With less than two weeks remaining in 2021, the major Wall Street firms and analysts have pulled out their crystal balls to peer through the curtains at what awaits for 2022. It’s an annual habit, and one that investors pay close attention to; while the forecasts are not always perfect, they do give a fair perspective of marketing terrain.

According to investment banking firm Raymond James, there are going to be plenty of opportunities in the year ahead. The firm’s stock analysts have been busy picking the equities they see as winners in 2022. These are Strong Buy choices, and not just from Raymond James – the Street generally agrees.

We’ve used the TipRanks platform to pull up the details on three of these Raymond James picks, stocks which the firm sees with 50% upside in the coming year – or better.

EngageSmart (ESMT)

The first stock on Raymond James’ radar is EngageSmart, a customer engagement and integrated payment software provider, offering solutions and subscriptions on the Software-as-a-Service model. The company’s solutions ease the path for business and enterprise customers, improving appointment scheduling, bill payment, and other common processes for more profitable operations. EngageSmart boasts that it has empowered over 74,000 small- and medium-sized business, and over 3,000 enterprise clients.

This is a new company in the public markets – it held its IPO at the end of September this year. In the event, EngageSmart upsized the offering, putting 14.6 million shares on the market instead of 13 million originally planned, and pricing them at $26 each, above the expected $23 to $25 range. The IPO raised in excess of $378 million in gross proceeds, above the $338 million forecast.

The IPO was followed in November by the company’s first financial release as a public entity. EngageSmart reported a solid gain in revenues, along with a deepening loss in earnings. At the top line, revenue came in at $55.5 million, up 42% from the previous year, while at the bottom line, the EPS loss of 6 cents was worse than the year-ago quarter’s break-even.

In several other important metrics, the company showed additional gains. Gross profits rose year-over-year, from $29.5 million to $41.3 million, and reflecting the success of the IPO, the company’s cash holdings increased from $29.4 million at the end of last year to $253.8 million at the end of 3Q21. The company’s total customer rose by 40% yoy, to 77,400, and the total transactions processed also grew 40%, to reach 28.6 million. All in all, it’s a picture of a fast-growing tech company.

At the same time, ESMT shares fell sharply, starting on the November 10 date of the earnings release. Raymond James analyst John Davis is blunt in his assessment of that development, writing: “We believe the severe stock reaction is largely due to technical factors coupled with general weakness of high growth fintech/software peers and recent IPO’s, rather than any true fundamental concerns, and as such think it has created a tremendous buying opportunity.”

Davis goes on to outline some of the positives here: “ESMT has a first/early mover advantage and product leadership that puts the company in pole position to capture share, driving 30%+ growth for the foreseeable future. More importantly, we believe there is a convincing bull case given tailwinds in both SMB (pricing + new specialties) and Enterprise (bill pay 2.0) that could result in material upside… While the 3Q top line may have modestly missed bulls’ lofty expectations, we think the potential for significant out year estimate revisions is little changed.”

In line with these bullish comments, Davis gives ESMT a Strong Buy rating, and a $40 price target to suggest a one-year upside potential of ~84%. (To watch Davis’ track record, click here)

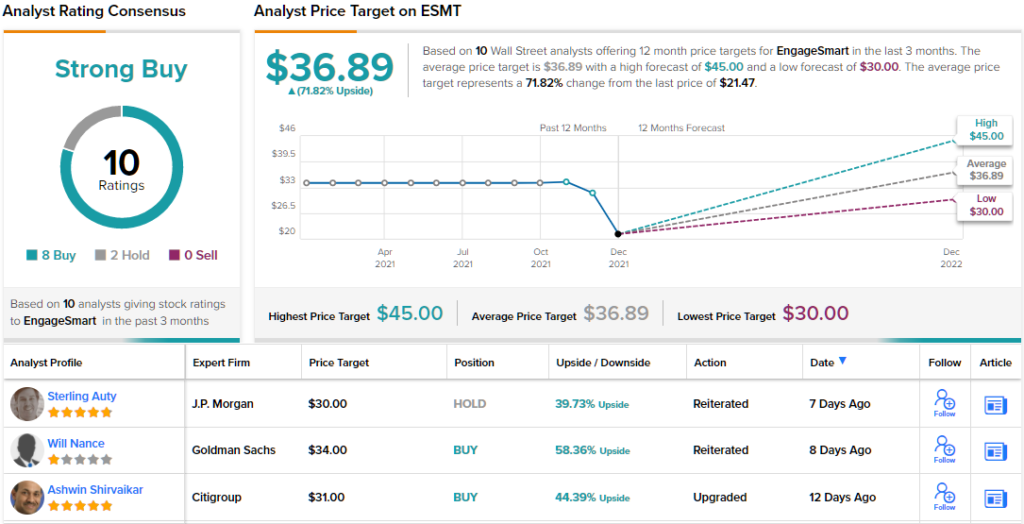

ESMT gets another Strong Buy from the analyst consensus view, based on 8 recent Buy ratings and 2 Holds. The shares are priced at $21.47 and their average price target of $36.89 implies ~72% upside from that level. (See ESMT stock analysis on TipRanks)

