Investment giant JPMorgan’s chief global market strategist Marko Kolanovic notes that the first quarter of this year saw an incredible $429 billion in total buyback activity. This represents a faster pace than both of the previous two years, and reflected a combination of healthy margins and strong corporate cash flows. That fundamental strength allowed corporations to step up and start buying even as the Federal Reserve stepped back by tightening up on monetary policy.

Kolanovic notes that not all sectors are equal when it comes to these buybacks. Tech and financial firms led the way, buying back $62 billion and $49 billion worth of shares, respectively. In an interesting point, Kolanovic brings attention to energy stocks, a sector that has ‘only’ seen $9.5 billion in buybacks – but that sum is 19x higher than just one year ago.

These high buybacks have coincided with the sharp declines we saw in stocks during the first 5 to 6 months of the year, and Kolanovic does not view that as a coincidence. Writing of the phenomenon, he says, “In the latest sell-off, JPM estimates 3-4x higher buyback executions than trend, which implies the corporate put remains active.”

What we can do with this, is look for companies that have been actively buying back their own stock. Using the TipRanks database, we’ve done just that; here are 3 stocks that show heavy buyback activity – along with Strong Buy ratings and robust upside potentials. These are firms that are working proactively to return cash to shareholders, and for return-minded investors, that’s always key. Here are the details.

Hertz Global (HTZ)

First on our list, Hertz, is a car rental giant and one of the world’s true ‘branding champions.’ The Hertz name and logo is recognized worldwide, as a leader in its industry. Hertz Global operates several car rental brands – the eponymous Hertz, plus Dollar, Thrifty, and Firefly – and reaches out clear around the world, operating on every continent except Antarctica.

The first quarter was good for Hertz. The company reported strong growth in a vital metric, average vehicles, which expanded from 367,600 units in 1Q21 to 481,211 units in 1Q22. Of that total, in the current quarter, 455,517 were listed as rentable vehicles, up from 361,561 in the previous year. These numbers were up 31% and 26% respectively.

Having more stock was a reflection of increased customer demand as pandemic restrictions eased and travelers once again began seeking vehicles. In turn, that drove higher revenue, which grew 40% year-over-year to reach $1.81 billion. On the bottom-line, Hertz reported 87 cents per share in diluted EPS, compared to the 33-cent loss in the year-ago quarter.

Hertz saw an operating cash flow $621 million in Q1, and reported total liquidity as of March 31 of $2.7 billion. That included a total of $1.5 billion in unrestricted cash.

Being awash in cash helped the company to buy back shares, and Hertz nearly exhausted its buyback authorization in the first part of the year. In June, the company announced that its Board had signed off a new buyback program, adding $2 billion to the $200 million remaining. Hertz has bought back 88 million shares as of June 14 of this year, and now has the go-ahead to buy back $2.2 billion worth of stock. The current authorization will cover some 29%, or more than 120 million, of HTZ’s outstanding shares.

In the eyes of Chris Woronka, covering Hertz for Deutsche Bank, the upsized share repurchase program equals a net gain for investors. He wrote back in June, “[We] believe the increased repurchase authorization is largely reflective of management’s confidence in its 2022 free cash flow generation and doesn’t necessarily extend to a view on 2023. We believe it’s likely that HTZ continues its current pace of ~$700 million of buybacks per quarter over the balance of the year, which would result in the company exhausting close to 70% of the current repurchase authorization by year-end…”

In a more recent note, the DB analyst reiterated his belief that HTZ can outperform, stating, “We do expect HTZ to continue showing strong RPD (revenue per day) growth, in line with recent results compared to 2019 levels. Our new forecasts imply that HTZ’s Q2 likely comes in approximately in line with consensus on revenue, slightly below on EBITDA, and slightly ahead on EPS due to share repurchase activity…”

Woronka’s comments back up his Buy rating on HTZ, and his $29 price target implies the car rental firm has a 59% share gain ahead of it this year. (To watch Woronka’s track record, click here.)

Wall Street, generally, comes down with the bulls on this stock – 3 out of 4 recent analyst reviews are to Buy, while the last is to Hold, giving HTZ a Strong Buy consensus rating. The stock has an average price target of $24 and a trading price of $18.22, suggesting a 32% one-year upside. (See Hertz’s stock forecast at TipRanks.)

ZipRecruiter (ZIP)

Now we’ll shift over to the world of job hunting. ZipRecruiter offers an online marketplace for both employers and job seekers, giving them a place to connect. The company boasts that its mobile site is the top-rated job hunting app on iOS and Android, and claims that 2.8 million enterprise customers have used the service, along with 110 million job seekers. These numbers make ZipRecruiter the top online hiring site in the US labor market.

That’s a solid base to support a business, especially at a time when the government’s monthly jobs numbers have been optimistic. For obvious reasons, that environment is good for a recruitment agency, and ZipRecruiter saw its Q1 top line grow by 81% year-over-year, to reach $227.2 million, the highest since ZIP entered the public markets through a direct listing in May of last year.

In a development of interest to investors, on June 27, ZipRecruiter became a component company of the Russell 3000 stock index. Joining the Russell index will give ZIP a higher profile, and is described by management as a ‘significant milestone.’

