The stock market is all about themes and right now, given Russia’s invasion of Ukraine and all that has followed in its wake, the times will shine a spotlight on Cybersecurity stocks.

It’s almost taken for granted that as the US and its allies ramp up sanctions and measures intended to shun and isolate Russia, Putin will respond by cyber warfare. Government organizations and corporations are obviously acutely aware of this and will therefore be spending large amounts of money to secure networks and troves of data. And that will provide an enormous tailwind for Cybersecurity stocks.

Surveying the cybersecurity landscape, JMP analyst Trevor Walsh has pinpointed 3 such names that are set to benefit from the current macro developments, and which the analyst thinks are poised to push significantly higher over the coming months.

Using the TipRanks database we can also get an idea what the rest of the Street has in mind for these names. It appears all are Buy-rated and projected to yield considerable returns in the year ahead. Let’s look behind the curtain.

OKTA (OKTA)

The first cybersecurity stock we’re looking at, Okta, is a leading player in the identity and access management space. Nowadays, enterprises view security and identity management as a major priority. It’s a market that is worth around $80 billion annually, and Okta could claim a serious chunk of this figure.

By securing and connecting business workflows which in turn results in more effective operating metrics, Okta’s offerings help companies accelerate their digital transformation.

And more and more companies are moving operations to the cloud with the digital transformation trend acting as a real tailwind. As such, OKTA is seeing meaningful growth. Additionally, an aggressive sales and marketing approach and significant acquisitions have also helped power the expanding topline.

This was evident in the identity-for-the-cloud specialist’s latest quarterly report – for 4Q21. Boosted by the March 2021 acquisition of Auth0, revenue reached $383 million, a 63% year-over-year increase and coming in some way above the Street’s $359.6 million estimate. While adj. EPS of -$0.18 beat the Street’s call by $0.06, the loss widened from the same period a year ago and the current climate is unforgiving for growth stocks posting losses. Going by Okta’s outlook, it will probably continue to do so for the foreseeable future. As the company expects ploughs ahead with more growth, in the upcoming fiscal year (FY23), it expects non-GAAP losses of around $185 million, widening the losses of $68 million posted last year.

That said, JMP’s Trevor Walsh thinks Okta has what it takes to keep on expanding the customer base. He writes, “Okta’s Identity Cloud serves as a flexible and reliable platform from which to tackle a variety of sub-segments within the broader Identity and Access space. While there are many niche players tackling specific identity-related security challenges in the market today, we believe security and developer teams will look to consolidate these use cases under a single identity and access platform provider. As Okta continues to expand its offering through organic and inorganic growth, we believe it will be well-positioned as the identity solution of choice for many organizations.”

To this end, Walsh rates OKTA an Outperform (i.e. Buy) along with a $260 price target. Should the figure be met, investors are looking at 12-months returns of ~53%. (To watch Walsh’s track record, click here)

