Corona may have locked us all indoors, shut down the economy for nearly half the year, and even put President Trump in the hospital – but it seems to have breezed right past the semiconductor industry. And for good reason. Semiconductor chips are essential to our economy. From mobile devices to laptop computers to wifi to factory floors, pretty much everything in our lives runs on semiconductor chips.

A look at the numbers will bear this out. The fifteen largest chip makers saw a combined $314 billion in sales last year, and the industry as a whole is on track to see $468 billion for 2020. It’s estimated that the industry will sell upwards of 1 trillion units this year.

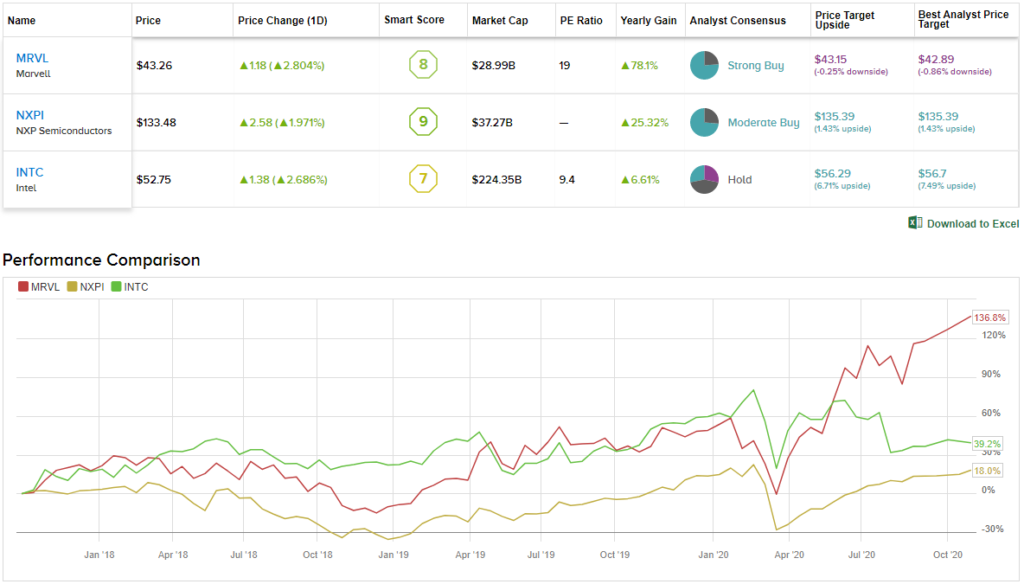

With this in mind, we’ve delved into chip stocks with two stocks to consider here and one to avoid. Using TipRanks’ Stock Comparison tool, we lined up the three alongside each other to get the lowdown on what the near-term holds for these chip players.

Marvell Technology (MRVL)

We’ll start with Marvell, whose $29 billion market cap makes it a mid-sized company in the semiconductor sector. With $2.9 billion in total sales last year, the company didn’t make into the list of the top 15 chip makers – but it’s still an important player, operating in over a dozen countries around the world and partnering with major names like Samsung and Nokia.

Marvell’s partnerships are boosting the company’s position in the growing market for 5G compatible chips. Both Samsung and Nokia are major handset makers, and Nokia has engaged with Marvell to solve “5G chip problems.” Marvell’s agreement with Samsung is big deal, as the Korean company is one of the world’s largest smartphone makers, and now a captive market for Marvell.

All of this helps explain why MRVL shares are up a whopping 64% year-to-date. The company is simply on a tear – and the general economic downturn in 1H20 was unable to impact Marvell’s revenues. The top line came in at $693 million and $727 million for Q1 and Q2, in line with the previous two quarters. Earnings per share grew sequentially from Q1 to Q2, from 9 cents to 12 cents, and beat the forecast by a 20% margin.

A solid foundation and profitable results have brought Marvell to the notice of 5-star analyst Hans Mosesmann who cover the stock for Ronseblatt.

“Marvell has 5nm silicon in their labs today and the performance and density characteristics look quite favorable… Marvell’s move has customer buy in up front due to the nature of the custom ASIC business. Marvell also gets the benefit of getting to re-purpose non-propriety customer 5nm building blocks for use in other products or market segments,” Mosesmann explained.

The analyst concluded, “We see Marvell’s market opportunity, secular and fundamental shifts in the world of computing, due to exponential growth in AI workload requiring more custom ASIC solutions, and the accelerated move to 5nm support the notion of a premium valuation multiple tot he 30x level from our current mid-20s view.”

