During a gold rush, sell shovels. During a semiconductor rush, buy providers of manufacturing equipment for the industry.

ACM Research (ACMR) has shown excellent financial results, and management continues to raise expectations. The Chinese semiconductor equipment market ranks second in terms of volume and first in terms of growth globally; this is a solid growth driver that will allow the company to maintain strong revenue growth in the long term.

Financial leverage is at a stable level. The company’s receivables are significant — the demand for products remains high.

According to my valuation, the company is trading at a significant discount to the fair price. I am bullish on ACM Research.

Company Profile

ACM Research is an American company; a provider of innovative manufacturing equipment for the global semiconductor industry.

The company manufactures semiconductor wafer wet cleaning front-end processing tools for advanced integrated circuits or chips. The company also develops, manufactures and sells a range of advanced packaging tools to wafer assembly and packaging customers. The company was founded in 1997 and is headquartered in Fremont, California.

Revenue breakdown by product category and wafer-related tools is presented below:

Industry As a Growth Factor

Mainland China is the main market of the company, 98% of product sales are there. Some of the products are purchased by subsidiaries of Chinese companies in Korea, Japan, Singapore and Taiwan.

The semiconductor industry is divided into three, highly specialized niches: packaging and testing, wafer manufacturing, and chip design. ACMR products are related to each niche.

The global semiconductor market is expected to grow from $452.25 billion in 2021 to $803.15 billion in 2028, at a CAGR of 8.6%.

China accounts for about 26% of the global semiconductor market, and a record 60% consumption of semiconductor products. According to IMARC, China’s semiconductor market is expected to grow at a CAGR of 11% by 2026.

The semiconductor wafer cleaning equipment market is expected to grow from $4.9 billion in 2020 to $7.7 billion in 2028, at a CAGR of 6.5%. The China market will grow at a CAGR of 9.7%, and reach $1.7 billion in 2027.

According to ACMR’s latest presentation, China is the fastest-growing geography — with the most prominent semiconductor equipment sales CAGR from 2016-21 of 20.7%, and sales volume at $16.8 billion.

The company’s management mentions that ACMR’s current product portfolio addressed more than $5 billion of the global wafer equipment market in 2020.

The total global market for these equipment segments is expected to increase by 6% to $6.8 billion in 2021. The company’s revenue in 2021 will be about $245 million, which brings the company’s share of the semiconductor equipment market to about 3% in 2021.

The company’s target market is growing, and the share of ACMR is about 3%. At the same time, the company’s revenue is growing much faster than the market; ACMR takes a percentage from competitors.

This trend means that the company is firmly positioned and will at least increase in line with the market in the long term.

Financial Performance

Revenue in 2020 was $156.6 million, which is $45.4 million or 44.9% more than in 2019. The main reason for the growth was increased wet cleaning sales and other front-end processing tools. Revenue for the first three quarters of 2021 was $164.6 million, up 47.7% from the same period in 2020.

The main reason for revenue growth in 2020 and the first three quarters of 2021 was increased sales of wet cleaning and other front-end processing tools.

At the end of the year, revenue is expected to grow by 50% in 2021 and be in the range of $230 billion to $240 billion. The company is growing faster than the industry, and its market share is still tiny. The company can maintain a high growth rate in the long term.

Since 2017, the company’s net profit margin has shown a positive trend. The growth of TTM depends on the fact that the share of operating expenses in revenue has decreased by 3% over the past nine months.

Asset turnover has been declining since 2018. The decline is due to the company manufacturing a new facility in 2018, and breaking ground on the new one million square feet R&D and production facilities in July 2022. With revenue growth and no asset growth, turnover will increase.

In 2016, the asset-to-equity ratio of the indicator declined sharply and is now holding at a relatively normal level.

Valuation

My valuation is relatively conservative. Within our DCF model, I made several assumptions. Management forecasts revenue of $255 million to $260 million for 2021, and $345 million to 385 million for 2022. I believe that this forecast is reasonable, because:

- Revenue for the first nine months of 2021 exceeds the previous period by $55 million.

- Demand for the company’s products is growing.

- The company also expects fiscal 2021 shipments of $365 million to $370 million.

