“You only get one shot” Eminem famously sang on “Lose Yourself.” That might have been true in the cutthroat music business the Detroit rapper was trying to break into, but the nice thing for investors is that Eminem’s problem doesn’t apply to the stock market.

While investors constantly rue missed opportunities, ruminating on a never-ending list of “if onlys,” the fact is there are always new opportunities in the public markets, it’s just finding them that’s the problem. A helping hand here would not go a miss, then.

Some of Wall Street’s top experts have pinpointed three names which they believe are primed for some strong gains over the coming months. These are small-cap stocks, trading under $10, which currently rated as Strong Buys by the analyst consensus. Let’s take a closer look.

SunOpta (STKL)

If we’re on the subject of opportunities, then they are often to be found in disruptive industries. SunOpta belongs in one such segment, as a developer and manufacturer of plant-based foods and ingredients in addition to offering fruit-based products.

The world is pivoting to more sustainable means of living and better nutrition, and SunOpta is committed to both, aiming to “make the planet and its people healthier.” To do so, the company boasts a wide selection of products which range from broths and stocks, beverages, snacks – all plant-based – and other various organic offerings.

Like many stocks whose share price soared dramatically in 2020’s post-covid slump bull market, STKL stock has found 2021 more of a struggle, with shares down by 25% year-to-date. Investors also appeared disappointed with the company’s latest earnings – for 2Q21.

While revenue grew by 9.7% year-over-year to $202.27 million, in the process beating the estimates by $3.99 million, the company just missed on the bottom-line, as EPS of -$0.02 came in $0.02 shy of the Street’s forecast.

Amid the recent sell-off, Craig Hallum analyst Alex Fuhrman thinks investors should load up on “the cheapest stock in plant-based food and beverage.”

“With the stock now trading below $10, STKL is now valued at less than 15x EV/EBITDA on our revised estimates, which we believe is a bargain in plant-based food and beverage, where most companies are still unprofitable,” Fuhrman said. “We expect consumer demand for plant-based products will continue to rise in the years to come, and demand for plant-based investments will remain strong as a result… What’s more, we believe there is an opportunity for demand in the food service channel to get even stronger as restaurants bounce back from COVID.”

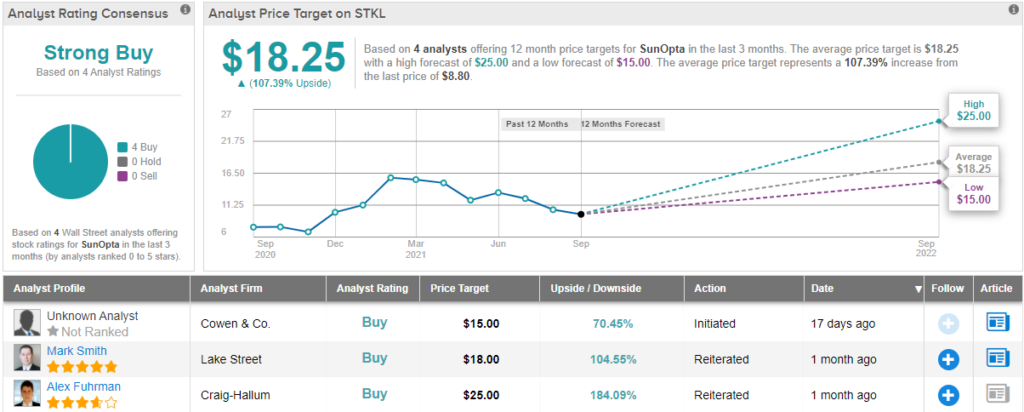

It’s a Buy rating, then, from Fuhrman who slaps a $25 price target on the shares, suggesting 12-month growth of a hefty 184%. (To watch Fuhrman’s track record, click here)

Overall, analysts are unanimous on this one; based on Buys only – 4, in total – this Stock boasts a Strong Buy consensus rating. Shares are trading for $8.8 and have an average target price of $18.25, which suggests a bullish 107% upside potential. (See STKL stock analysis on TipRanks)

AcuityAds Holdings (ATY)

Next up, we have Toronto-based Acuity Ads, a company operating in the ad tech industry. Acuity offers programmatic advertising solutions – providing all the tools needed to manage ad campaigns. This is a growing segment, with companies hoping to make the most of a rising secular trend – the move from linear TV to Connected TV (CTV). Acuity is a rising player in this industry and its clients range from medium-sized businesses to Fortune 500 companies.

