Healthcare companies are not completely immune to macro pressures but are generally more resilient compared to companies in other sectors. This is because of the essential nature of medicines and services offered by healthcare companies. Moreover, several healthcare companies are developing various treatments to address unmet medical needs, which is expected to drive their long-term growth. Using TipRanks’ Stock Comparison Tool, we placed AbbVie (NYSE:ABBV), Novo Nordisk (NYSE:NVO), and Eli Lilly (NYSE:LLY) against each other to find the healthcare stock that could fetch the most attractive returns as per Wall Street analysts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

AbbVie (NYSE:ABBV)

AbbVie investors have been worried about the impact of the loss of exclusivity of the company’s blockbuster rheumatoid arthritis drug Humira. In Q3 2023, Humira’s revenue declined 36.2% to $3.55 billion. However, the company is confident about mitigating the impact of Humira’s lower revenue with growing sales of other drugs like immunology treatments Skyrizi and Rinvoq.

Additionally, AbbVie recently announced two major acquisitions that are expected to boost the company’s growth in the times ahead. AbbVie is acquiring ImmunoGen for $10 billion to accelerate its entry into the ovarian cancer commercial market.

Earlier this month, the company announced the buyout of Cerevel Therapeutics for $8.7 billion, with the acquisition expected to enhance its neuroscience pipeline.

Is ABBV Stock a Buy or Sell?

On Monday, Goldman Sachs analyst Chris Shibutani upgraded AbbVie to Buy from Hold with a price target of $173. The analyst thinks that Humira’s sales have held up better than he expected despite competition from multiple biosimilars. Shibutani also noted the strong performance of AbbVi’s immunology treatments, Rinvoq and Skyrizi. He also expects AbbVie’s aesthetics franchise to reaccelerate next year, fueled by Botox’s dominant position in the industry.

Wall Street has a Moderate Buy consensus rating on Abbvie based on eight Buys and five Holds. The average price target of $170.25 implies 11.1% upside. Shares are down 5% year-to-date. ABBV offers a dividend yield of 4%.

Novo Nordisk (NYSE:NVO)

Denmark-based Novo Nordisk had a strong run this year, thanks to the buzz around the company’s weight loss drugs Wegovy and Ozempic. The company’s sales in the first nine months of 2023 increased 29% to 166.4 billion Danish Kroner, while operating profit rose 31% to 75.8 billion Danish Kroner. Novo Nordisk’s solid results were driven by a 36% rise in the sales of its Diabetes and Obesity care portfolio.

Looking ahead, the company aims to bolster its leadership in diabetes care, with a goal to reach a global market value share of more than one-third by 2025. The company is also targeting obesity drug sales of 25 billion Danish Kroner by 2025. In the first nine months of 2023, NVO’s obesity care sales rose by 167% to 30.4 billion Danish Kroner.

What is the Price Target for Novo Nordisk Stock?

Earlier this month, Cantor Fitzgerald analyst Louise Chen initiated coverage on Novo Nordisk stock with a Buy rating and a price target of $120. Chen expects the demand for obesity drugs to remain attractive in the years ahead. The sales (annualized) for this category are already more than $10 billion.

The analyst estimates sales to grow to $100 billion over the next 5 to 7 years, reflecting nearly 40% to 60% CAGR (compound annual growth rate). Chen expects NVO to be an “outsized beneficiary” of this robust sales trend, given its leadership, which is currently a duopoly with Eli Lilly.

Overall, Novo Nordisk scores Wall Street’s Strong Buy consensus rating based on four unanimous Buys. The average price target of $116.67 implies 21.3% upside potential. Shares have risen over 42% since the start of this year.

Eli Lilly (NYSE:LLY)

Eli Lilly shares have rallied about 60% year-to-date due to the optimism around tirzepatide, which has been approved for diabetes (Mounjaro) and weight loss (Zepbound). However, on Monday, LLY stock declined 2.3% following the release of data that indicated that patients who took Zepbound regained about 14% of their weight over a period of about one year.

However, BMO Capital analyst Evan David Seigerman noted that this data was initially announced in October and was well-received back then. He thinks that the concern over post-treatment weight regain is “overblown,” with the pullback in the stock presenting a buying opportunity.

Coming to recent performance, Eli Lilly reported better-than-expected Q3 2023 results, driven by a 37% growth in its revenue to $9.5 billion. The top line gained from robust sales of its diabetes drug Mounjaro and higher revenue from several other treatments, including breast cancer pill Verzenio and diabetes drug Jardiance. The company is confident about the road ahead, supported by a robust pipeline that it continues to enhance through internal drug development and strategic acquisitions.

Is Eli Lilly a Good Stock to Buy?

On Tuesday, Morgan Stanley analyst Terence Flynn increased the price target for LLY stock to $727 from $722 and maintained a Buy rating. While providing a 2024 outlook for the North American biopharma sector, Flynn highlighted four themes – “diabesity,” product cycles, policy, and rates. For Eli Lilly, the analyst expects “another year of dispersion” and recommends investors to continue to focus on companies that can deliver growth in the second half of the decade.

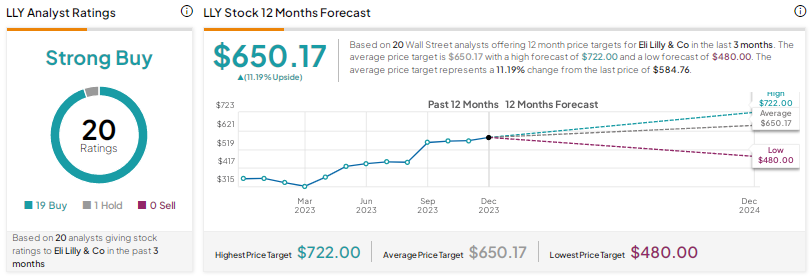

Including Flynn, 19 analysts have a Buy rating on Eli Lilly stock, while one has a Hold recommendation. At $650.17, the average LLY price target implies 11.3% upside potential.

Conclusion

Wall Street is highly bullish on the prospects of Novo Nordisk and Eli Lilly but cautiously optimistic about AbbVie. Currently, analysts see higher upside potential in Novo Nordisk’s stock, thanks to the stellar demand for its weight loss drugs.