NFT, or non-fungible tokens, is the hottest buzzword right now, with many companies venturing into NFTs. According to a Market Insider report, 2021 was a “breakthrough year” for the sale of NFTs, as total sales volume hit $14 billion.

But what are NFTs? NFTs are digital assets like art, music, or videos created using blockchain technology. Each NFT has a unique digital signature that makes it difficult for NFTs to be exchanged for one another, and no two NFTs can be equal.

What is blockchain? Blockchain’s meaning is a network that holds “blocks” of transactions.

Content creators can monetize their content through royalty payments or by selling their art directly to consumers in a unique way through NFTs.

Let us look at some of the best NFT stocks about which analysts are bullish, using the TipRanks stock comparison tool.

Funko (NASDAQ: FNKO)

Funko is a pop culture consumer products company whose products include plush and action toys, vinyl figures, apparel, board games, and accessories.

Funko made its foray into NFTs last year through the acquisition of a major ownership stake in TokenWave for an undisclosed amount. It was TokenWave that developed TokenHead, a website and mobile app that showcases and tracks around 10 million NFTs and has approximately 100,000 visits each day. It is available on both the iOS and Android platforms.

In Q3, the company also launched multiple Digital Pop! NFT Collections that were “sold out in minutes,” according to the company.

In December, Jeffries analyst Stephanie Wissink came away impressed after hosting a call with the company’s executive management. The analyst pointed out numerous growth drivers for the company. Those include steady licensing rates in the mid-teens, as Funko offers licensed content in a wide variety of product categories.

The analyst added that there are other positives for the stock, including growing strength in the direct-to-consumer category and LoungeFly category of products and “real value” when it comes to Funko’s NFT strategy.

As a result, the analyst is upbeat about the stock, with a Buy rating and a price target of $25 (39% upside) on the stock.

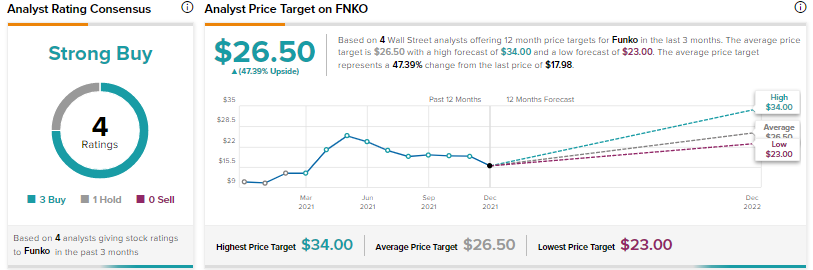

Besides for Wissink, 2 other analysts are also bullish on the stock, with a consensus rating of Strong Buy based on 3 Buys and 1 Hold. The average Funko stock prediction of $26.50 implies upside potential of 47.4% to current levels.

PLBY Group (NASDAQ: PLBY)

PLBY Group is a leisure, lifestyle, and pleasure company, and owner of the Playboy brand. Similar to FNKO, PLBY Group ventured into NFTs last year. The company did this by partnering with Nifty Gateway, an all-in-one platform owned by Gemini that can be used to buy, sell and store collectibles and digital art.

The aim of this collaboration was to create a series of digital art collaborations between Playboy and Nifty on the Nifty Gateway marketplace. PLBY is of the opinion that its Playboy-themed NFTs could create cross-selling opportunities between its physical products and digital artworks and is also looking at loyalty programs.

Indeed, in Q3, the company’s CEO, Ben Kohn, outlined its strategic roadmap, stating that the Group has made “meaningful progress” against the three strategic pillars.

This includes expanding its direct-to-consumer (DTC) commerce business in the United States, “optimizing our licensing partnerships in key territories and categories, and driving new recurring revenue growth initiatives with a focus on innovative digital offerings such as our soon-to-launch creator-led platform, CENTERFOLD, and our NFT Rabbitars, which we plan to develop into a membership experience.”

The company had unveiled its collection of Playboy Rabbitars NFTs in October last year, consisting of 3D rabbit characters.

Following its strong Q3 results where revenues surged 67% year-over-year, Loop Capital analyst Daniel Adam, while keeping a Buy rating on the stock, raised the price target from $29 to $50 (111.95% upside), all because of NFTs.

The analyst stated in his research note to investors that while his initial coverage of the stock had not accounted for NFTs in his financial model, the news that PLBY sold out $9 million worth of Rabbitars with hours of the NFTs launch was a “testament to the massive opportunity” that existed for the stock.

Two other analysts besides for Adam are also optimistic about the stock, with a consensus rating of Strong Buy based on a unanimous 3 Buys. The average PLBY Group stock prediction of $48.67 implies upside potential of 106.3% to current levels.

When it comes to TipRanks Investors, they are also very positive about the stock. The TipRanks Crowd Wisdom tool indicates that 11.5% out of 538,832 portfolios have upped their holding of PLBY in the last 30 days.

eBay (NASDAQ: EBAY)

eBay is another company that ventured into NFTs last year, by allowing the sale of NFTs on its platform. eBay had stated on its website, following the launch of NFTs, “In the coming months, eBay will add new capabilities that bring blockchain-driven collectibles to our platform.”

The company has not given any color on the sale of NFTs so far. But it is increasingly concentrating on its Marketplace platform and has sold off several business segments over the past two years, including StubHub, Classifieds, and EBAY Korea.

Around two days back, KeyBanc analyst Edward Yruma reiterated a Buy rating and a price target of $90 (39.6% upside) on the stock. The analyst perceives that over the next 18 to 24 months, the company could earn more than $1 billion of incremental EBITDA through advertising.

This is because the analyst’s fieldwork regarding the Promoted Listings Advanced (still in beta phase) that was launched back in September and Promoted Listings Express initiatives made him optimistic about the company’s advertising business.

The rest of the analysts on Wall Street are cautiously optimistic about the stock, with a consensus rating of Moderate Buy based on 7 Buys and 12 Holds. The average eBay stock prediction of $78.06 implies upside potential of 21% to current levels.

Download the TipRanks mobile app now.

Disclosure: At the time of publication, Shrilekha Pethe did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates. Read full disclaimer >