Over the past month, we’ve seen two juxtaposed patterns in the stock market: a steady decline and an increase in volatility. When volatility is up, even in a downward trend, investors can find stocks that are set to gain. The key is measuring the risk and reward, and finding stocks with an initial cost of entry that is commensurate with both.

It’s a tricky balance point to find, but many investors find the sweet spot in low-cost stocks, equities priced below $10 per share. At this level, the initial cost is generally affordable, and simple mathematics will magnify any potential gain. While losses can be magnified in the same way, that can be minimized by careful choices before buying in.

We’ve gotten the ball started, using the TipRanks database, to find three low-cost stocks with triple-digit upside potential – that is, potential to double or more in the year ahead. According to the Wall Street pros, these are all ‘Strong Buys;’ let’s dive into the details and find out why.

VIZIO Holding (VZIO)

TV is hardly a new technology – it’s been around for nearly a century. But Vizio, a California-based company, aims to bring the old tube to the cutting edge of modern immersive entertainment tech. The company produces a line of Smart TVs, audio sound bars, and SmartCast broadcast subscriptions that bring the latest in interactive television to the living room.

Vizio went public just a year ago, in March of 2021, putting 12.25 million shares on the market at $21 each. Since the IPO, the shares have slumped, falling 57%. Vizio currently has a market cap of $1.72 billion.

In Vizio’s recent 4Q21 report, the company reported a year-over-year decline in quarterly total revenue, from $734.3 million to $628.8 million. Earnings also fell, from a 55-cent diluted EPS profit in 4Q20 to a 22-cent loss in the current report.

There were some bright spots. The company saw SmartCast active accounts grow by 24% y/y, reaching 15.1 million, and its Platform+ net revenue hit $105.1 million, for a y/y gain of 74%.

Analyst Jason Kreyer, of Craig-Hallum, sees Vizio in the midst of a successful repositioning, writing: “Vizio’s investments to improve supply chain and ultimately inventory levels over the past six months are now bearing fruit as the company aggressively repositions the price points on popular living room TVs. Given the immense value created by ad units embedded in WatchFree+ and continued viewership gains, Vizio is taking a more aggressive approach to TV market share, knocking down prices on popular TVs to take share away from peers. Thus far, management has seen the desired results with an uptick in shipments and strong WF viewership trends.”

“We see an opportunity in VZIO shares given the recent pullback across peers, while Vizio repositions its strategy to accelerate progress on the LT plan,” the analyst summed up.

To this end, Kreyer rates VZIO a Buy, and his $20 price target implies an impressive one-year upside potential of 123%. (To watch Kreyer’s track record, click here)

Overall, the Strong Buy consensus rating on Vizio is based on 6 recent analyst reviews, which include 5 Buys and a single Hold. The shares are priced at $8.97; their $19 average target indicates potential for ~112% upside in the year to come. (See VZIO stock forecast on TipRanks)

PureCycle Technologies (PCT)

Next up is a technology company in the recycling business. PureCycle is working on the commercialization of cutting edge plastics recycling, to create a recycled product free of contaminants – as pure as the original plastic, and fit for use in a wider range of applications, especially food packaging, than standard recycled plastics.

PureCycle has yet to generate a revenue stream, making this stock highly speculative. For now, PureCycle has two plants under construction. Plant 1, in Ironton, Ohio, is set to complete construction in the fourth quarter of this year, while Plant 2, a plastics purification complex in August, Georgia, is breaking ground, with initial construction work scheduled to begin this month.

In an important development, PureCycle has signed letters of intent giving it access to currently untapped plastics feedstock waste streams, for up to 60 million pounds. These letters of intent ensure that the new facilities, Plants 1 and 2, will have feedstock to begin operations when construction and fitting-out is complete.

Meanwhile, the company announced last week a private equity capital raise, to worth some $250 million. The capital will come from existing institutional shareholders, plus one new large-scale investor. The new capital will help the company keep its manufacturing plant build-out on schedule.

PureCycle entered the public markets last year in March, through a SPAC deal with Roth CH Acquisition Company I. The business combo was approved on March 16, and the PCT ticker started trading on the NASDAQ on March 18. Shares in PCT are down 67% since the stock started trading.

