While the new coronavirus variant – Omicron- initially caused some panic in the markets, resulting in a widespread selloff, these fears were somewhat allayed by a statement from President Biden yesterday.

In an address to the American people on Monday, the president commented, “This variant is a cause for concern — not a cause for panic.”

In a separate statement by the White House on Friday, the President urged Americans to become fully vaccinated.

The reassurance from the President resulted in the Dow Jones Industrial Average (DJIA) and the Nasdaq (NDX) indexes recovering and rising by 0.7% and 1.8%, respectively. Overall, many of the stocks in the pharmaceutical sector, specifically those addressing the Omicron variant, also witnessed rising investor interest, resulting in soaring stock prices.

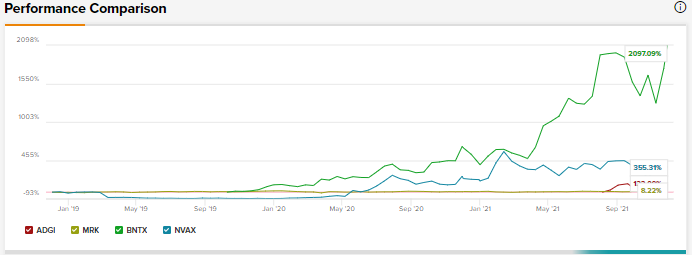

Using the TipRanks stock comparison tool, let us look at some of these stocks in the pharma sector which still have some upside potential left among soaring valuations, and whether analysts are still bullish on these stocks.

Adagio Therapeutics (ADGI)

Some encouraging news from Adagio regarding the Omicron variant resulted in the stock jumping 86.4% yesterday to close at $46.83.

Adagio is a clinical-stage biopharmaceutical company that is focused on the development and discovery of antibody-based solutions for infectious diseases, including the coronavirus. Yesterday, the company provided additional information in a press release about its investigational monoclonal antibody (mAb) product candidate, ADG20, that provides neutralizing activity against SARS-CoV-2.

Laura Walker, Ph.D., Co-Founder and Chief Scientific Officer of Adagio, commented, “Due to the highly conserved and immunorecessive nature of the epitope recognized by ADG20, we expect that ADG20 will retain activity against Omicron, as we have observed in in vitro models with all other variants of concern identified previously. Further, none of the mutations present in the spike protein of the Omicron variant have been associated with escape from ADG20 neutralization.”

The company’s management mentioned its ongoing in-vitro studies to evaluate the neutralization activity of ADG20 against Omicron. Adagio plans to submit Emergency Use Authorization (EUA) submissions for the prevention and treatment of COVID-19 to the U.S. FDA and other regulatory bodies by the middle of next year. (See Analysts’ Top Stocks on TipRanks)

This news was viewed positively by Wall Street analysts. Stifel Nicolaus analyst Stephen Willey reiterated a Buy rating on the stock, following the news. The analyst said that the news of the Omicron variant bore out his investment thesis about vaccines alone being insufficient to address the pandemic.

The analyst added that ADG20’s neutralization potency and breadth, long protection period, and operationally friendly administration profile would make it an appealing option to battle the uncertainty related to new variants.

The rest of the analysts on the Street echo Willey and are also bullish about Adagio Therapeutics, based on 4 unanimous Buys. The average Adagio price target of $49.67 implies 6.1% upside potential to current levels.

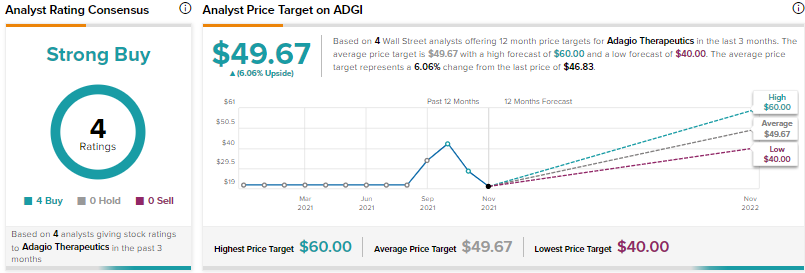

Merck (MRK)

Shares of Merck fell 5.4% after Citigroup analyst Andrew Baum lowered his rating on the stock from a Buy to a Hold. The analyst also lowered the price target from $105 to $85 (13.5% upside) on the stock.

Baum had been bullish on the stock for the past 2.5 years, so this downgrade was a surprise. Explaining his view about Merck, the analyst said that his bullish outlook on the stock was based on the “under-appreciation” of Merck’s HIV treatment drug pipeline, islatravir.

But the analyst’s bullish outlook on the stock was hampered by an update provided by the company earlier this month. The Phase-2 clinical trial of MK-8507 and islatravir (ISL), two drugs that were taken orally once a week for HIV-1 infection, indicated that total lymphocyte and CD4+ T-cell counts (type of immune cells) declined in randomized study participants who received ISL+MK-8507. (See Top Smart Score Stocks on TipRanks)

Following a recommendation from the external Data Monitoring Committee (eDMC), MRK has stopped dosing in the trial and paused the development of MK-8507.

Analyst Baum noted in his research report that there is a “high probability that [Merck] will abandon islatravir development in the next three months given likely high regulatory concerns.”

The analyst added, “We expect the diminishing outlook for islatravir to further expedite Merck’s business development efforts.”

Merck suffered another setback last week when it provided an update on the MOVe-OUT study of molnupiravir, an investigational oral antiviral medicine for COVID-19. This study indicated a 30% relative reduction in hospitalization risk in the molnupiravir group.

