Despite the ongoing macro uncertainty, several tech stocks had a strong run this year due to generative artificial intelligence (AI)-related tailwinds, expectations of interest rate cuts, and company-specific strengths. However, many investors wonder if there is more room to run. Using TipRanks’ Stock Comparison Tool, we placed Apple (NASDAQ:AAPL), Advanced Micro Devices (NASDAQ:AMD), and Amazon (NASDAQ:AMZN) against each other to pick the most attractive tech stock as per Wall Street analysts.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Apple Stock (NASDAQ:AAPL)

Apple reported better-than-expected earnings for the fiscal fourth quarter (September quarter) last month despite its overall revenue declining for the fourth consecutive quarter. Consumer spending on big-ticket discretionary items, like Apple’s products, has been hit by macro pressures. In the September quarter, the company’s overall revenue declined 1% to $89.5 billion, as higher iPhone sales and Services revenue were offset by a decline in Mac and iPad sales.

Aside from macro pressures, there are also concerns about the impact of China’s iPhone ban across government agencies and the loss of a patent infringement suit related to Apple Watch. Nonetheless, most Wall Street analysts have a bullish long-term sentiment about Apple.

Is Apple Stock a Good Buy Now?

On December 14, Citigroup analyst Atif Malik reiterated a Buy rating on AAPL stock with a price target of $230. The analyst expects earnings growth of 14% and free cash flow growth of 11% in 2014, fueled by continued gross margin expansion.

Malik contends that bears on the stock are missing Apple’s structural gross margin improvement, which is driven by iPhone premiumization, acceleration in Services revenue, and the favorable impact of silicon insourcing. The analyst expects these trends to continue in 2024 and sees AI phones and Vision Pro adoption as potential upside catalysts.

Overall, Wall Street has a Strong Buy consensus rating on AAPL stock based on 24 Buys and eight Holds. The AAPL average price target of $202.40 implies 2.8% upside potential. Shares have advanced over 51% year-to-date.

Advanced Micro Devices Stock (NASDAQ:AMD)

While Nvidia (NASDAQ:NVDA) has grabbed the limelight this year due to the tremendous demand for its graphics processing units (GPUs) in building and training generative AI models, AMD is gearing up to catch up.

The company expects its recently launched MI300 series to compete with Nvidia’s AI processors. AMD estimates its GPU revenue to surpass $2 billion in 2024. The company’s 2024 revenue is also expected to gain from a recovery in the demand for its products catering to the PC market.

What is the Price Target of AMD?

Last week, Bank of America analyst Vivek Arya upgraded AMD stock from Hold to Buy and increased the price target to $165 from $135. The analyst explained that his previous concerns about Embedded (FPGA) and Gaming (consoles) corrections have now “generally materialized,” with rapidly growing opportunities in data center GPUs/accelerators indicating upside to medium-term sales outlook.

While the analyst continues to view Nvidia as his top compute and AI pick, he believes that AI or generative AI is a multi-year phenomenon and presents opportunities for many chip companies. He thinks that AMD is well-positioned to gain an incremental share of the hugely profitable $100 billion-plus accelerator market while continuing to advance in the server CPU market.

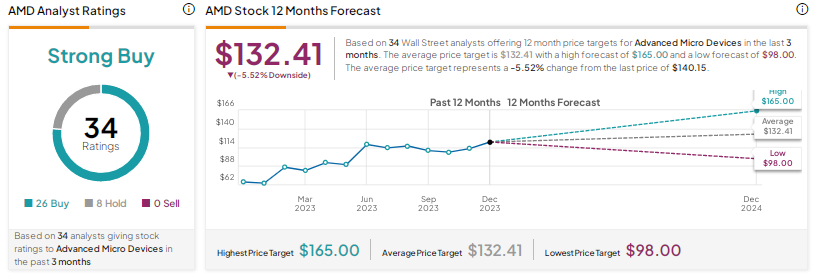

With 26 Buys and eight Holds, Advanced Micro Devices stock earns Wall Street’s Strong Buy consensus rating. Shares have rallied more than 116% year-to-date. At $132.41, the AMD average price target implies a possible downside of 5.5% from current levels.

Amazon Stock (NASDAQ:AMZN)

Amazon shares have jumped 83% so far this year, reflecting the e-commerce and cloud computing giant’s strong execution and improved profitability due to cost reduction measures. In particular, the company’s third-quarter revenue grew 13%, driven by strength in the retail segment and Amazon Web Services (AWS) cloud computing business.

The momentum in Amazon’s retail business is expected to continue in the crucial holiday quarter. Also, the company’s AWS segment is well-positioned to gain from its investments in generative AI. Further, Amazon’s advertising business, which grew 25% in Q3 2023, is being considered as one of the key growth drivers for the company.

Is Amazon a Buy, Hold, or Sell?

On Monday, Roth MKM analyst Rohit Kulkarni reiterated a Buy rating on the stock and raised his price target from $165 to $180. The analyst called AMZN his mega-cap pick for 2024, followed by social media behemoth Meta Platforms (NASDAQ:META) and search engine giant Google’s parent Alphabet (NASDAQ:GOOGL).

Kulkarni stated that Amazon is the only mega-cap stock for which he expects an accelerating top line and expanding operating margin in 2024. He believes that the Street’s consensus estimate continues to underestimate the potential acceleration in Amazon’s 2024 and 2025 free cash flow. He expects the company’s FCF to benefit from improving fundamentals and declining capital expenditure.

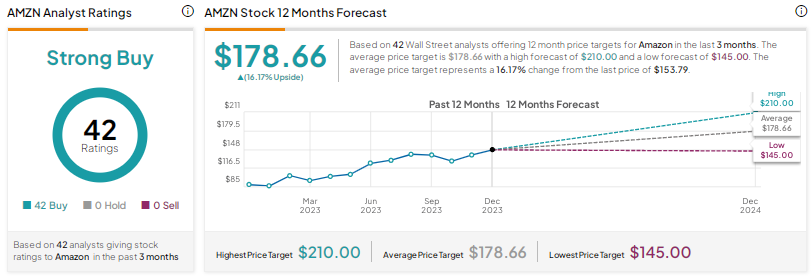

Amazon scores Wall Street’s Strong Buy consensus rating based on 42 unanimous Buys. The average price target of $178.66 implies about 15.6% upside potential.

Conclusion

Analysts are bullish on all three tech stocks discussed here based on their solid fundamentals, strong execution, and attractive long-term growth potential. That said, they see a higher upside in Amazon than the other two stocks, supported by the strength in its e-commerce and cloud computing businesses and the rapidly growing ad revenues.