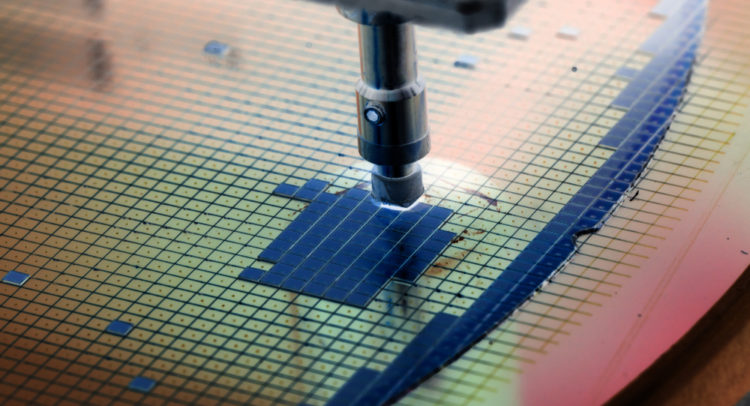

Semiconductors are an essential part of our daily lives. From our smartphones to personal computers to our cars and other electronic devices – these tiny silicon chips are everywhere. Over the past year, demand for semiconductors ballooned, and chipmakers struggled to satiate the market’s appetite. Higher sales of consumer electronics amid the COVID-19 pandemic and their application in cars and modern technologies like 5G, AI (artificial intelligence), and cloud computing can be attributed to the rising demand.

The industry also marked a wave of consolidation. Nvidia announced the acquisition of Arm, while AMD proposed to acquire Xilinx. However, the bigger question is whether these multi-billion dollar deals will be approved. Also, as the economy is slowly getting back on its feet, pure-play foundries are busy fulfilling orders for the automotive industry, DigiTimes reported citing industry sources.

While demand for semiconductors could remain uneven industry-wise, IDC forecasts 12.5% year-over-year growth in the semiconductor market and expects it to reach $522 billion this year.

With an increasing focus on digitization and secular industry trends, the outlook for semiconductor stocks looks positive. Using the TipRanks database, we identified three “Strong Buy” semiconductor stocks with considerable upside potential. Let’s take a look.

Chipmaker Micron has a rich portfolio of memory and storage products that fuel the modern-day digital economy. It recently delivered robust Q3 results, reflecting 36% year-over-year growth in its revenue and a 136% jump in adjusted net income. Shares of Micron have reversed some of their gains but are up about 54% over the past year. (See Micron stock charts on TipRanks)

Micron CEO Sanjay Mehrotra said, “Micron is in the best position ever to capitalize on the long-term demand trends across the data center, intelligent edge and user devices.”

Following the quarterly results, Needham analyst Rajvindra Gill maintained a Buy rating with a price target of $130 on the stock. This reflects 12-month upside potential of 68.6% from current levels. Gill expects Micron to gain from the recovery in the memory cycle. He added, “We expect MU’s top and bottom lines to benefit from growth in NAND and DRAM prices, which we expect to occur throughout 2020. Moreover, we view MU as a key beneficiary of strong data center demand and increased DRAM and NAND content in 5G handsets.”

Overall, 22 Wall Street analysts have weighed in on Micron shares in the past three months, giving the stock 17 Buys and 5 Holds for a Strong Buy consensus rating. The average Micron price target of $118.79 implies approximately 54.1% upside potential to current levels.

Broadcom manufactures a wide range of semiconductors and offers infrastructure software solutions. Strength across its multiple end markets is driving is semiconductor revenue. Meanwhile, Broadcom’s CEO Hock Tan sees “strong demand from service providers and hypercloud” and expects “year-over-year growth to sustain” in Q3.

Broadcom’s consolidated revenue increased 15% during the last reported quarter. Furthermore, its operating profit jumped 25%. Thanks to strong product demand, Broadcom stock has surged nearly 46% over the past year. (See Broadcom stock charts on TipRanks)

Last month, Bank of America Securities analyst Vivek Arya reiterated his Buy rating with a price target of $580 (23.3% upside potential) on the stock and views Broadcom as an “extremely attractive” pick for growth and income investors. Furthermore, Broadcom’s multiple growth catalysts, compelling valuation, and solid profitability are the main drivers of Arya’s bull case.

Consensus among analysts is a Strong Buy based on 17 Buys and 2 Holds. The average Broadcom price target of $543.71 implies approximately 15.6% upside potential to current levels.

Applied Materials (NASDAQ: AMAT)

Shares of the chip manufacturer Applied Materials have more than doubled in one year, reflecting its strong financial performance on the back of broad-based strength across its semiconductor businesses. In Q2, Applied Materials’ net sales jumped 41% year-over-year, while its net income surged 76% versus the prior-year period. (See Applied Materials stock charts on TipRanks).

Its CEO, Gary Dickerson, said, “We are confident in our ability to outperform our markets as large, secular trends create sustainable demand for semiconductors and our leadership in materials engineering becomes increasingly critical to deliver new chip technologies.”

Following the Q2 numbers, Needham analyst Quinn Bolton maintained a buy rating with a price target of $153 (15.5% upside potential) on the stock. In a note to investors, Bolton said, “As the wafer fab equipment (WFE) market leader, AMAT is exposed to the secular growth of WFE, and in particular the deposition and etch segments that have outperformed WFE in the last cycle as Moore’s Law has slowed down across logic, DRAM and NAND devices.”

He added, “compared to its closest peers, AMAT has a balanced mix of business between the logic/foundry and memory end markets, as well as the broadest product portfolio with a #1 or #2 position in multiple billion dollar categories, which should provide growth, stability, and profitability to the company for multiple years into the future.”

Overall, Applied Materials has a Strong Buy consensus rating based on 10 reviews that include 8 Buys and 2 Holds. The average Applied Materials price target of $157.50 implies approximately 18.8% upside potential to current levels.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.