ZipRecruiter has been actively buying back shares this year, and the company’s Board had originally authorized a $100 million program. In addition to that program, some $6.6 million worth of Class A common stock was also available for repurchase, and that was increased in June of this year by an additional $150 million Board authorization for share repurchases. Going forward, ZipRecruiter has authorization to buy back some $156.6 million worth of stock. This equals well over 8.8 million shares, or about 10% of the company’s outstanding stock.

This company has caught the eye of Aaron Kessler, 5-star analyst with Raymond James, who writes of ZipRecruiter, “Based on recent industry data points, we expect another solid quarter for the company. According to Indeed and BLS, U.S. listings and openings remain near record highs. NFIB data also points towards accelerated SMB hiring expectations and Google search trends suggest strong interest in ZipRecruiter despite tough comps. Our positive fundamental view is based on: a large recruitment TAM that is increasingly shifting online; a leadership position with strong brand recognition driving a high degree of organic traffic and a unique AI-powered matching technology…”

In Kessler’s view, this supports a Strong Buy rating for ZIP, and his $40 price target implies a 121% upside in the next 12 months. (To watch Kessler’s track record, click here.)

The Raymond James view here is not the only bullish take; this stock has 5 recent reviews, which break down 4 to 1 in favor of Buy over Hold. The shares have a trading price of $18.07 and an average price target of $31.40, indicating a one-year upside potential of 74%. (See ZipRecruiter’s stock forecast at TipRanks.)

Capri Holdings (CPRI)

Last up on our list, Capri Holdings, is a global retailer in the fashion industry. The company, which offers lines of apparel, shoes, and accessories under the high-end brand names Versache, Jimmy Choo, and Michael Kors, operates through a network of more than 1,200 retail locations. These include both stand-alone stores and in-store boutiques.

Customers like high-end branded merchandise, and they are willing to pay for it. These facts powered Capri to revenue of $1.49 billion in its most recent quarterly report, from 4Q of fiscal year 2022 (March quarter). This result was a 24% gain year-over-year, marked the 5th consecutive quarter of top line y/y gains, and was a company record.

Record revenues drove other positive markers in its wake. Capri’s gross margins for fiscal Q4 stood at 64.1%, another company record, and diluted EPS, which grew 2.5x from the year-ago quarter, came in at $1.02.

All of this added up to a company with confidence, and Capri bought back 5.1 million shares of its own stock during its recent fourth fiscal quarter. These shares cost ~$300 million, and left ~$500 million under the repurchase authorization. This authorization was replaced on June 1 by a new program, totaling $1 billion over the next two years. The new authorization can fund the purchase of more than 21 million shares at current prices, or about 15% of Capri’s outstanding common stock.

BTIG analyst Camilo Lyon has reviewed Capri Holdings, and describes the company as ‘our top mid cap pick for 2H22.’ Explaining why, Lyon writes that the company, “plans to implement additional price increases this fall across the brand portfolio, to which the current price increases have seen no resistance from customers. The company raised its F23 EPS outlook to $6.85 (from $6.60) with only FQ1 EPS below the prior guidance, and the guide now contemplates buybacks with its newly approved $1B share repurchase program.” Looking forward, he adds, “[We] believe CPRI is executing well in a challenging macro environment as it continues to benefit from robust demand trends, positioning the company on a path to achieving $7B in revenue and 20% operating margins over time.”

Lyon rates these shares as a Buy, and his $100 price target is indicative of a 106% upside this coming year. (To watch Lyon’s track record, click here.)

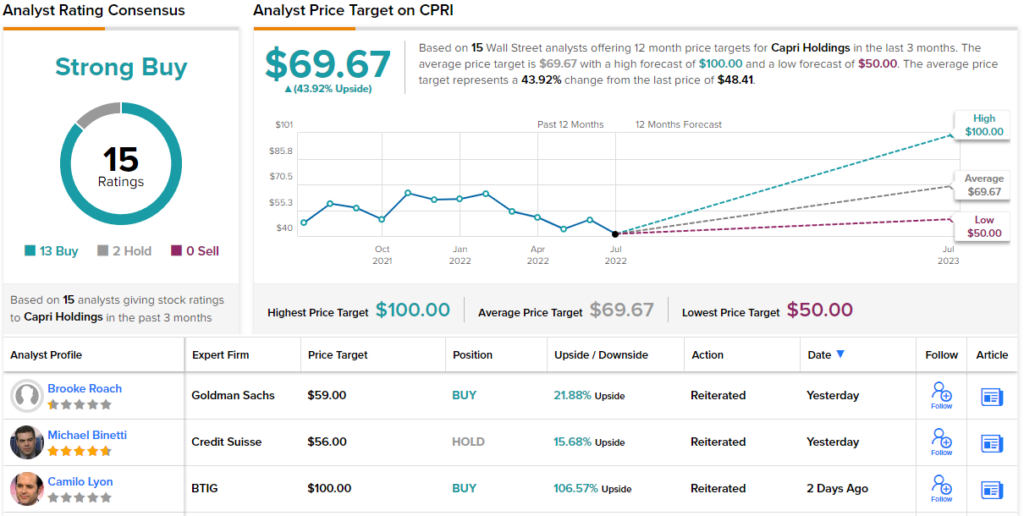

With Capri, we get to a stock that has generated some buzz on the Street. CPRI shares have 15 recent analyst reviews, with include 13 Buys against just 2 Holds for a Strong Buy consensus rating. The stock’s average price target of $69.67 implies a 44% upside from the current share price of $48.41. (See Capri’s stock forecast at TipRanks.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.