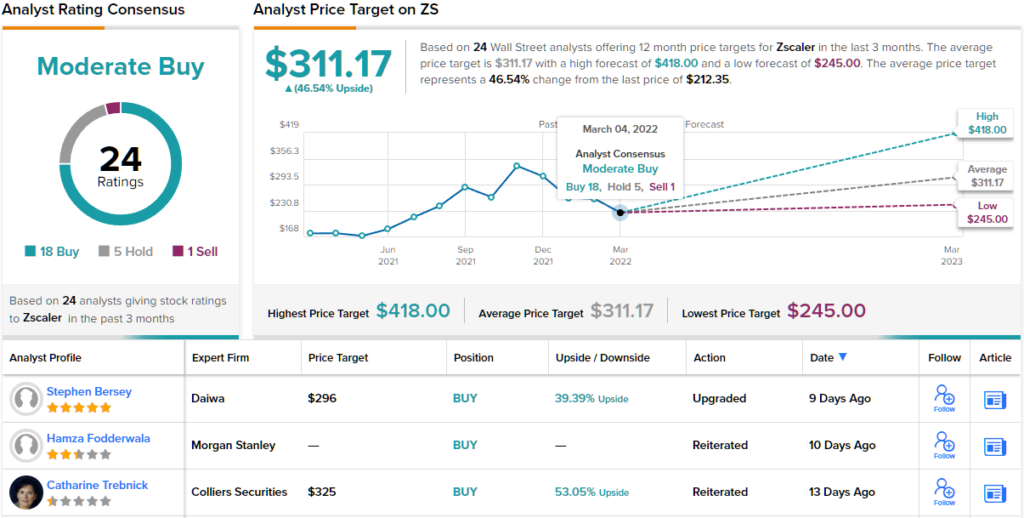

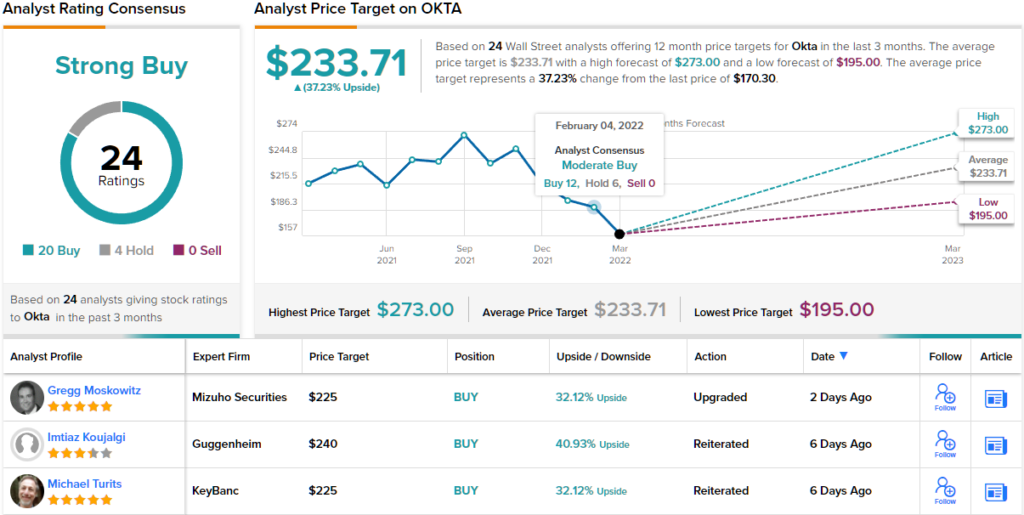

Overall, Okta has plenty of Street support; of the 24 analyst reviews on record, 5 stay on the sidelines but all 19 others are positive, resulting in a Strong Buy consensus rating. Going by the $233.71 average price target, the shares are anticipated to appreciate ~37% over the coming months. (See OKTA stock forecast on TipRanks)

SentinelOne (S)

Next up, SentinelOne, is a cybersecurity firm with a difference. There are many companies focused on stopping cyberattacks, but SentinelOne’s USP is that its platform is driven entirely by artificial intelligence (AI), making it completely autonomous and doing away with the need for any human intervention. This gives SentinelOne an edge; as attacks have gotten increasingly sophisticated, it can stamp them out as they happen.

The platform’s simplicity and the all-round protection provided has made SentinelOne a favorite amongst businesses. The customer count increased to more than 6,000 by the end of 3Q21 (October) from April’s 4,700 client list. The company counts big players such as Samsung, Estee Lauder, Hitachi and Electronic Arts as customers.

This popularity is reflected in an expansion of the top-line. In the most recent quarterly report, for F3Q22, revenue increased by 128.1% year-over-year to reach $56.02 million, in turn beating the Street’s call by $6.44 million. There was a beat on the bottom-line too, as adj. EPS of -$0.15 came in $0.03 above the consensus estimate.

Given the continued growth, the $139.2 million of revenue accrued in the fiscal year’s first 3 quarters already eclipses the 93.1 million generated over the entire previous year. The company sees that trend continuing; SentinelOne predicts more triple-digit growth in Q4 and anticipates bringing in more than $199 million for the full year.

Walsh lists several reasons to get behind this company. These include, “1) a unique endpoint security architecture emphasizing an AI-driven approach which sustains marked differentiation in a competitive, established market; 2) potential for international footprint expansion; 3) demonstrated TAM extensibility via inorganic contributions and technology tuck-ins; 4) an open architecture for optimized customizability across XDR (extended detection and response) use cases, leveraging the broadest range of integrations and inter-operability with best-of-breed security providers; 5) an accelerating top-line story post public debut still in hyper-growth mode; and 6) a sticky land/expand subscription model.”

Based on these reasons, Walsh rates S shares an Outperform (i.e. Buy) and his $65 price target suggests room for ~88% share appreciation in the year ahead.

Most on the Street are onboard too; the stock has a Moderate Buy consensus rating, based on 7 Buys vs. 3 Holds. The analysts see plenty of room for growth here; the $55 average target implies ~59% upside for the next 12 months. (See SentinelOne stock forecast on TipRanks)

Zscaler (ZS)

By 2025, Cybersecurity Ventures estimates cybercrime will result in losses of $10.5 trillion a year, far above 2015’s $3 trillion hit. It is cloud-based cybersecurity security specialists such as Zscaler that help companies counter this increasingly costly threat. The company boasts a cloud-native platform, the Zscaler Zero Trust Exchange, which facilitates companies’ secure move from a network infrastructure to the cloud.

And Zcaler has scale on its side, as it is the largest security cloud; every day, the platform scans more than 200 billion web transactions, pinpointing and preventing over 150 million attacks a day with the use of AI. With each client added to the platform, its overall security is enhanced, leading to a network effect, with every new client benefitting the platform’s other users.

The platform has consistently garnered accolades too, for several years being recognized by Gartner as a best-in-class offering. Meanwhile, Zscaler has exhibited consistent growth, on display again in the latest earnings report – for F2Q22

Revenue increased by 62.8% from the same period a year ago to reach $255.56 million, ahead of consensus by $13.69 million. There was a beat on the bottom-line too as adj. EPS of $0.13 came in $0.02 above the Street’s call.

However, anything less than pristine reporting on all fronts won’t cut the mustard in the current unforgiving stock market climate and the stock sold off due to weaker than anticipated guidance.

However, Walsh highlights the company’s “best-of-breed capabilities” and thinks investors should take note of the company due to several reasons: “1) a novel and highly efficient approach to solutions within the network security domain, which continues to be one of the foundational components to an organization’s cybersecurity technology stack; 2) rise of Zero Trust frameworks as a critical strategy within cybersecurity for which Zscaler’s Zero Trust Exchange was designed specifically to address; and 3) an experienced management team led by visionary founder, CEO Jay Chaudhry, who brings decades of leadership and security industry experience having founded four companies prior to Zscaler.”

Unsurprisingly, Walsh rates ZS stock an Outperform (i.e. Buy) and his $350 price target shows room for ~65% growth over the one-year timeframe.

Looking at the consensus breakdown, Zscaler’s Moderate Buy consensus rating is based on 18 Buys, 5 Holds and 1 Sell. Shares are expected to change hands for ~47% premium a year from now, given the average price target currently stands at $311.17. (See Zscaler stock forecast on TipRanks)

To find good ideas for cybersecurity stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.