Shares of ACM Research (ACMR) closed 4.29% lower on Friday, August 6, after the company held a conference call to discuss its second-quarter performance.

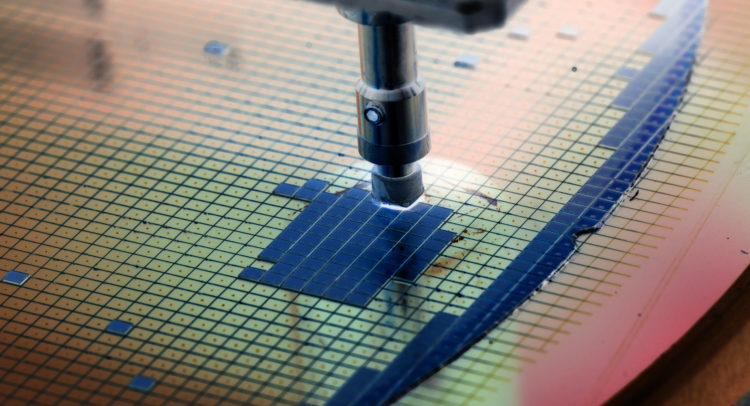

Notably, the single-wafer wet cleaning equipment manufacturer released its second-quarter earnings after the markets closed on August 5, wherein both top and bottom lines lagged consensus estimates. Moreover, a higher mix of lower-margin products like semi-critical tools and advanced packaging tools dented the gross margin.

Nonetheless, strong traction in shipments that reached $82 million was a tailwind. Moreover, a solid pipeline of shipments, which is to be completed in the second half of 2021, was also encouraging. The company raised its revenue target to $225 million-240 million from $205-230 million, and maintained its long-term target of non-GAAP gross margin between 40% and 45%. (See ACM stock chart on TipRanks)

YMTC is expected to be one of the top customers of ACM for 2021. Further, shipments to SMIC, especially trailing-edge fabs, are expected to increase in the last leg of 2021. Demand from SMIC is likely to pick up in 2022. Moreover, YMTC is expected to start filling its second fab shell in the same year, which is likely to increase demand for ACM’s products.

Notably, ACM recently announced that it was awaiting approval from the China Securities Regulatory Commission (CRSC) for the ‘STAR’ listing of its Chinese subsidiary, ACM Shanghai. If the listing materializes, it can propel ACM further upward in the semiconductor equipment industry.

“As the Chinese government cracks down on tech companies that are not seen as strategic for China, China-listed semiconductor stocks have performed relatively well in recent months and we believe the STAR IPO in late 3Q21/early 4Q21 could turn out to be well timed,” said Needham analyst Quinn Bolton, who reiterated a Hold rating on ACM. Bolton, however, did not assign any price target to the stock.

Bolton believes that the geopolitical risks associated with SMIC are likely to stay for quite some time. Moreover, as per market whispers, the U.S. government might soon set regulatory roadblocks on YMTC. The analyst said, “Although we believe ACMR is still likely to grow strongly, these risks are largely out of ACMR’s control and may remain an overhang for the stock.”

As wafer fab equipment (WFE) spending in China continues to grow, the prospects of ACM continue to strengthen. ACM’s market share in China has grown meaningfully as Chinese fabs continue to localize equipment suppliers to decrease dependence on the U.S.

Although the analyst had expected the impending ACM Shanghai IPO to drive share price upwards, the recent escalation of Sino-U.S. semiconductor trade issues and a potential export ban to SMIC could “significantly weaken both ACMR’s fundamentals and ACM Shanghai’s IPO valuation.”

Consensus among Tipranks’ analysts for ACM is a Moderate Buy based on 2 Buys and 2 Holds. The average ACM price target of $117.5 implies 28.1% upside potential from current levels.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.