In this time of pandemic and panic, stock markets have been – rising. Yes, we had a crash in February/March, part of that initial ‘panic mode’ when Federal, state, and local governments shut down economic activity and ordered social lockdown policies, but that turned around at the end of March. We’ve had a bullish rally since then. The S&P 500 stands just above 3,200, only 5% below its all-time peak.

A bull rally naturally attracts investors, and plenty of stocks see a lot of action – but that doesn’t mean every stock is a buying proposition. Given the uncertainty of the ongoing pandemic and the looming November election, investors need to make their stock choices carefully. And that means knowing which ones to keep away from.

Opening the TipRanks database, and screening for the ‘Strong Sell,’ we’ve pulled up details on three stocks that Wall Street’s analysts agree on: don’t touch it with a 10-foot pole! That’s about three meters, so keeping that distance should fit in well with coronavirus restrictions.

Invesco Mortgage Capital (IVR)

First on our list is a real estate investment trust. REITs are frequently excellent investments; real property tends to bring in solid returns, and due to regulatory requirements, REITs also tend to pay out reliable and generous dividends. But not every company in the segment hits that potential.

Invesco has a portfolio based on residential and commercial mortgage-backed securities and mortgage loans, with an emphasis on those guaranteed by the US government. For those who don’t remember, these are the securities whose collapse 12 years ago sparked the last financial crisis. And in the current climate, with unemployment skyrocketing, many states are offering legal remedies for people having trouble making the house payment – a clear sign that property owners, reliant on mortgage and rent payments, are in for a rough ride.

The company saw expenses rise and earnings fall in Q1, reported at the end of June. In a move to shore up liquidity, Invesco took aggressive action to pay down debt and deleverage the portfolio. And finally, the company was forced to slash back the regular quarterly dividend, from 50 cents to just 2 cents. While these moves may, in the long run, give the company a secure footing, they do not inspire confidence in the short run. The stock, which fell 89% in the February/March crash, has utterly failed to regain any traction. IVR shares remain 78% below their February levels.

Douglas Harter, 4-star analyst with Credit Suisse, sees hard times ahead for IVR. He writes, “IVR has continued to shed assets to meet margin calls and boost liquidity; the company has sold an additional $6.2 billion of MBS and CRT assets…”

No company shedding assets at this pace can attract investors, and Harter rates the stock a Sell. His $2.50 price target indicates a downside of nearly 26% in the coming year. (To watch Harter’s track record, click here)

Overall, IVR’s Strong Sell consensus view on IVR is based on 4 ratings, all of which agree. The shares are selling for only $3.35, and the average price target stands at $2.50, matching Harter’s downside prediction. (See Invesco stock analysis at TipRanks)

REV Group, Inc. (REVG)

The next stock on our list is a specialty manufacturer. REV Group lives in the automotive sector, where it builds niche vehicles, such as ambulances, buses, fire trucks, and street sweepers. The company saw earnings turn negative in Q1, which was partly in-line with historical precedent (calendar Q1 is typically REV Group’s worst of the year), but also due to coronavirus shutdowns forcing factory closures. Q2 earnings remained negative, with a 13 cent per share loss, a far cry from last year’s Q2 profit of 20 cents per share.

Company revenues were also way down in Q2, at $547 million compared to $615 million the year before. In the earnings release, management acknowledged that REV Group has not been executing as they would like; the company has consistently missed targets in recent quarters, and losses incurred are not wholly due to the ongoing pandemic. A new CEO took the reins in March, which is a natural response to management failures, but the current climate is a difficult one for a top management transition.

Another Credit Suisse’s 4-star analysts, Jamie Cook, has been less than impressed by REV Group. He points out the basic soundness of the company’s niche, it’s good liquidity position, and the positive vibes of the new leadership – but then writes, “[Until] a formal plan of attack is laid out to the street coupled with reasonable financial targets, which we do not expect until early 2021, we believe the stock will likely underperform the broader group. Furthermore, we believe REVG will need to re-gain credibility by executing against new targets, given the history of execution issues under previous leadership.”

Cook downgrades REVG, moving the stock from Neutral to Sell. His price target, at $6, shows the extent of his pessimism, indicating a 6% downside risk. (To watch Cook’s track record, click here)

Cook’s move to Sell makes the outlook on REVG shares unanimous, with four recent reviews giving the stock a thumbs down. This makes for a Strong Sell analyst consensus rating. Shares are priced at $6.38, and the average price target, $6.04, implies a 5% downside. (See REVG stock analysis on TipRanks)

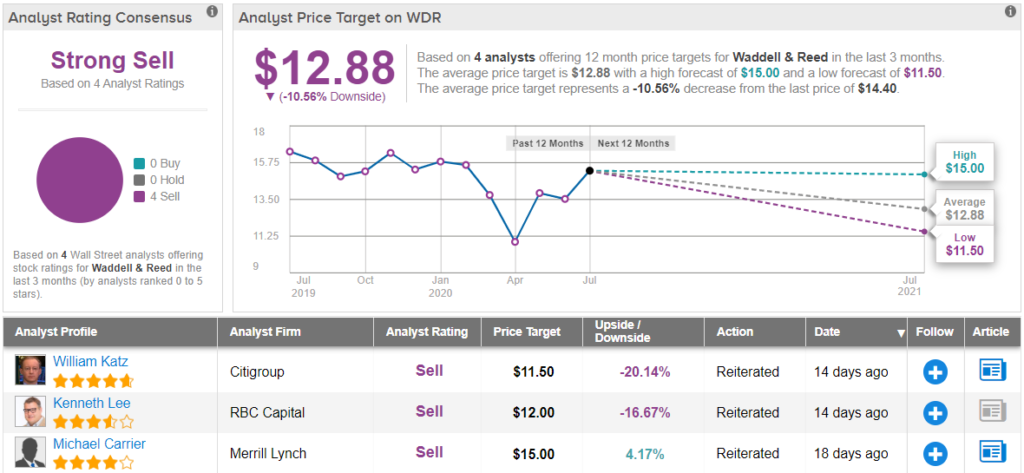

Waddell & Reed Financial (WDR)

Asset management company Waddell & Reed has been showing inconsistent performance during 1H20. Q1 saw earnings collapse dramatically, from 51 cents to 32 cents sequentially. In Q2, May was the company’s best month since the winter of 2018, but June was a $720 million outflow of cash and assets. The stock has managed to rebound from the winter’s crash, but remains 10% below February’s peak – an unfavorable comparison to the S&P 500, which is only down 5% in the same period.

On a positive note, WDR has maintained its dividend during these times, keeping the payment steady at 25 cents per share. This gives the stock a 6.7% yield, excellent by any standard.

Evercore ISI analyst Glenn Schorr covers this stock, and he sees the cash outflows as decisive. Acknowledging the positives, he goes on to write, “WDR saw $720mn of outflows to end the quarter, more than doubling sequentially… Relative to monthly expectations, we see the -$0.7bn figure as a little worse than the -$0.4bn we had & pretty close to what the Street was looking for.”

Schorr sees Waddell continuing to underperform in the near term, and that informs his Sell rating. His price target, $14, suggests a 4.9% downside to the stock. (To watch Schorr’s track record, click here)

Once again, Wall Street’s analysts are unanimous in their Sell ratings, with four of them marking WDR down. The stock has a $12.88 average price target, indicating a potential 11% one-year downside from the current trading price of $14.54. (See WDR’s stock-price forecast on TipRanks)

To find better ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.