Even during economic downturns, one fact remains resolute: pharma stocks represent the ultimate risk/reward plays. Out on Wall Street, the sector has become known for its high volatility. How did it earn this reputation? It comes down to the nature of the industry itself.

Unlike companies in other areas of the market, pharma stocks depend less on earnings results, and more on clinical data and regulatory decisions. As the latter determine the trajectory of these stocks, a single piece of good news can act as a catalyst that sends shares skyrocketing.

That being said, shares can plummet just as easily should a company publish lackluster data or if approvals don’t come through. For this reason, in-depth due diligence is necessary before pulling the trigger on a name in this sector.

Today, we’ll look at three pharma stocks recommended by Sumant Kulkarni, a top-rated analyst from Canaccord. Kulkarni believes these three tickers could be propelled higher by upcoming clinical trial results that could be huge catalysts for each one.

Indeed, according to TipRanks’ database, each ticker scores a “Strong Buy” consensus rating from the rest of the Street and boasts substantial upside potential.

Zynerba Pharmaceuticals (ZYNE)

Focused on developing transdermally-delivered cannabinoid therapeutics, Zynerba Pharmaceuticals wants to improve the lives of patients suffering from neuropsychiatric conditions like Fragile X syndrome (FXS), Autism Spectrum Disorder (ASD), 22q and a heterogeneous group of rare and ultra-rare epilepsies known as developmental and epileptic encephalopathies (DEE).

On the heels of its recent positive data readout and more potential catalysts ahead, Kulkarni believes ZYNE’s $5.50 share price looks like a steal.

On May 27, ZYNE released data from its Phase 2 open-label BRIGHT trial studying Zygel (ZYN002), a transdermal synthetic cannabidiol gel, in ASD. Even though it’s still early, the data indicated that the asset could serve as an add-on treatment to the standard of care for the behavioral symptoms associated with the condition.

Expounding on this, Kulkarni noted, “Specifically, Zygel ‘hit’ on all five sub-scales of the Aberrant Behavior Checklist – Community (ABC-C), and also on the Parent-Rated Anxiety Scale – ASD (PRAS-ASD), while retaining the relatively-benign safety/tolerability profile seen so far.”

While certainly promising, focus remains primarily on the data readout for the double-blind, placebo-controlled, CONNECT-FX pivotal trial evaluating Zygel in FXS, which is slated for later this month.

“Our view is there is limited read-through from today’s ASD data to FXS, but we are encouraged Zygel appears to have activity on scales associated with social parameters. Our stock thesis is unchanged in that FXS has no approved products and trial data remain difficult to call, but we believe ZYNE presents significant opportunity for risk-tolerant investors going into the FXS data set,” Kulkarni commented.

If that wasn’t enough, Kulkarni points to several other possible catalysts on the horizon. The verdict from ZYNE’s discussions with the FDA regarding Zygel’s DEE pivotal program is set to come in the next few weeks, with top-line results from the Phase 2 open-label INSPIRE study for Zygel in 22q coming the following quarter.

To this end, Kulkarni rates ZYNE a Buy along with an $18 price target. This target implies shares could more than double in the next year. (To watch Kulkarni’s track record, click here)

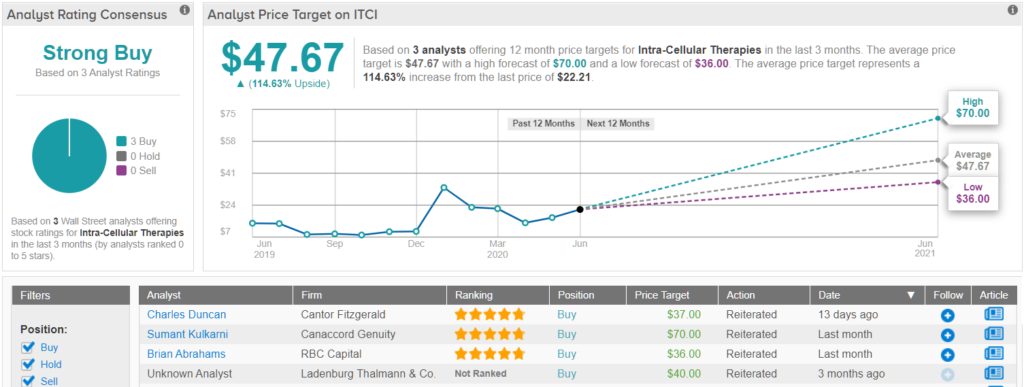

Like Kulkarni, other analysts also take a bullish approach. ZYNE’s Strong Buy consensus rating breaks down into 6 Buys and zero Holds or Sells. Given the $19.17 average price target, the upside potential lands at 249%. (See Zynerba stock analysis on TipRanks)

BioXcel Therapeutics (BTAI)

Next up we have BioXcel Therapeutics, which uses artificial intelligence (AI) to develop cutting-edge medicines across neuroscience and immuno-oncology. With two major potential catalysts in the near-term, it’s no wonder Wall Street focus has locked in on this name.

On June 11, the company revealed that the first patient had been enrolled in RELEASE, its Phase 1b/2 trial assessing the use of BXCL501, a sublingual dexmedetomidine film, in treating opioid withdrawal symptoms.

Weighing in on the implications of this development, Kulkarni said, “This on-time start means BXCL501 will move into a sub-chronic dosing setting vs. acute/rescue therapy for agitation where it is farther along in development. This move also ties into BTAI’s strategy to build a broader/leading franchise around agitation, which is an approach that we continue to view as smart. We also remain impressed by management’s ability to hit stated timelines, and look forward to RELEASE top-line data in 1Q21.”