The company’s platform illumin™ has been making waves and uses AI/machine learning abilities to streamline and optimize the entire advertising process. It also helped the company post a strong set of results in its recent Q2 earnings report.

Illumin’s Q2 revenue came in at $5.2 million, up over 60% sequentially. Connected TV growth was even more impressive, increasing by a huge 400% year-over-year. In total, the company delivered revenue of $30.29 million, up by 54.9% from the same period in 2020, and beating the Street’s forecast by $6.44 million. EPS of $0.06 also beat the consensus estimate – by $0.04.

This is a small-cap stock, whose shares were on a tear last year, accumulating gains of a humongous 945% in 2020 and adding more muscle at the start of the year. But ultimately, despite the recent beats, the stock has befallen the fate of many 2020 high-flyers, with shares sitting 37% in the red in 2021.

However, Roth Capital’s Darren Aftahi sees a bright future for this ad tech player. The 5-star analyst rates ATY a Buy and his $14 price target suggests shares have room for ~102% growth in the year ahead. (To watch Aftahi’s track record, click here)

“We expect ATY to continue to invest in illumin to expand its pipeline (beyond new vertical wins), including product enhancement around social and search and over time sales outside of North American regions, which should be highly complementary to the favorable connected TV and programmatic environment,” Aftahi wrote. “illumin’s continued pipeline traction, further investment, and the thawing from verticals still hindered by COVID, keep us optimistic… We believe ATY’s solid balance sheet could be deployed in strategic M&A, which alongside improving fundamentals could lead to better growth.”

Turning now to the rest of the Street, where based on 4 unanimous Buys, ATY has a Strong Buy consensus rating. The shares are trading for $7, and their $15.22 average price target implies ~117% upside potential for the coming year. (See ATY stock analysis on TipRanks)

AvePoint (AVPT)

Tech behemoth Microsoft is not eligible to be included on a list of stocks going for under a tenner, although no doubt investors would salivate at the prospect. The closest you might get to such a notion is via Microsoft by association.

This is where software maker AvePoint enters the frame. The company is the world’s largest provider of Microsoft 365 data management solutions. Over 8 million cloud customers utilize the company’s SaaS solutions for the migration, management and protection of data.

The company might have a long history of Microsoft affiliation but is new to the public markets. AVPT stock began trading on the NASDAQ on July 2 after going public via the blank check route – following a SPAC merger with Apex Technology Acquisition Corporation, with the combination generating net proceeds of $204.5 million. SPACs have suffered this year and AvePoint’s first few months as a publicly traded entity have also resulted in share losses – of 25%. During this period, the company delivered its first public quarterly statement.

AvePoint reported revenue of $45.3 million, amounting to a 38% year-over-year increase. ARR (annual recurring revenue) – a key SaaS metric – came in at $139 million, a 33% improvement on the same period a year ago. These “strong” results, says Evercore’s Kirk Materne, show that the company is “continuing to capitalize on Microsoft’s strong ecosystem growth.”

Exhibiting growth in all regions and with strong global tailwinds pushing the company ahead, management highlighted the fact this was AVPT’s 10th consecutive “high-growth quarter.” Materne expects this trend to continue.

“We see AVPT as a durable high growth (+25%-30%) company that is well positioned to benefit from the continued growth of MSFT’s cloud offerings and expect that the valuation can ‘re-rate’ from here as more investors get to know the story over the next 6-12 months,” the 5-star analyst added.

Accordingly, Materne has an Outperform (i.e. Buy) rating for the stock backed by a $15 price target. The implication for investors? Upside of ~67%. (To watch Materne’s track record, click here)

All in all, there are 6 AVPT analyst reviews on record, of which 5 are to Buy and 1 to Hold, culminating in the stock’s Strong Buy consensus rating. Shares are priced at $8.93 each, and the average price target is only fractionally below Materne’s objective; at $14.9, the figure is expected to deliver 12-month returns of ~67%. (See AVPT stock analysis on TipRanks)

To find good ideas for small-cap stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.