Macro factors rather than fundamentals are driving stocks’ performances these days. Rising rates and geopolitical tensions have made for a difficult trading environment.

Against this backdrop, says Oppenheimer’s Owen Lau, it is important to root out “true fundamentals that could be underestimated.” Looking at the case of Coinbase (COIN), Lau thinks he might have just “identified a hidden value in Coinbase Ventures that the market may not have fully appreciated.”

Since its 2018 launch, Coinbase Ventures has turned into one of the industry’s “most active” venture capital arms. While it is still yet to contribute financially, Lau lists several reasons why the investments matter strategically: “1) support the crypto ecosystem allowing for greater adoption; 2) gain insights into emerging technologies; 3) provide a strong pipeline for M&A; and 4) generate attractive ROIC longer term.”

The investments accelerated significantly in 2021 and there are now 250 companies which Coinbase has invested in, amounting to a “carrying value” of ~$352 million.

Based on the assumption of 5% ownership, Lau reckons the portfolio’s fair value is $6.6 billion compared to the $352 million at “cost basis.“ According to the analyst’s sensitivity analysis and assuming a 13% ownership stake, the market value could rise to as much as $17 billion. And there’s potential upside to that estimate as well, due to the “continuous capital influx to blockchain/digital assets.”

So, what does this ultimately mean? Lau explained: “Taking out both net cash ($15/share) and estimated fair value of Coinbase Ventures ($19/share), the core business is only trading at 3.8x 2023E consensus revenue; therefore, we believe the stock is significantly undervalued.”

Lau thinks his forecast could yet prove to be on the conservative side, given the crypto economy has in no way matured yet. Furthermore, as Coinbase’s diversification process continues, over the long-term, the fundamentals are “likely to manifest their importance.”

To this end, Lau maintains an Outperform (i.e., Buy) rating for COIN shares, backed by a $377 price target. Should the target be met, a twelve-month gain in the shape of ~105% could be in store. (To watch Lau’s track record, click here)

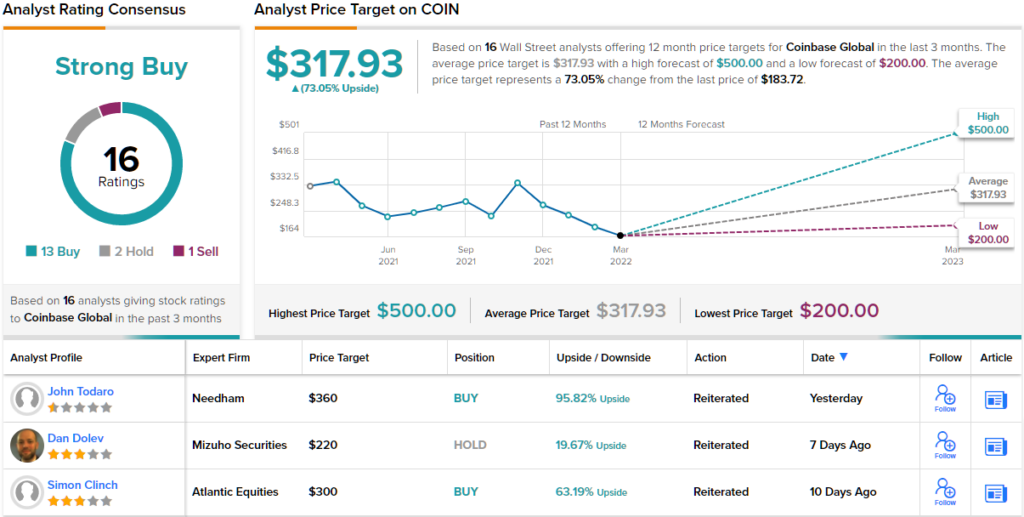

The Street’s average target is a more modest $317.93, yet that figure could still generate returns of 73% in the year ahead. Overall, the stock’s Strong Buy consensus rating is based on 13 Buys, 2 Holds and 1 Sell. (See Coinbase stock analysis on TipRanks)

To find good ideas for crypto stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.