Accordingly, Mosesmann rates MRVL a Buy along with a $60 price target. This figure implies a potential upside of 38% for the coming year. (To watch Mosesmann’s track record, click here)

Overall, the 21 recent reviews of MRVL stock break down to 15 Buys and 6 Holds, giving the stock a Moderate Buy analyst consensus rating. (See MRVL stock analysis on TipRanks)

NXP Semiconductors (NXPI)

Next up, NXP, moves us up a step in size. This company, holding dual headquarters in both the Netherlands and Texas, was ranked 14 out of the top 15 semiconductor companies in 2019, counting by total sales (NXP saw $8.86 billion in sales last year).

While revenues and earnings have slipped due to the corona pandemic and supply and distribution disruptions, the company remains profitable. Continued profitability has supported the share price. NXPI has recovered more than 97% of its share price losses since this year’s mid-winter swoon, and is now showing a 6% year-to-date gain.

NXP is in an interesting position. Almost half of the company’s business comes from the automotive industry, where the chip maker is a major supplier of circuits and networking processors for battery monitors and radar systems. These are technologies integral to electric cars and autonomous vehicles, which despite their fits and starts are moving ahead steadily.

Fortunately for NXP, the global automotive industry expects both electric cars and autonomous cars to gain market share – and is adjusting planning accordingly. Gary Mobley, 5-star analyst with Wells Fargo, definitely agrees.

“Our investment thesis is based largely on a recovery in global automotive production. Longer-term, our investment thesis is underpinned by: 1) growing semiconductor content per automobile, 2) NXPI share gains in the automotive semiconductor market, and 3) the growing need for secure, contactless mobile payments as well as authentication & proximity sensing,” Mobley wrote.

The analyst concluded, “[We] believe NXPI should experience outsized revenue growth, margin expansion and EPS growth in CY21. Additionally, we feel shares are attractively valued relative to normalized non-GAAP EBIT and EPS power.”

Mobley is impressed enough here to rate NXPI an Overweight (i.e. Buy) rating, and a $145 price target that indicates a 9% upside from current levels. (To watch Mobley’s track record, click here)

NXP Semiconductor is another company with a Moderate Buy analyst consensus rating. The stock has 19 recent reviews, including 14 Buys and 5 Holds. (See NXPI stock analysis on TipRanks)

Intel Corporation (INTC)

Our last stock is a big stick in the chip world. From 1993 to 2017, Intel was the #1 company in the global semiconductor market, by total sales volume. It was overtaken by Korean rival Samsung for 2017 and 2018, but in 2019 Intel regained its crown, with $69.83 billion in total semiconductor sales. Projections for 2020, however, show Samsung overtaking Intel again, even as Intel’s sales are on track to hit $72 billion.

Intel’s problem stems from its success. It originally built is leading market share by dominating the PC and laptop market for processor chips – a vital niche, that continues to hold up the company’s sales. But markets change. Smartphones and tablets have been eating away at the edges of the computer niche, as the increase in capability, and large-scale competitors like Nvidia (NVDA) and AMD (AMD) have been directly competing in the computer processor market. And Intel is finding other avenues blocked by mid-level competitors, like Marvell and NXP above, which have taken leading positions in smaller, but fast growing, segments of the chip industry.

The financial results from 1H20, and the stock performance, have been reflecting the uncertain status of Intel’s market position. Revenues remain stable, between $19 and $20 billion per quarter, but EPS has been sliding since Q4 of last year. 1Q20 earnings came in at $1.45 per share, down 4.6% sequentially; 2Q20 EPS fell another 15% to $1.22 per share. And the stock is currently down 10% so far this year, in trading that has been highly volatile.

Adding more fuel to fire, Northland analyst Gus Richard rates INTC an Underperform (i.e. Sell), and his $48 price target implies a 9% downside from current levels. (To watch Richard’s track record, click here)

In his comments, the 5-star analyst paints a gloomy picture of Intel’s future.

“INTC expects 2H to be down Y/Y. INTC continued to sell to Huawei in 1H despite prior attempts by the US commerce departments to restrict Huawei access to US technology. We expect sales to Huawei to go to zero by the end of Q3. Intel is also losing share to AMD and Apple is moving to its own CPU in notebooks. Data points do not paint a positive picture for INTC in 2H and beyond. Intel is on the wrong track,” Richard wrote.

Overall, the analyst consensus on Intel is a cautious Hold. The stock has 32 recent rating, breaking down to 9 Buys, 14 Holds, and 9 Sells. (See Intel’s stock analysis at TipRanks)

To find good ideas for chip stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.