The collapse of two U.S. banks in March wreaked havoc in the market and particularly impacted the financial sector. Though fears related to the banking crisis have eased of late, longer-term investors should consider this recent selloff as a good entry point.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Furthermore, most financial companies continue to benefit from higher interest rates. Additionally, M&A and trading activities are picking up steam and should benefit the financial industry.

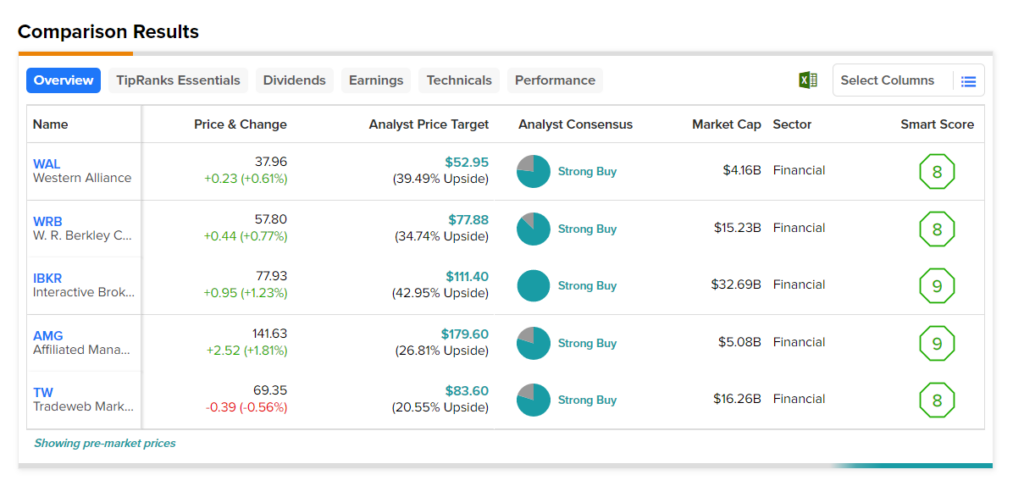

To help investors select the best financial stocks from a wide universe, we have leveraged the TipRanks Stock Screener tool. These stocks have received a Strong buy rating from analysts and boast an Outperform Smart Score (i.e., 8, 9, or 10) on TipRanks, which points to their potential to beat the broader market. Further, analysts’ price targets reflect an upside potential of more than 20%.

Here are the five best financial stocks for investors to consider.

- Western Alliance (NYSE:WAL) – The company offers a wide range of commercial and business banking solutions. Following the better-than-expected Q1 results on April 18, WAL stock received Buy ratings from seven analysts. Its price forecast of $129.17 implies a 40% upside. Also, the stock has a Smart Score of eight.

- Interactive Brokers (NASDAQ:IBKR) – The automated electronic broker’s stock has an analyst consensus upside of 42.3%. IBKR stock has a Smart Score of nine. The company reported Q1 earnings on April 18, after which five analysts rated the stock a Buy.

- Tradeweb Markets (NASDAQ:TW) – The company operates electronic over-the-counter marketplaces for trading fixed-income products, ETFs, and derivatives. TW stock’s price forecast of $83.60 implies 20.5% upside and has a Smart Score of eight. It reported strong Q1 results on April 27, following which the stock was assigned two Buy and two Hold ratings.

- Affiliated Managers (NYSE:AMG) – AMG stock’s average price target implies a consensus upside of 26.8% and carries a Smart Score of nine. The asset management company has equity investments in a diverse group of investment management firms.

- W. R. Berkley (NYSE:WRB) – W.R. Berkley engages in the property and casualty insurance business. The stock’s average price target of $77.88 implies a 34.7% upside potential, Also, its Smart Score of eight is encouraging. Despite the first quarter’s mixed results, which were released on April 20, four analysts have given the stock a Buy rating on TipRanks.