Boeing (BA) is one of the largest aerospace companies in the world. It leads in the manufacture and sales of commercial jetliners, defense, space, and security systems. In addition, it is a service provider of aftermarket support.

The company’s share price is near its 52-week low, and I am moderately bearish after two turbulent years for the airline industry. (See Analysts’ Top Stocks on TipRanks)

Yet, the stock has proven itself remarkably sensitive and adaptable to bad news from both within the company and outside economic pressures. Shares might fall further on mongering about the Omicron variant and fear of the pandemic’s resurgence. The first tool in governments’ kit bags is to arrest air travel, resulting in downdrafts for BA. Impulse response rules the stocks of the industry.

Retail investors must be venturesome to buy BA at this time. However, the company is not going to suffer a rash of cancellations for airplanes and other products. Furthermore, the current share price tumble will prove temporary if news about the variant’s mild effects holds true.

Three Risks to Consider

First off, with the onset of the pandemic, BA suspended the dividend. It is not likely to be re-instated this year or next. Boeing reported a Q3 2021 loss of 60 cents per share when it incurred $183 million in quarterly “abnormal costs.” I expect revenue to increase, topping $16 billion next quarter, but the company will still lose money.

The second risk comes from continuing production problems, as they delay deliveries and increase costs for groundings and recalls. These setbacks affect both the commercial and defense sectors. Boeing’s defense business is promising, but setbacks like inefficiencies and COVID-19 have cost the company more than $5 billion.

The third risk to investors is my concern for Boeing’s backlog of 5,058 aircraft. The backlog is approaching its all-time high of 5,964 aircraft set back in 2018. The firm introduced its widebody passenger and cargo 777X airline at the recent Dubai Airshow. In addition, the 787 Dreamliner is soon to be back in production, and India ordered 72 737Max jets (est. $9 billion)

However, considering the company’s current debt, delivering the backlog may become unsustainable. As of September 2021, Boeing had $62.4 billion in debt and approximately $20 billion in cash.

Wall Street’s Take

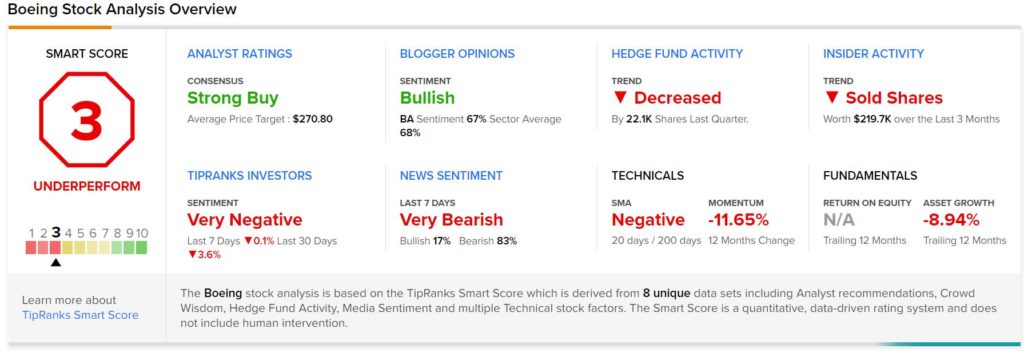

Turning to Wall Street, Boeing has a Strong Buy consensus rating, based on 13 Buys and three Holds assigned in the past three months. The average Boeing price target of $270.80 implies 38.9% upside potential.

Smart Score

Boeing scores a 3 out of 10 (Underperform) on TipRanks’ Smart Score rating system, despite the analysts’ consensus of a Strong Buy and bullish sentiment from bloggers. What affects airline stocks makes BA investors shiver.

TipRanks investors are very negative now. Hedge funds decreased their holdings by 22M shares last quarter, whereas insiders only lightly sold shares over the same period.

The Takeaway

Retail investors can find less risky stocks in these turbulent times but never assume BA is a feckless stock. It consistently shows resilience and experiences startling runups in the share price. The stock regularly interests analysts who continue to maintain a Strong Buy recommendation.

I do not expect Boeing to reinstate the dividend while earnings, cash on hand, and debt are unbalanced. The company faces pressures from within and without. COVID-19 variants will affect airlines. So will rising interest rates, supply chain disruptions, defense, and NASA belt-tightening.

The airline industry is facing uncertainty; lower market demand, cash flow troubles, and more bankruptcies over the next three years in the industry will take their toll on BA. 737 orders are trickling in and 787 deliveries are not happening. Management and investors do not yet get that bigger isn’t always better.

Disclosure: At the time of publication, Harold Goldmeier did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >