Airport stocks are rarely brought to the attention of retail investors. Yet, they can be marvelous investments due to their one-of-a-kind features. In this article, we are looking at three airport stocks whose unique qualities position them well for a potential takeoff in 2023.

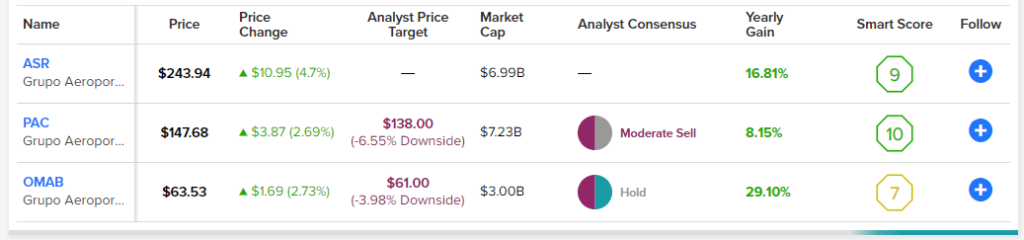

Particularly, Mexico-based Grupo Aeroportuario del Sureste (NYSE: ASR), Grupo Aeroportuario del Pacifico (NYSE: PAC), and Grupo Aeroportuario del Centro Norte (NYSE: OMAB) have been experiencing improvements in their financials over the past several quarters following the COVID-19 pandemic. Despite their shares trading near all-time high levels after outperforming the S&P 500 (SPX) in the past year, their unique traits and attractive valuations could imply further upside in 2023, even though analysts don’t expect upside from these stocks (see below).

What Makes Airport Stocks Attractive Investments?

Airports are totally unique assets that come with multiple attractive and investor-friendly characteristics. Let’s go through three of the most significant traits that benefit airport stocks.

1. High-Quality, Diversified Revenues

One of the most attractive characteristics of airports is that they enjoy high-quality revenues via multiple sources. Firstly, airports sign multi-year leases with airlines. These leases are usually long-term agreements that can provide a steady and predictable source of cash flow for the airport. Further, airports generate cash flows from a variety of other sources, including concessions, parking, and real estate rentals.

Airlines are usually big, reputable businesses. Most are publicly traded, with transparent financials, while airports are incredibly critical for them to operate. Therefore, airports have minimal risks when it comes to collecting their rightful fees. Additionally, whether it comes from collecting car parking revenues, rental income from businesses operating within the airport, or other fees, these are high-margin cash flows with minimal operating costs. Airports provide the space and overall infrastructure but don’t actually go through the hassle of operating these businesses directly, which makes for a great business model.

2. Growing Travel Demand

The COVID-19 pandemic had a disastrous impact on the travel industry between 2020 and 2021. However, demand for travel has been rebounding, resulting in a growing demand for vacation and commercial trips. Flights generated revenues of just $36.4 billion in the U.S. in 2020, a massive drop from their pre-pandemic figure of $108.4 billion in 2019. With demand for travel rebounding strongly, flights are expected to generate revenues of $130.9 billion in 2023 – a new all-time high.

Additionally, revenues are expected to grow by a CAGR of 3% through 2027. This means that airports are likely to be negotiating more leases with airlines, organically benefiting from the industry’s growth without additional efforts.

3. Limited Investable Opportunities

Finally, airport stocks benefit from the fact that there are only a few investable opportunities in the space. This makes them highly-attractive assets. This comes in two forms.

Firstly, most airports around the world are wholly or partly owned by governments. Los Angeles International Airport (LAX) or Denver International Airport, for instance, are owned and operated by The City of Los Angeles and the City & County of Denver, respectively. Thus, investors have no opportunity to invest in the bulk of the world’s airports.

Secondly, airports are highly regulated and have essentially no competition in their respective markets. It’s not like a potential competitor can go and build an airport next to an existing one and compete. Besides, they require enormous capital expenditures to contrast. In any case, this is also another reason why investors have very limited options when it comes to gaining exposure to airports, which makes the existing publicly-traded stocks like ASR, PAC, and OMAB highly scarce and attractive assets.

Takeaway: Why are These Airport Stocks Worth Considering?

Besides the attractive characteristics attached to airport stocks, as just discussed, ASR, PAC, and OMAB have multiple charming features on their own, which makes them attractive investments worth considering. Firstly, they are the biggest publicly-traded companies in the space, with exposure to multiple assets. I mentioned that airports benefit from diversified cash flows; ASR, PAC, and OMAB, each own nine, 12, and 13 airports, respectively.

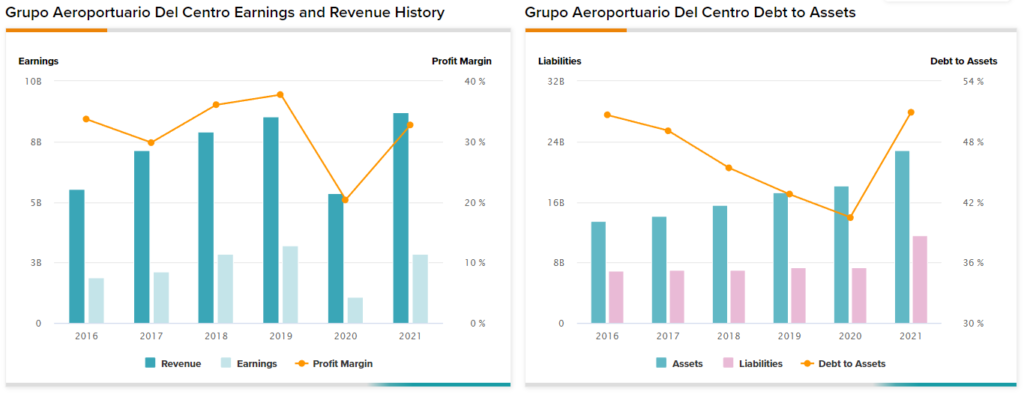

Further, the companies have a consistent history of generating sustainable profits and returning capital to shareholders due to their multiples qualities, as mentioned earlier.

The combination of growing profits which has resulted in share price gains and hefty dividends has resulted in ASR, PAC, and OMAB stocks recording total returns of 353.2%, 322.2%, and 181.6%, respectively, over the past decade.

Regarding their dividends, it’s worth noting that while ASR, PAC, and OMAB do not have consistent track records, they do tend to grow their payouts in line with their profits. Unless you really value consistency when it comes to dividend growth, they should still serve adequately when it comes to growing your income over time.

Finally, despite their shares trading near all-time high levels, all three stocks appear to be quite attractively priced. Specifically, ASR, PAC, and OMAB are currently trading at forward P/E ratios of 13.8x, 14.5x, and 16.4x, respectively. These multiples are below their historical averages. Regardless, I find these multiples very cheap, considering the positive qualities attached to airport stocks. Thus, I believe all three stocks have strong prospects to keep flying higher through 2023.