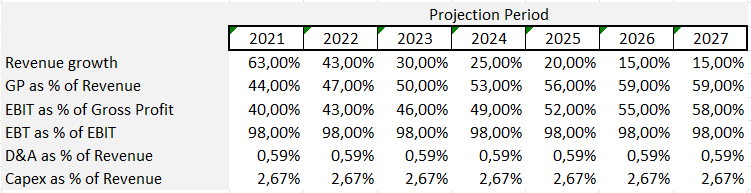

Comparative indicators are based on historical dynamics and current trends. Terminal growth 6% (2027 and beyond). My assumptions are presented below:

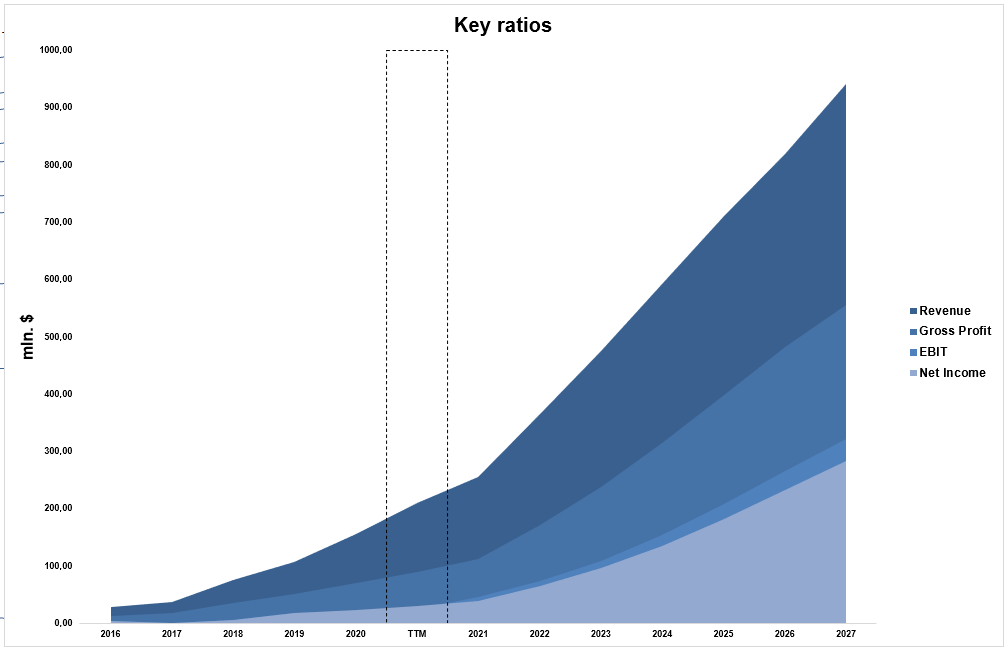

Based on the assumptions, the expected dynamics of key financial indicators are presented below:

With a Stable growth Cost of Equity equal to 10%, the Weighted Average Cost of Capital (WACC) is 10%.

I have determined that the fair capitalization of the company is about $2.8 billion, or $131.90 per share. The company is trading below its fair price. Upside potential is 49%.

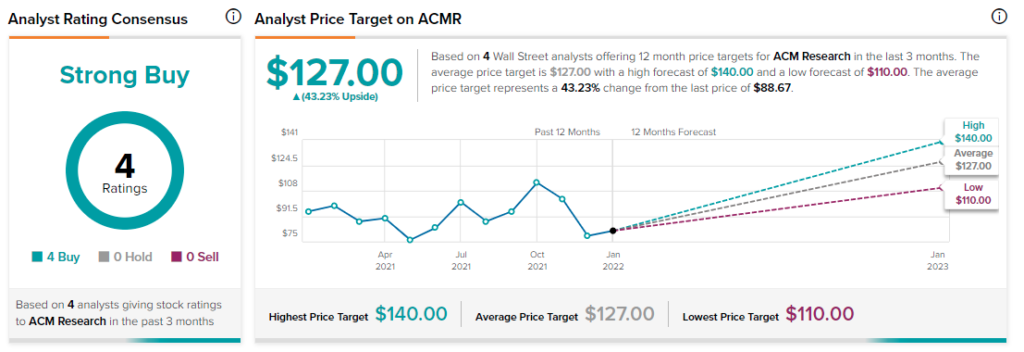

Wall Street’s Take

From Wall Street analysts, ACM Research earns a Strong Buy analyst consensus based on four unanimous Buy ratings. At $127, the average ACMR price target implies 43.2% upside potential.

Conclusion

The company’s financial performance is proliferating, and demand for products remains high.

Management has raised expectations for revenue growth. The size and growth rate of the Chinese semiconductor market fully provide ample opportunity for long-term growth in ACMR’s financial performance. Thus, I am bullish on the company.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure