U.S. stock indices were on a downward slide last week as investors continued to sell their stocks. The earnings season so far has proven to be a mixed bag of results. Moreover, the banking sector, including large U.S. banks including Citigroup (C), Wells Fargo (WFC), Goldman Sachs (GS), and Morgan Stanley (MS) saw Q1 results that came in ahead of Street estimates, but profits saw a sharp decline.

Other macroeconomic uncertainties continue to spook investors including supply chain constraints, the Fed’s attempts to rein in soaring inflation through hiking interest rates, elevated commodity costs, and rising bond yields. Add to this mix expensive gasoline and investors have been caught between a rock and a hard place with nowhere to go.

As a StreetInsider report quoted Ryan Detrick, chief market strategist at LPL Financial as saying, “There’s some concerns this earnings season. Expectations are the lowest since the recovery started and it’s got investors cautious of how companies will step up to the earnings altar in the coming weeks.”

In this scenario, the TipRanks Analysts’ Top Stocks can be a helpful tool for investors as it identifies stocks across eight different sectors that the best performing analysts on Wall Street are bullish about. These stocks have a ‘Strong Buy’ consensus rating and investors can further filter these stocks not only by sector but also by market cap.

Today, let us look at the top three stocks in the payments processing domain across the Services sector and see why Wall Street analysts are bullish about these stocks.

Mastercard (NYSE: MA)

Earlier this month, Mastercard released its Mastercard Spending Pulse report. This report measures in-store and online retail sales across all modes of payment. The report indicated that excluding auto and retail, sales were up 8.4% year-over-year in March and 18% compared to spending before the pandemic in 2019, not adjusting for inflation.

This report echoed what Deutsche Bank analyst Bryan Keane has been saying; that payment processing companies like Mastercard and Visa (V) could benefit significantly from “strong payment volumes both globally and in the US as consumer spending remains strong despite continued concerns over inflation and supply chain issues.”

Moreover, according to the analyst, as travel picks up, cross-border transactions could also see a recovery.

Keane believes that both MA and V will see a quicker rise in revenues “over the mid-term” and these companies could benefit “from new tech payments use cases such as open banking and BNPL [Buy Now Pay Later].”

As a result, the analyst is bullish on the stock with a Buy rating.

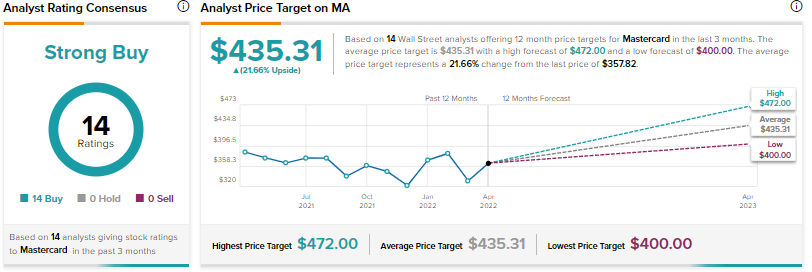

Other Wall Street analysts also side with Keane and are upbeat about the stock with a Strong Buy consensus rating based on 14 unanimous Buys. The average Mastercard stock forecast is $435.31, implying an upside potential of 21.6% from current levels.

Equifax (NYSE: EFX)

Equifax is a data analytics and technology company that is headquartered in Atlanta, Georgia, and provides consumer credit reports. The company currently operates in four global regions including North America, Asia-Pacific, Europe, and Latin America.

The company’s products and services cater to clients across different verticals including mortgage, financial services, employers, government (state, federal and local), and consumers.

Mortgage clients were the company’s biggest clients and made up 32% of EFX’s revenues of $4.92 billion in FY21. It is the headwinds from these mortgage clients that have kept Deutsche Bank analyst Faiza Alwy sidelined on the stock with a Hold rating. This fear has also been reflected in EFX’s stock price that has eroded by 23.8% year-to-date.

Alwy expects that considering the scenario of rising interest rates where mortgage affordability could be an issue, mortgage inquiries could decline. This is also borne out by EFX as the company expects mortgage inquiries to drop by 21.5% this year.

However, the analyst pointed out in her research report that EFX has spent the last four years in enhancing its cloud capabilities through an investment of $1.5 billion. In addition, Alwy stated that EFX has also spent more than $3.5 billion in “bolt-on M&A [mergers and acquisitions].”

Alwy is of the view that considering more than half of EFX’s revenues come from the cloud, the enhanced cloud capabilities could provide EFX the “ability to quickly ingest and manage diverse data types and develop custom reports, products and solutions quickly and effectively.”

While the company’s recent M&A activity could add “100-200 bps to its revenue growth, alongside annual organic growth of 7%-10%.”

Alwy has a price target of $265, just above the lowest price target of $240 on Wall Street. Alwy’s price target implies an upside potential of 22.5% at current levels.

The rest of the analysts on Wall Street, however, are optimistic about the stock with a Strong Buy consensus rating based on 10 Buys and two Holds. The average EFX stock forecast is $294.08, implying an upside potential of 35.9% from current levels.

Shift4 Payments (NYSE: FOUR)

Shift4 Payments, Inc. is a payment processing company that provides integrated payment processing and technology solutions. Its payments platform provides end-to-end payment processing that can be used across “multiple channels (in-store, online, mobile and tablet-based) and industry verticals,” according to the company.

The firm generates a majority of its revenues from processing fees paid by its merchants and which is a percentage of end-to-end payments volume. When merchants subscribe only to FOUR’s gateway, the company generates revenues from transaction fees that are a combination of a fixed fee for every transaction, and a monthly fee.

Shift4 also charges a subscription fee through licensing subscriptions for its technology solutions.

In Q4, the company’s end-to-end payments volume soared 97% year-over-year to $13.4 billion while gross revenues less network fees was up 65% year-over-year to $146.9 million.

The company has been focused on its core strategic objectives including gaining market share reflected in the rise in payment volumes, investing in new products like the SkyTab point-of-sale, and expanding its global footprint through the Finaro acquisition.

Early last month, the company announced the acquisition of Finaro for $525 million. Finaro is a cross-border eCommerce payment platform and a bank in the European Union (EU). This acquisition will be a revenue opportunity worth $5 billion for Shift4 in the European eCommerce market.

This bright outlook for the stock has resulted in Citigroup analyst Ashwin Shirvaikar resuming coverage of the stock with a Buy rating and a price target of $81 on the stock. The analyst is positive about FOUR’s leadership position in two large end-markets including food and beverage and the hospitality business.

Shirvaikar stated in his research note that FOUR’s “differentiated business model” has “led to a leadership position in two large end markets.”

Other Wall Street analysts, however, are cautiously optimistic about the stock with a Moderate Buy consensus rating based on eight Buys and three Holds. The average FOUR stock forecast is $75.09, implying an upside potential of 24.5% from current levels.

Bottom Line

From this list, it is obvious that these three payment services stocks stand to benefit from higher payment processing volumes and higher consumer retail spending.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure.