2020 has been anything but a fairy tale for the movie and entertainment industry. With COVID-19 forcing many movie theaters to close their doors in the first half of the year, 2020 North American box office is trending down 78.4% to $1.90 billion year-to-date compared to 2019.

Adding insult to injury, Cineworld Group is expected to close its theaters in the U.K. and the U.S. This news comes on the heels of the announcement that the November release of the new James Bond movie had been delayed.

Don’t panic, this is not to say investors should abandon hope for the sector. Despite the pressures facing the industry, the Street’s pros are pounding the table on one movie theater stock, arguing it is well positioned to deliver handsome returns in the year ahead. However, this optimism doesn’t extend to every player in the space, with the analysts advising caution when it comes to one in particular.

Taking this into consideration, we ran both tickers through TipRanks’ database to find out what makes one so compelling and the other a no-go.

IMAX Corporation (IMAX)

First up we have IMAX, which is an entertainment technology company specializing in motion-picture technologies and large-format motion-picture presentations. Following the release of Tenet in the top two global markets, the U.S. and China, some members of the Street think that now is the time to pull the trigger.

Representing B.Riley FBR, analyst Eric Wold tells clients that the expectation of strong box office share from IMAX screens plays into his “long-standing positive IMAX thesis as the best play for the restart of the global exhibition industry.”

Along with the strong showing from The Eight Hundred in China, Tenet opened in 38 international markets, with 248 IMAX screens in those markets contributing $5 million in box office, or 9.4% of the film’s total box office (from only 1% of the total screens). Even though IMAX screens are operating at only 50% capacity, the 9.4% box office share was comparable to the 9.6% generated for Interstellar and 12.6% for Dunkirk even with a greater number of available non-IMAX screens (and seats) dedicated to Tenet.

On top of this, even more theaters than originally expected got the last-minute green light to open their doors. “We view the last-minute approvals for theaters in New Jersey, Maryland and parts of California bode well for stronger totals over the opening weekend and the coming weeks—especially within New Jersey, which is likely to attract moviegoers from New York and possibly Connecticut,” Wold commented.

This prompted the analyst to state, “After the higher-than-typical box office share generated by IMAX with The Eight Hundred in China and early international market results for Tenet both demonstrating the strength of the IMAX format, we remain optimistic moviegoers will increasingly gravitate to higher-quality, premium formats with a very IMAX-friendly film slate over, at least, the next 12-18 months.”

If that wasn’t enough, new IMAX installs are expected to ramp up in 2H20 and 2021. “We believe exhibitors will move to get IMAX screens installed in order to take advantage of both the IMAX market share momentum that is developing as well as a film slate during 2021 that is increasingly tilted toward IMAX-friendly tent pole films. We believe this could help drive a meaningful tailwind to current expectations,” Wold explained.

What’s more, based on the expectation that theater capacity restrictions will loosen throughout 2021, if not before, consensus estimates that project 2022 IMAX box office figures will land below levels reported for 2018 appear “overly conservative” to Wold.

In line with his optimistic approach, Wold stayed with the bulls. In addition to a Buy rating, he left a $21 price target on the stock. Investors could be pocketing a gain of 81%, should this target be met in the twelve months ahead. (To watch Wold’s track record, click here)

Where do other analysts stand on IMAX? 5 Buys and 2 Holds have been issued in the last three months. Therefore, IMAX gets a Moderate Buy consensus rating. Given the $16.21 average price target, shares could surge 39% in the next year. (See IMAX stock analysis on TipRanks)

AMC Entertainment (AMC)

As for AMC Entertainment, one of the world’s top entertainment companies, 2020 has been anything but smooth sailing. However, Wall Street doesn’t see the tides turning anytime soon.

Writing for MKM Partners, analyst Eric Handler acknowledges that in the most recent quarter, the company’s cash burn held steady at less than $95 million per month. With its debt restructuring, AMC has improved its cash position while reducing its cash interest payments.

When it comes to the rest of its quarterly results, with U.S. theaters closed throughout the quarter and its international circuit closed for two-thirds of the quarter, he considers the figures “largely irrelevant.” Handler added, “AMC’s risk profile remains very high with a still-elevated level of debt and a questionable FCF outlook.”

AMC has been reopening its overseas circuit in the last six weeks, increasing from 37 open theaters. In the U.S., the reopening of the company’s theaters will begin ramping in the next several weeks. According to Handler, the timeline for the reopening of its New York City and California theaters remains unclear, and thus, it “will probably result in a slower initial financial recovery relative to its industry peers.”

Additionally, there are multiple questions that need to be answered regarding AMC’s premium video on-demand (PVOD) deal with Universal. “While AMC has stated it would not have agreed to a PVOD deal unless it would create economic value for its shareholders, we have our doubts about the financial success of this venture for the company,” Handler stated.

These issues include the fact that AMC generates on average more than $9.23 of gross profit per attendee, and Handler isn’t sure if Universal would be willing to compensate the company that much to make up for any cannibalization. He also noted, “In our view, for AMC to profit from PVOD, Universal would have to compensate the theater operator through lower film rents, which would also result in a reduced margin to the studio.”

Another cause for concern is that AMC accounts for just 25% of U.S. box office revenue. In Handler’s opinion, this means Universal will need other theater operators to sign on in order to make this platform viable. That said, he doesn’t believe there are enough domestic circuits interested in making PVOD successful, as Regal and Cinemark aren’t on board.

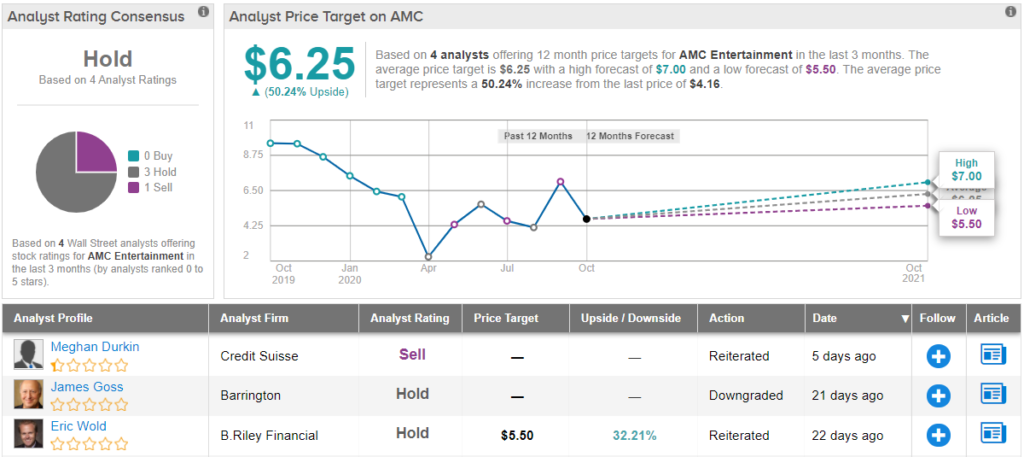

Given all of the above, Handler is watching from the sidelines for now. To this end, he maintains a Neutral (i.e. Hold) rating and $4.50 price target. This target still leaves room for shares to rise 21% in the next year. (To watch Handler’s track record, click here)

Looking at the consensus breakdown, 3 Holds and 1 Sell have been issued in the last three months. So, AMC gets a Hold consensus rating. However, based on the $6.25 average price target, shares could surge 50% in the next year. (See AMC stock analysis on TipRanks)