Speaking to the opportunity in this indication, there’s already a significant unmet need, and COVID-19 could potentially make the situation worse for many patients. As a result, Kulkarni projects a 2023 launch and unadjusted peak sales of $472 million in 2030.

However, before this, data on the candidate’s use in treating agitation caused by other conditions is expected. Kulkarni is looking forward to the data readout for the Phase 3 SERENITY trial of BXCL501 in agitation in schizophrenia and bipolar disorder this July as well as the results from the Phase 1b/2 TRANQUILITY trial in dementia-induced agitation in mid-2020.

Calling the above readouts “two key catalysts”, Kulkarni noted, “We continue to believe SERENITY data will come before TRANQUILITY, and like the risk-reward for the stock going into these events based on solid Phase 1b/2 data in schizophrenia, and proof-of-concept data in dementia.” The analyst added, “We model a probability of approval estimate of 75% for agitation in schizophrenia/bipolar disorder and our 2030E peak unadjusted sales are $313 million. We model 65% probability of approval in agitation in dementia, and our 2030E unadjusted peak sales are $584 million.”

All of the above combined with other possible catalysts involving BXCL501 and BTAI’s other candidate, BXCL701, slated for 2H20 prompted Kulkarni to keep a Buy recommendation and $71 price target on the stock. Should the target be met, a twelve-month gain of 34% could be in store.

All in all, other analysts are on the same page. 4 Buys and no Holds or Sells add up to a Strong Buy consensus rating. Based on the $89 average price target, which is more aggressive than Kulkarni’s, the upside potential comes in at 68%. (See BioXcel stock analysis on TipRanks)

Intra-Cellular Therapies (ITCI)

Founded on Nobel-prize winning research that uncovered how therapies impact the inner-workings of cells in the body, Intra-Cellular Therapies hopes to address the unmet needs of patients battling complex psychiatric and neurologic diseases. Ahead of an important possible catalyst, Kulkarni thinks ITCI is “significantly undervalued”.

It should be noted that its most recent quarter saw the company achieve a major milestone as its recently-approved Caplyta product, lumateperone, for schizophrenia, was launched. Only on the market since March 23, the asset generated just under $1 million in sales, with Kulkarni calling for $1.1 million. This is impressive as the estimate wasn’t updated after the onset of the COVID-19 pandemic.

“Given the current environment, we get the sense that ITCI has been nimble enough to adapt well and has also made good progress with payers… We continue to believe Caplyta could generate meaningful sales in schizophrenia, and at these levels we are BUYERS on this opportunity alone.” Kulkarni explained.

Also noteworthy for Kulkarni, though, is the publication of data from the Phase 3 global adjunct trial for lumateperone in bipolar depression, which is set to come in mid-20. Additionally, the analyst points out that ITCI should provide updates regarding its discussions with the FDA on this indication.

“That said, we also like the stock going into the mid-20 Phase 3 data for lumateperone in bipolar depression, which represents greater unmet need and is a potentially larger market opportunity with fewer approved products,” Kulkarni stated. The analyst added, “Recall that in 1Q20, ITCI started another monotherapy Phase 3 trial (global) with results expected in 2H21. ITCI, however, expects to send in a supplemental new drug application (sNDA) for bipolar depression in late-2020. With a successful global monotherapy trial and a U.S. trial with mixed results, we believe ITCI has a solid shot at a potential approval in this indication.”

The good news didn’t end there. Kulkarni believes that the possible upside drivers extend beyond lumateperone, with Phase 1/2 data for ITI-214 in heart failure expected in the next few weeks.

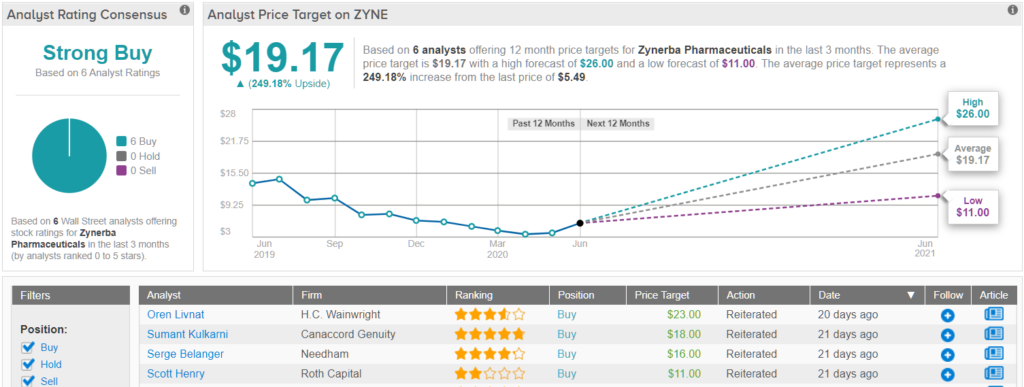

It should come as no surprise, then, that Kulkarni stayed with the bulls. In addition to keeping a Buy rating on the stock, the analyst maintained a $70 price target, which brings the upside potential to 215%.

Do other analysts agree with Kulkarni? As it turns out, they do. Only Buy ratings, 3 to be exact, have been received in the last three months, so the consensus rating is a Strong Buy. At $47.67, the average price target indicates 115% upside potential. (See Intra-Cellular stock-price forecast on TipRanks)

To find good ideas for pharma stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.