Mizuho Securities analyst Mara Goldstein noted that the results of the MOVe-OUT study were “lower than the interim results recently released that showed a relative risk reduction of 48% based on a reduction in hospitalization or death of 7.3% in the molnupiravir group versus 14.1% in the placebo group.”

While the analyst acknowledged that the “downward efficacy trend” in this study could “raise questions,” she added “that the data still indicates a positive risk-benefit.”

Contrary to Baum, analyst Goldstein remained upbeat, with a Buy rating and a price target of $100 (33.5% upside) on the stock.

Other analysts on the Street, however, are cautiously optimistic about Merck, giving 5 Buy and 6 Hold ratings. The average Merck price target of $93.73 implies 25.2% upside potential to current levels.

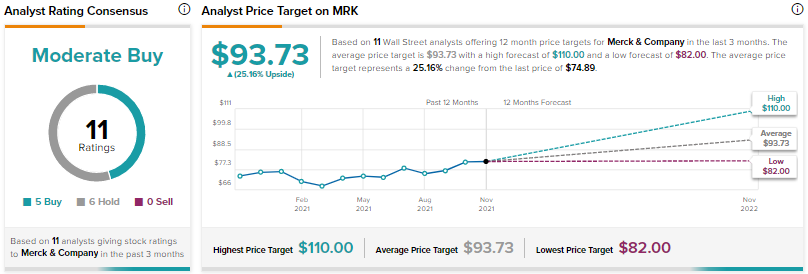

BioNTech SE (BNTX)

According to a Reuters report, BioNTech stated yesterday that the company had started working on a vaccine addressing the Omicron variant and the development of this vaccine is a part of BioNTech’s and Pfizer’s (PFE) standard procedure to address new variants. BioNTech and Pfizer are together making COVID-19 vaccines.

The Reuters report cited a BNTX statement that said the company is engaged in “the first steps of developing a potential new vaccine overlap with the research necessary in order to evaluate whether a new shot will be needed.”

According to H.C. Wainwright analyst Robert Burns, if this research indicates “significantly lower vaccine efficacy against Omicron, Pfizer and BioNTech, as well as Moderna, believe that they could develop a tailor-made vaccine against Omicron in roughly 100 days.”

The analyst anticipates that if this “were to occur, we anticipate that it would positively impact BioNTech’s top-line revenue.”

Last week, BioNTech and Pfizer received a positive opinion regarding COMIRNATY, the companies’ COVID-19 vaccine for children in the age group of 5 years to 12 years from the Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency (EMA). (See Insiders’ Hot Stocks on TipRanks)

Earlier this month, the U.S. Food and Drug Administration (FDA) also expanded the EUA for a booster dose of COMIRNATY for individuals 18 years of age and older.

Analyst Burns approves of these developments regarding COMIRNATY and commented that “broad-based booster deployment is a crucial step in achieving and maintaining herd immunity, as well as critical to COMIRNATY’s long-term commercial success.”

The analyst is upbeat, with a Buy rating and a price target of $360 on the stock.

The rest of the Wall Street analysts, however, are cautiously optimistic about BioNTech, with a Moderate Buy consensus rating, based on 3 Buys and 7 Holds.

The average BioNTech price target of $293.70 implies approximately 19% downside potential to current levels, suggesting that the stock could be overvalued at current levels.

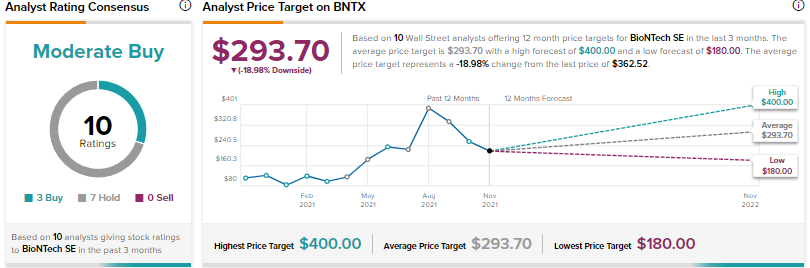

Novavax (NVAX)

Shares of Novavax tanked 11% yesterday to close at $193.96 on the news that the Indian regulatory authority, Drugs Controller General of India (DCGI), had asked for additional data after reviewing the EUA application from the Serum Institute of India (SII) regarding Novavax’s COVID-19 vaccine, Covovax.

However, B.Riley Financial analyst Mayank Mamtani remained encouraged by the company’s “multi-pronged commercialization strategy.”

According to the analyst, this includes the COVID-19 vaccine candidate, NVX-CoV2373, known as Nuvaxovid in European Union and Covovax in Asia.

Mamtani is also positive about the company’s “next-gen variant specific candidate (s), including Omicron-specific construct already in preclinical testing, and a combination COVID/flu candidate.” He explained further that the latter two have low starting dose levels, which differentiates them from competitors Pfizer/BioNTech and Moderna. (See Top Smart Score Stocks on TipRanks)

Mamtani added that the “timeliness of global vaccine rollout, amid Omicron spread, could boost ‘2373 uptake curves, both as primary vaccination series and as booster.”

As a result, the analyst reiterated a Buy and a price target of $305 (57.3% upside) on the stock.

The rest of the analysts were cautiously optimistic about Novavax, with a Moderate Buy consensus rating, based on 2 Buys and 1 Hold.

The average Novavax price target of $249.67 implies approximately 28.7% upside potential to current levels.

Disclosure: At the time of publication, Shrilekha Pethe did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >