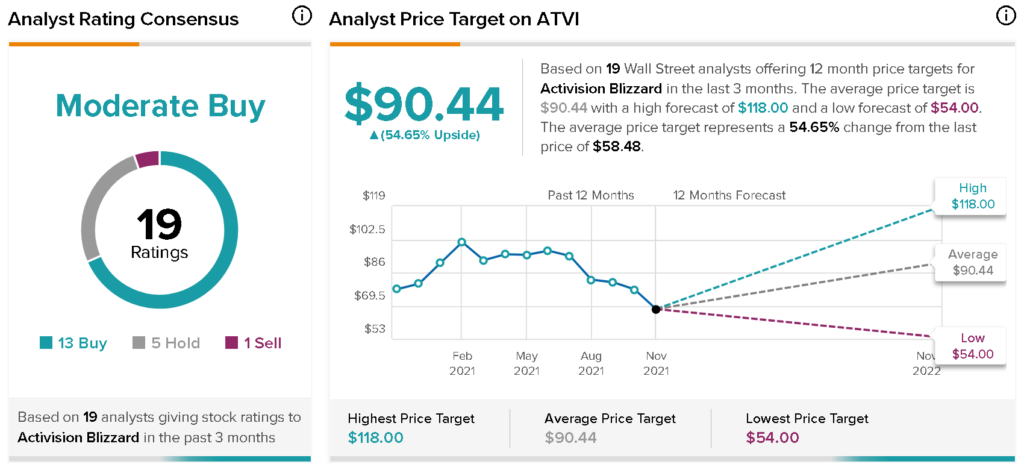

According to TipRanks’ analyst rating consensus, ATVI is a Moderate Buy, based on 13 Buy ratings, five Hold, and one Sell ratings. The average Activision price target is $90.44, implying 54.7% upside potential.

The Takeaway

Bargains are great, but the last thing investors need right now is to invest in a scandal-ridden company like Activision Blizzard.

There are plenty of other businesses to own shares of. It’s probably best to pick one with a happy, stable workplace culture.

For the time being, then, it’s perfectly fine to just watch ATVI stock from a distance and see how the troublesome events play out.

Disclosure: At the time of publication, David Moadel did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >