Fundamental catalysts suggest that AbbVie (ABBV) stock has a long upside pathway ahead. As society gradually claws its way back to normalcy, the demand for elective procedures is also normalizing, which is boding very well for the pharmaceutical firm. As a result, I am bullish on ABBV stock.

Back in 2019, AbbVie announced that it would acquire Allergan for about $63 billion, according to a Reuters report. At the time, one of AbbVie’s primary focuses was on Botox, a lucrative wrinkle treatment.

Consisting of a botulinum toxin that paralyzes muscles, Botox routinely generates more than $3 billion in annual sales globally. Prior to the pandemic, experts projected that sales would hit $4.6 billion by 2024.

Of course, COVID-19 disrupted AbbVie’s plans for the popular cosmetic treatment, sending ABBV stock plummeting during the spring doldrums of 2020. Fortunately, the volatility was short-lived, with the company lending its expertise to help fight COVID-19.

However, now that the global health crisis is fading into the rearview mirror, AbbVie’s Botox business suddenly looks attractive again. Indeed, by the end of last year, media reports indicated that U.S. Botox sales – which surpassed the $1 billion mark in the first nine months of 2021 – have never been higher.

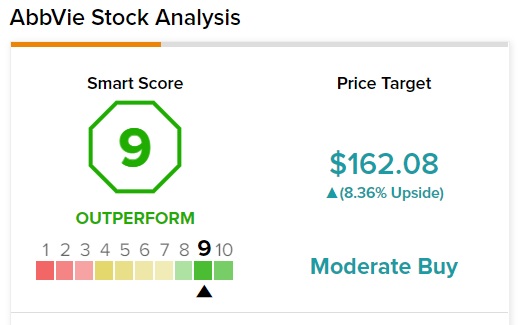

AbbVie’s High Smart Score Rating

On TipRanks, ABBV has a 9 out of 10 on the Smart Score rating. This indicates solid potential for the stock to outperform the broader market.

AbbVie Has Many Growth Catalysts for Its Cosmetic Procedures

The underlying company enjoys multiple angles to address within the broader cosmetics sector.

First, the incentivization factor for AbbVie’s Botox is off the charts, as demonstrated by ramped-up sales for the wrinkle treatment. For instance, the American Psychological Association states that 42% of U.S. adults reported undesired weight gain. Within this cohort, the average gain was 29 pounds.

Translation? Quite a few people likely let themselves go on the looks departments, but they’re also ready to get back on the treadmill.

Second, data from Rush University Medical Center reveals that the pandemic may have directly increased the demand for cosmetic procedures.

As one theory goes, the rapid pivot and integration of teleconferencing platforms – a prerequisite for remote operations – made many people self-conscious. For the first time, employees had to look at their own faces in addition to those of their coworkers.

Third, it’s also possible that as employers start recalling their employees back to the office, the sudden pressure to look presentable may also boost Botox sales. In addition, relaxed COVID-19 mitigation rules mean that socialization is back on the agenda, further incentivizing cosmetic procedures.

AbbVie’s Strong Financial Performance

Aside from the Botox framework, ABBV stock also benefits from underlying fiscal resilience. AbbVie was one of the few companies that managed to post robust growth in 2020, posting revenue of $45.8 billion. This figure was up nearly 38% from 2019’s tally of $33.3 billion.

In 2021, AbbVie again delivered the goods, generating sales of $56.2 billion, a lift of nearly 23% on a year-over-year basis. Better yet, the momentum continues to build into this year, with first-quarter sales of $13.5 billion, up 4% from the year-ago level. Further, net income came in at $4.5 billion, representing a lift of over 26% year-over-year.

Indeed, AbbVie’s profitability metrics are nearly class-leading. For instance, its operating margin of 35.4% well exceeds the drug manufacturing industry median of 5.4%. In fairness, such strong numbers might make ABBV stock a bit overvalued on paper. However, most signs point to booming demand for cosmetics, which means ABBV may have longer legs.

In April 2021, the American Society of Plastic Surgeons revealed that pent-up patient demand was fueling the surge in electric procedures. It stands to reason that a less intrusive procedure such as Botox will likewise enjoy a robust sales trajectory.

Wall Street’s Take on ABBV Stock

Turning to Wall Street, ABBV stock has a Moderate Buy consensus rating based on nine Buys, three Holds, and one Sell rating. The average AbbVie price target is $162.08, implying 8.36% upside potential.

Conclusion: A Security for Insecurities

Among the radical changes of the COVID-19 crisis, a less-appreciated impact may be its role in shifting the paradigm of the cosmetics industry.

Never before have so many people become self-aware of their physical appearance, thus driving sales of various beauty care products and procedures. Moreover, pent-up demand suggests that ABBV stock may have an extension on its relevance.