Technology stocks have been leading the market’s rebound off the October lows, thanks in part to some better-than-expected numbers. Looking ahead, I’d look for any signs of a broadening out of the rally as consumer staples stocks also look to get in on the action.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Therefore, let’s use TipRanks’ Comparison Tool to gain a glimpse of three consumer staples stocks that continue to boast remarkable marks from top analysts on Wall Street.

Coca-Cola (NYSE:KO)

Coca-Cola is the sugary soda company and Warren Buffett staple that’s stumbled over the past year, plunging around 18% from peak to trough before posting a near-full recovery to around $64 per share. The company recently cracked open a cold one for investors, and though there was a lot of fizz to get excited about, the market’s reaction was quite muted.

Many investors may be overlooking Coke shares as we head into a harsher economic environment that could cause inflation to stick around for a while longer. At the end of the day, Coke is a powerful brand with equally remarkable pricing power in a very steady sector. For these reasons, I remain bullish.

As expected, price increases haven’t hurt demand for those delicious, sugary beverages, as Q1 revenue climbed 5% year-over-year. In most regions, demand was quite flat, but in Latin America and Asia, there was still plenty of fizz.

If inflation lingers longer, Coke likely will not have much of an issue passing on additional costs to the consumers. I just do not see consumers switching over to a generic cola to save a few dimes per can.

Looking further out, Coke is well-equipped to diversify away from “unhealthy,” sugar-loaded beverages. As Coke looks to wander into healthier beverage categories, the firm may have the means to keep growing at a low single-digit pace.

At 28 times trailing price-to-earnings (P/E), Coke stock’s valuation isn’t all too sweet given that its peer group (non-alcoholic drinks) trades at over 33 times.

I’m still a big fan of Coke and think it’s not a mystery why Buffett refuses to sell his long-time stake. There’s just no reason to, especially amid inflation.

What is the Price Target for KO Stock?

Coke’s a Strong Buy on Wall Street, with 13 Buys and three Holds assigned in the past three months. The average KO stock price target of $69.53 implies 8.8% gains from here.

Constellation Brands (NYSE:STZ)

Constellation Brands is an alcoholic beverage maker that’s gone flat, now wandering around where it peaked out back in 2018. The company’s top boss previously noted that inflation is acting “a bit stubborn.” With premium brands like Corona and Modelo under its hood and a “low bar” placed by management, Constellation seems well-equipped to plow through another year of rampant input cost increases. Given this, I’m staying bullish on the name.

At this juncture, it seems that price hikes won’t curb beer demand by all too much. Still, management seems to be erring on the side of caution with its latest round of guidance, calling for non-GAAP EPS (earnings per share) to be in the $11.70-$12 range, falling slightly shy of the consensus.

Analysts at RBC Capital view the modest guidance as an opportunity. I think they’re right. There’s minimal evidence that suggests Constellation will succumb to a mild-to-moderate recession. Further, RBC (NYSE:RY) also notes of Constellation’s propensity to guide conservatively “to start the year.” Nik Modi of RBC Capital has a $295.00 price target on STZ stock, implying a Street-high 29% upside from current levels.

In such a rocky and uncertain year, management is only prudent to guide a tad lower. It’s far better to underpromise and overdeliver, after all.

What is the Price Target for STZ Stock?

Constellation Brands is also a Strong Buy, with 13 Buys and three Holds. Further, the average STZ stock price target of $258.38 suggests 13.05% gains for the year ahead.

Philip Morris International (NYSE:PM)

Shares of the big tobacco firm Philip Morris have really dragged their feet over the past five years, with just 19.7% gains over the timespan (not including dividends).

Undoubtedly, the main attraction to the name is the 5.1% dividend yield. Though there may be deep value to be had in the stock, investors must factor in longer-term secular headwinds that could act as a drag on longer-term growth. For these reasons, I’m staying neutral on the stock.

The company is fresh off some mixed Q1 results. Per-share earnings came in at $1.38, above the $1.34 estimate, on a respectable $8.1 billion of revenue. Still, shares sagged a bit as the firm lowered its 2023 adjusted EPS guidance to $6.10-$6.22 from $6.25-$6.37.

Philip Morris has done a respectable job of pivoting into forward-looking markets like heated tobacco products (think IQOS ILUMA) and oral nicotine, with the goal of diversifying into smoke-free products by 2025. However, I still view regulatory hurdles and inflation as pressures that could keep the stock range-bound for longer.

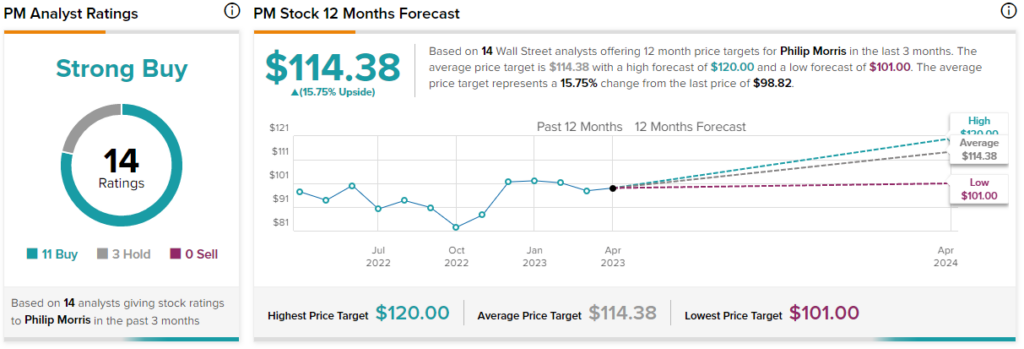

What is the Price Target for PM Stock?

Philip Morris remains a Strong Buy on Wall Street based on 11 Buys and three Holds. The average PM stock price target of $114.38 implies 15.8% upside potential.

Conclusion

Consumer staples stocks are great portfolio stabilizers that are praised by Wall Street analysts. Currently, analysts expect the most gains from PM stock for the year ahead.