UserTesting (USER)

Next up is another tech company – but one in a truly unique niche. UserTesting is a human insights platform, offering its customers a ‘user eye’ view of how their software performs. UserTesting’s platform allows customers to receive video of their users, using products. The product brings a powerful perspective to developers, who can see how end-users interact with apps and react to designs and processes, concepts and brands.

By the end of 3Q21, UserTesting boasted more than 2,100 customers in over 50 countries – a customer base that includes more than half of the world’s most valuable brand names. This growth, and the rising stock markets of the past year, supported an IPO, which was held in November. The USER ticker debuted on Wall Street on November 17 with 10 million shares put on the market at $14 each. The IPO raised $140 million in gross proceeds.

After the IPO, shares began to fall, and have so far failed to recover. The stock is down 35% since it hit the market. Looking at the situation from Raymond James, 5-star analyst Brian Peterson acknowledges this reverse, but sees the stock still in a sound position for future growth.

“We think the secular shift toward technology-enabled methods of market research and customer analytics are creating a number of new software categories, leading to substantial spend opportunities for a number of software vendors. USER should be a prime beneficiary of this dynamic, given that it’s video-oriented platform can often provide more human insights than other data/survey focused applications. While the market remains early in its adoption curve, we believe the quick time to value for customers vs. legacy approaches should allow USER to deliver 30% growth for the foreseeable future,” Peterson opined.

These comments support a Strong Buy rating from Peterson, and his $14 price target shows in confidence in an upside of 68%. (To watch Peterson’s track record, click here)

It’s clear from the Wall Street reaction that UserTesting has more fans than just the Raymond James analyst; it has a unanimous Strong Buy consensus rating, based on 11 positive reviews. The stock is currently price at $8.31 and has a $13.70 average price target, for ~65% one-year upside potential. (See USER stock analysis on TipRanks)

Dave & Buster’s Entertainment (PLAY)

We started our list with two tech stocks, and we’ll finish it up with a shift in focus, to entertainment and leisure. Dave & Buster’s is a well-known chain of venues, featuring a combination of full-service restaurant and bar seating and menus with high-end video arcades featuring the latest games. It’s an amusement center for grown-ups, who still have a connection to their inner child – and it has proven successful. The chain has 143 stores, in the US and Canada; its most recent location opened in the third quarter of this year. Dave & Buster’s boasts that, during 3Q21, it had recouped its losses from the pandemic shutdowns of 2020.

Despite the strong rebound from last year, sales in Q3 were down slightly from Q2. The quarterly revenue of $317.9 million was down 16% sequentially. Looking back to 2019, however, at the last pre-pandemic Q3, the current report fares better – 3Q21 showed revenues up 5.6% from the pre-pandemic 3Q19. This raises the possibility that the sequential fall was due to an artifact of the rebound, and a surge of customers as soon as businesses reopened, rather than a lack of popularity or declining business.

Earnings were also solid. EPS for the quarter was 21 cents per share; this compares favorably to the $1.01 net loss per share in 3Q20 and the slim 2-cent per share profit in 3Q19.

In his coverage for Raymond James, analyst Brian Vaccaro notes D&B’s sound performance, and makes the case that the stock’s current underperformance relative to the broader market.

“Simply put, we believe PLAY shares are materially undervalued at an EV/EBITDA in the mid-5’s given 1) a path towards higher margins (200-300 bp) and EBITDA($~400M vs. $316M) in ‘22 vs. ‘19, 2) accelerating unit growth in ‘22 (mid-SD %) and beyond (strong ROI’s bolstered by smaller prototype), and 3) its much improved B/S (potential to refi HY notes in ‘22) and liquidity position that could allow the company to opportunistically buy back stock through ‘22 (new $100M repo authorization),” Vaccaro explained.

To this end, Vaccaro rates PLAY as a Strong Buy, and his $55 price target implies a one-year upside of ~53%. (To watch Vaccaro’s track record, click here)

Once again, we’re looking at a stock with a Strong Buy from the Street as well as Raymond James. PLAY shares have 9 reviews, breaking down 7 to 2 in favor of Buy over Hold. The average price target of $50.43 suggests an upside of 40% from the trading price of $35.95. (See PLAY stock analysis on TipRanks)

See what top Wall Street analysts say about your stocks >>

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.