Shares of biopharma company AbbVie (NYSE: ABBV) have surged 15.5% year-to-date, outperforming the broader market. Amid the volatility, many investors prefer safer bets like AbbVie, which offers an attractive dividend yield.

AbbVie’s dividend yield stands at 3.49%, ahead of the healthcare sector’s average dividend yield of 1.35%.

AbbVie is widely known for its blockbuster autoimmune disease drug Humira, which generated $20.7 billion in revenue in 2021, accounting for 37% of the company’s overall revenue.

While concerns about the loss of the U.S. exclusivity for Humira in 2023 prevail, AbbVie is strengthening its portfolio through organic growth, strategic acquisitions (like Allergan in 2020), and collaborations.

The company sees robust growth prospects for several drugs, including immunology drugs Skyrizi and Rinvoq. It anticipates Skyrizi and Rinvoq to contribute over $15 billion in combined risk-adjusted global sales in 2025.

Upcoming Results

AbbVie’s Q421 revenue grew 7.4% to $14.89 billion, slightly lagging analysts’ estimate of $14.95 billion. Revenue from Humira increased 3.5% to $5.3 billion, driven by 6% growth in the U.S., partially offset by a 9.1% decline in Humira’s international revenue due to biosimilar competition.

Q421 adjusted EPS of $3.31 increased 13.4% year-over-year and surpassed analysts’ estimates of $3.28. AbbVie expects 2022 adjusted EPS in the range of $14.00-$14.20 compared to $12.70 in 2021 and higher than Wall Street’s expectations of $13.99.

AbbVie is scheduled to announce its Q122 results on April 29. Analysts expect revenue to increase 5.3% to $13.62 billion and EPS to grow 6.4% to $3.14.

Wall Street’s Take

Ahead of the print, BMO Capital analyst Gary Nachman reiterated a Buy rating on AbbVie and raised the price target to $174 from $161 based on an improving outlook.

Nachman expects “solid 1Q22 results” driven by continued momentum in the company’s key growth drivers. Specifically, the analyst is optimistic about “immunology with impressive Skyrizi Rx trends and Rinvoq growth taking JAK share (recent positive physician feedback on increasing use), and Neuroscience led by robust migraine franchise accelerating with Qulipta/Ubrelvy taking share (also positive physician feedback).”

Further, Nachman expects Abbvie’s Aesthetics line to perform well and help to offset potential revenue declines in Hematologic Oncology and Eye Care business lines. He also believes that AbbVie’s pipeline could drive further multiple expansion.

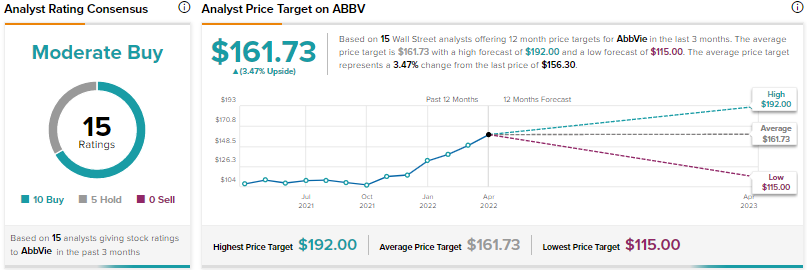

Turning to the rest of the Street, AbbVie scores a Moderate Buy consensus rating based on 10 Buys and five Holds. The average AbbVie price target of $161.73 suggests a modest 3.47% upside potential from current levels.

Conclusion

While Humira continues to be AbbVie’s crown jewel, investors will be keen to observe the performance of other rapidly growing drugs, like Skyrizi and Rinvoq, which are expected to drive the company’s top-line growth in the years ahead.

Currently, AbbVie scores a nine out of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure