Activision Blizzard (NASDAQ: ATVI) shares have treaded continuously lower over the past couple of quarters, reaching new lows during December before somewhat rebounding over the past month.

Despite the recent decline, ATVI remains the most valuable U.S.-based video game company, boasting a market cap of $50.8 billion.

I have previously mentioned that ATVI’s stock is one of my favorites in the space due to the company’s numerous positive characteristics. These include operating a very diversified portfolio of video game titles, including legendary franchises and IP (intellectual property) such as Call of Duty, World of Warcraft, and Candy Crush, which have historically attracted consistent player bases and generated predictable cash flows.

Activision Blizzard is made of Activision, Blizzard, and King, each concentrated on maximizing profitability on their own based on the respective genres they specialize in, thus enriching investors’ margin of safety.

Shares have suffered lately following the news coming out informing that the company’s CEO, Bobby Kotick, knew for years regarding sexual misconduct incidents at ATVI, which then neglected to disclose to the board.

With the smoke clearing over the past month following written promises from the company to transform its culture, investors should start valuing the company again based on its financial strengths.

The company still makes a ton of money, and when taking into account its overall financials and inexpensive valuation, I believe there is meaningful upside in ATVI’s stock. Hence, I remain bullish on the stock.

Loyal Player Base Drives Improving Financials

Despite the recent concerns surrounding the company, operationally, ATVI remains solid. This is illustrated in its solid player retention rates.

By far, this is the gaming company with the most outstanding ability to preserve a very stable player base among its titles. Many gaming titles are usually played by gamers for a certain amount of hours, providing developers/publishers with no incremental value in the long term.

In contrast, ATVI’s titles have historically sustained robust player bases for months/years following their launches due to their online multiplayer elements, which provide great replay value.

In its Q3 2021 results, Activision Blizzard reported GAAP net revenues of $2.07 billion, 6.1% higher year-over-year, and solid operating margins, which landed at 40%. EPS was $0.82, versus $0.78 in the comparable period last year, with the company’s profitability also improving.

Results were primarily driven by ATVI’s Blizzard segment, whose revenues grew 20% year-over-year, powered by the successful launch of Diablo II: Resurrected.

ATVI’s King segment’s revenues also grew by 22% year-over-year, reaching a new quarterly record due to very strong year-over-year trends for both in-app purchases and advertising rates.

Wall Street’s Take

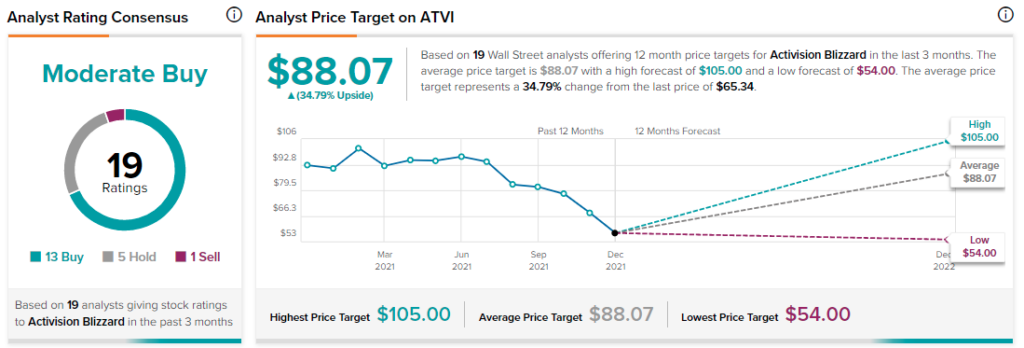

Turning to Wall Street, Activision Blizzard has a Moderate Buy consensus rating, based on 13 Buys, five Holds, and one Sell assigned in the past three months. At $88.07, the average ATVI price target implies 34.8% upside potential.

Conclusion

With the company projected to produce EPS of $0.54 in its upcoming earnings and FY 2021 EPS of $3.81, the stock is currently trading with a P/E of 17.2, which is quite an inexpensive valuation for the industry.

Considering the company’s improving financials and the ongoing stock buybacks that occur on the cheap, this looks like a good stock.

Download the TipRanks mobile app now

Disclosure: At the time of publication, Nikolaos Sismanis did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >