Back in September, Ray Wang, principal analyst and founder of Constellation Research, called MATANA, an acronym for Microsoft (MSFT), Apple (AAPL), Tesla (TSLA), Amazon (AMZN), Nvidia (NVDA), and Alphabet (GOOGL, GOOG) to be the new face of big tech stocks, instead of the popular FAANG group. We will use TipRanks’ Stock Comparison Tool to pit Apple, Amazon, and Tesla against each other to pick the most attractive MATANA stock.

In an interview with Yahoo Finance, Wang explained that he formed the MATANA group by dropping Meta Platforms (META) and Netflix (NFLX) from the FAANG group and adding Microsoft, Tesla, and Nvidia. Wang called Netflix and Meta “one trick ponies” and expressed concerns about further growth in Netflix’s subscriptions and Meta’s prospects beyond its advertising revenues.

Let’s see Wall Street’s opinions on Apple, Amazon, and Tesla.

Apple (NASDAQ:AAPL) Stock

Despite foreign currency fluctuations and supply chain bottlenecks, Apple topped analysts’ expectations for the fiscal third quarter (ended June 30, 2022). Management reassured investors that despite macro challenges and foreign exchange headwinds, year-over-year revenue growth in the fiscal fourth quarter will accelerate compared to the June quarter.

However, investors are concerned that an economic downturn might impact consumers’ discretionary spending and hurt the sales of Apple’s products, which generally command a premium price than rivals.

Near-term headwinds might remain a drag on AAPL stock. Nonetheless, Apple remains an attractive long-term pick based on its solid financial position, strong brand name, innovation, and booming services business. Apple’s services division, which includes revenue from Applecare, advertising, cloud, and other services, is now advancing further in payment solutions by expanding in growth areas like buy now, pay later.

Is Apple a Buy or Sell Now?

Yesterday, KeyBanc analyst Brandon Nispel increased his iPhone revenue estimates to reflect higher average selling prices. Nispel also expects Apple’s fiscal fourth quarter to benefit from an extra week of iPhone sales and a shift in product mix to higher-priced models like the Pro and Pro Max. The analyst also expects the tech giant to gain from the higher-priced iPhone 14 Plus replacing the iPhone 13 Mini.

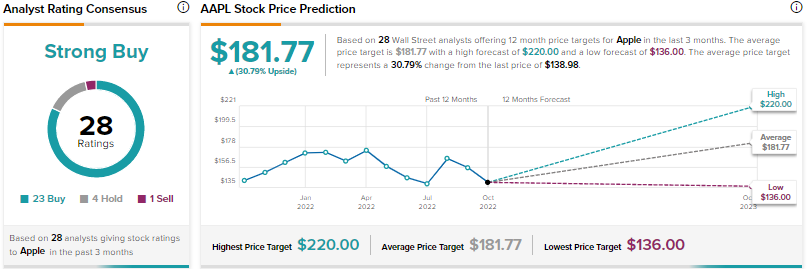

On TipRanks, Apple stock scores a Strong Buy consensus rating based on 23 Buys, four Holds, and one Sell. The average AAPL stock price target of $181.77 suggests 30.8% upside potential. Shares have plunged about 22% year-to-date as of October 11.

Amazon (NASDAQ:AMZN) Stock

Amazon’s e-commerce sales have weakened after witnessing elevated levels earlier in the pandemic. The company still delivered market-beating revenue growth of 7.2% in the second quarter, driven by higher revenue from the Amazon Web Services (AWS) cloud computing division and increased advertising sales. However, higher fuel and transportation costs as well as a loss related to the company’s investment in Rivian (RIVN) weighed on the Q2 bottom line.

Amazon is focusing on reducing costs and enhancing the productivity of its fulfillment network to improve its profitability amid an inflationary environment.

Is Amazon a Buy, Sell, or Hold?

Last week, J.P. Morgan analyst Doug Anmuth reaffirmed his Buy rating for Amazon stock, calling it his firm’s “best idea” based on expectations of “revenue acceleration, margin expansion, and capex moderation (all led by retail) to drive significant FCF inflection in 2023.”

Anmuth is confident about Amazon’s ability to outperform despite a challenging operating backdrop. The analyst expects the company to have an “inventory advantage” in the crucial holiday season compared to omnichannel retailers, who might face physical space-related constraints.

Anmuth also expects margins of the company’s retail business to come back to mid-single digits driven by lower fuel and freight costs compared to the first six months of the year.

Overall, the Street rates Amazon stock a Strong Buy based on a whopping 35 Buys against One Hold. The average AMZN stock price prediction of $171.94 implies 53.2% upside potential. Shares have declined about 32.7% in 2022.

Tesla (NASDAQ:TSLA) Stock

Leading electric vehicle maker Tesla aggressively ramped up its production after it suffered supply chain and production disruptions due to COVID-related restrictions in China. The company produced 365,923 vehicles in the third quarter and delivered 343,830 units. However, Q3 deliveries failed to surpass analysts’ estimates.

TSLA stock has plunged 38.5% this year (as of October 11) due to macro challenges, supply woes, and the uncertainty and distraction associated with the Musk-Twitter deal. Investors are also concerned about the rising competition in the EV space, both in the domestic market as well as in China, the largest EV market.

What is the Target Price for TSLA?

On Monday, Morgan Stanley analyst Adam Jonas slashed his price target for Tesla stock to $350 from $383 but maintained a Buy rating. Following the Q3 update, Jonas trimmed his 2022 delivery forecast to 1.31 million units from 1.37 million units. He reduced the 2023 delivery estimate to 1.8 million vehicles from 2 million.

Jonas opines that the factors that impacted Tesla’s Q3 production and deliveries could persist into Q4 and 2023.

All in all, the Street is cautiously optimistic about Tesla stock, with a Moderate Buy consensus rating that breaks down into 19 Buys, seven Holds, and five Sells. The average Tesla stock target price of $321.69 implies 49% upside potential.

Conclusion

Among the three MATANA stocks discussed above, Wall Street is highly bullish on Amazon and Apple compared to Tesla. Despite near-term challenges and an impending recession, analysts are optimistic about the long-term prospects of the tech giants. Currently, analysts see more upside potential in Amazon stock than in Apple and Tesla.

Amazon’s leadership position in e-commerce, solid financials and growth prospects in cloud computing make it an attractive pick.