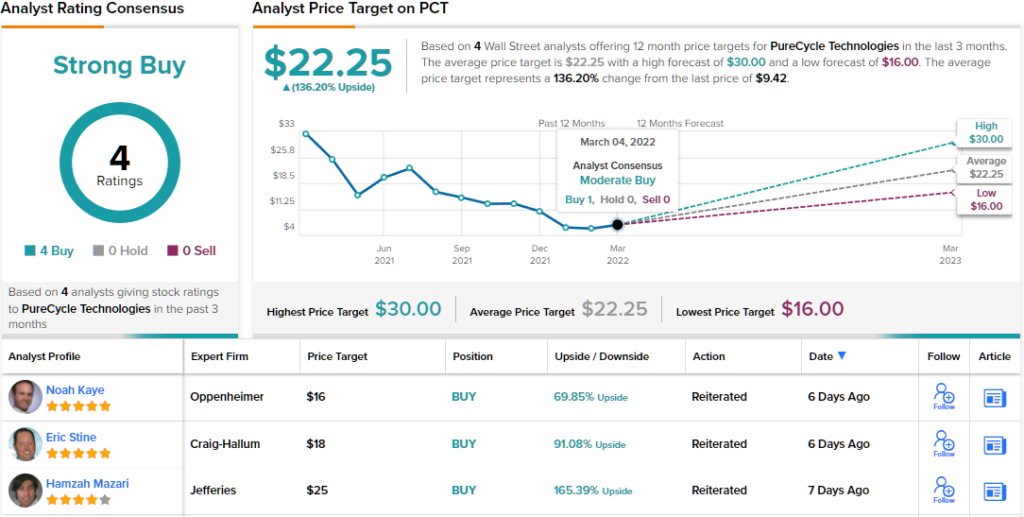

Covering the stock for Jefferies, analyst Hamzah Mazari says ‘Buy more if you believe the company is on track,’ and goes on to elaborate: “The pullback in the SPAC complex creates a good entry point, coupled with the recent private equity raise which provides ample liquidity/development funds at this stage.” Mazari adds, “It appears so far, things are on budget and on time without any significant cost overruns…”

In line with these comments, Mazari rates PCT a Buy, and his $25 price target implies a robust upside potential of ~165% for the next 12 months. (To watch Mazari’s track record, click here)

Wall Street, generally, is sanguine about this speculative recycler; the stock’s Strong Buy consensus rating is based on 4 unanimously positive reviews. The average price target of $22.25 suggests a 136% upside from the current trading price of $9.42. (See PCT stock forecast at TipRanks)

Taysha Gene Therapies (TSHA)

Last on our list is a biopharma company, based in Texas. Taysha Gene Therapies takes a patient-centric approach to the development new treatments for monogenic diseases of the central nervous system (CNS). The company is working with the University of Texas Southwestern Medical Center, and has an extensive portfolio with no fewer than 26 active research tracks. These tracks range from discovery and preclinical research to Phase 1 and 2 clinical human clinical trials with upcoming regulatory steps.

In recent months, Taysha has released updates on its two most advanced drug candidate programs. At the end of January, the company announced positive data on clinical efficacy and safety for TSHA-120, a drug candidate under development as a treatment for giant axonal neuropathy. The company announced that the drug has met its endpoints for Phase 1/2 trials.

Also in January, the company announced that initial biomarker data for TSHA-101 was positive, an important step in continuing the ongoing Phase 1/2 clinical trial. TSHA-101 is a treatment for GM2 Gangliosidosis, and is the first bicistronic gene therapy in clinical development. Additional data is expected by the end of 2022.

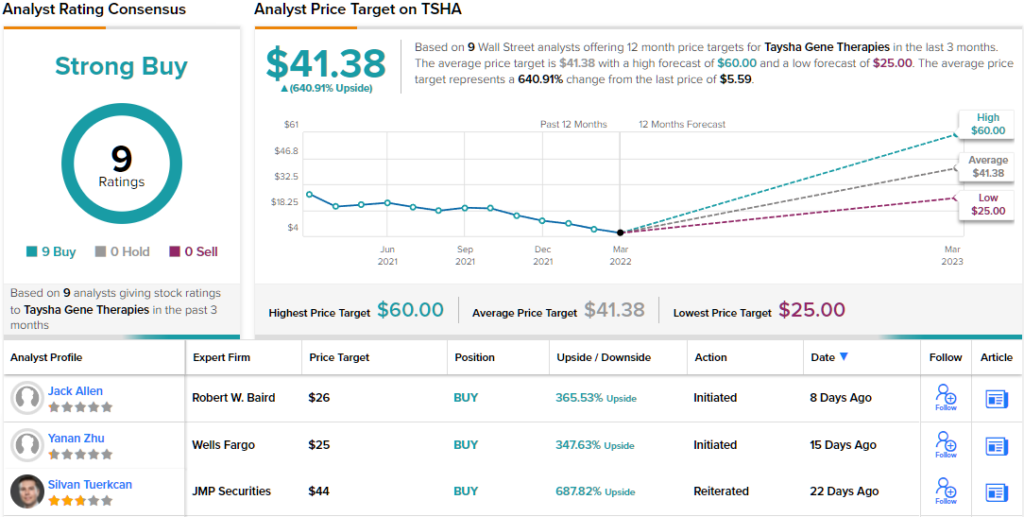

Analyst Jack Allen, covering Taysha for Baird, points out that the lead drug candidate is showing solid progress. Allen wrote, “Taysha’ lead asset, TSHA-120, is a gene therapy for giant axonal neuropathy (GAN). Given the combination of the encouraging clinical data from this program and high unmet need in GAN we believe this asset is well positioned to see a rapid regulatory approval pathway, with FDA guidance (expected mid-’22) representing the next key catalyst for the company.”

“We believe the current valuation of Taysha significantly discounts the fundamental scientific strength of this company and expect shares to appreciate significantly in the coming month,” Allen summed up.

Accordingly, Allen rates TSHA stock an Outperform (i.e. Buy), and set a $26 price target, suggesting it has an impressive upside of 365% for the next 12 months. (To watch Allen’s track record, click here)

All in all, there are 9 analyst reviews on record for TSHA stock and they are all positive, making for a unanimous Strong Buy consensus view from Wall Street. The shares are trading for $5.50, and the average price target, at $41.38, gives a high upside potential of ~641%. (See TSHA stock analysis on TipRanks)

To find good ideas for small-cap stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.