Investor focus has landed squarely on the surge in new COVID-19 cases and its threat to economic reopenings, but there’s another possibility being ignored. According to Morgan Stanley equity strategist Mike Wilson, even though the market is expecting economic activity to decline, earnings could get a major boost.

“Cautious investors may be overlooking the potential for operating leverage to fuel an earnings rebound… Aggressive cost-cutting in a downturn is what creates the powerful operating leverage when the economy recovers,” Wilson commented.

While unemployment has skyrocketed during the coronavirus crisis, Wilson argues operating leverage was already dropping before the pandemic’s onset. “It’s also a classic feature of late-cycle economic expansions. My point is that many companies were already exhibiting negative operating leverage pre-COVID-19. This gives me confidence that Q2 will likely be the trough for earnings growth,” he explained.

Bearing this in mind, some investors are on the hunt, looking to snap up compelling names before shares re-embark on an upward trajectory. For the more risk-tolerant, focus has locked in on penny stocks, or tickers trading for less than $5 per share. The appeal is clear; the bargain price tag means you can get more bang for your buck and even what feels like inconsequential share price appreciation can result in huge percentage gains.

What’s the flip side? Minor share price depreciation can fuel major percentage losses. By nature of these massive movements, penny stocks are notoriously volatile.

Using TipRanks’ database, we identified three penny stocks the pros believe could see explosive gains in the coming months. Not to mention each one gets a “Strong Buy” consensus rating from the analyst community.

Daré Bioscience, Inc. (DARE)

Focused on identifying and advancing cutting-edge therapies, Daré Bioscience’s products could provide women with additional choices, improved outcomes as well as options that are easier to use. Its strong pipeline and $1.00 share price have scored it substantial praise from the pros on Wall Street.

One of these DARE bulls is Aegis Capital’s Nathan Weinstein. Citing its DARE-BV1 asset as a key component of his bullish thesis, the analyst tells investors that DARE had kicked off its pivotal trial for the candidate in patients with bacterial vaginosis (BV) earlier than he previously expected.

Speaking to the therapy’s potential, DARE-BV1 is a bio-adhesive formulation of clindamycin phosphate 2% that, in a previous proof-of-concept study, generated an 86% clinical cure rate of BV. The trial, “DARE-BVFREE”, is a randomized, double-blind, placebo-controlled pivotal Phase 3, and will enroll 240 patients across multiple sites in the U.S., with the primary endpoint being clinical cure (resolution of signs and symptoms). Weinstein points out that the therapy has already been given both Fast Track and QIDP designations. “Topline data is anticipated to be released this year, and, if the study is successful, we expect an NDA application to be filed in 2021,” the analyst added.

On top of this, DARE’s pipeline features two other promising lead assets including Ovaprene, a monthly non-hormonal contraceptive, and Sildenafil Cream, designed for the treatment of female sexual arousal disorder (FSAD).

Commenting on the pipeline, Weinstein stated, “We think the diversified, women’s health-focused pipeline is undervalued relative to what we view as the upside potential, given: (1) the company’s proven ability to strike sizable partnership deals, (2) the uniqueness of the assets that address what we view as unmet needs in the market, (3) the appeal of having multiple shots on goal, and (4) the possibility that FSAD proves to be a larger TAM than is currently appreciated.”

If that wasn’t enough, the company is also developing a user-controlled long-acting reversible contraceptive device called DARE-LARC1, with the product already receiving funding from the Bill & Melinda Gates Foundation.

To this end, Weinstein rates DARE shares a Buy along with a $5 price target. This figure conveys his confidence in DARE’s ability to soar 403% in the coming year. (To watch Weinstein’s track record, click here)

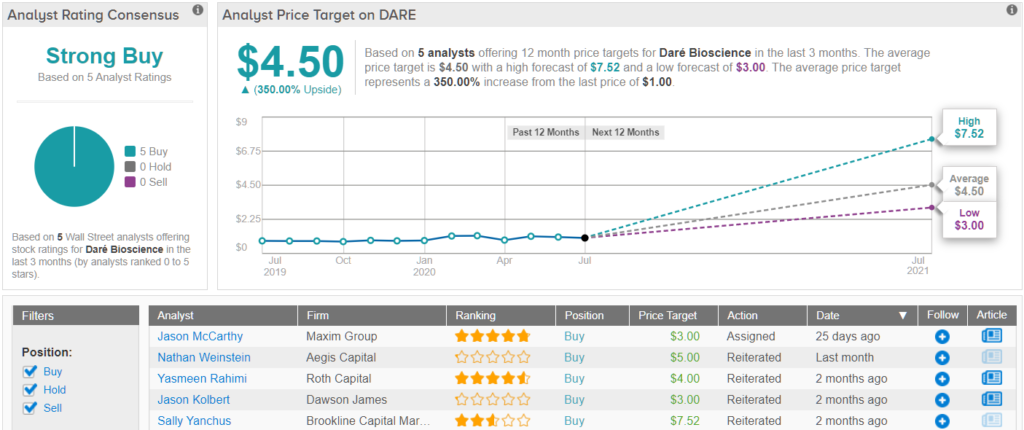

Turning now to the rest of the Street, other analysts are on the same page. With 5 Buys and no Holds or Sells, the word on the Street is that DARE is a Strong Buy. Given its $4.50 average price target, upside of 350% could be in store for investors. (See DARE stock analysis on TipRanks)

Alphatec Holdings (ATEC)

When it comes to Alphatec Holdings, it has undergone a transformation thanks to its new management team, with it now operating as an innovative procedural-driven spine company.

Based on this revamp and its $4.45 share price, major returns could be on the horizon, according to Northland Capital’s Jason Wittes.

Wittes tells clients the restructuring that has taken place over the last two years, which included the sale of its international business and a shift away from lower end distributors that were associated with lower profit and controversial Physician Owned Distributors (PODs), has enabled it to build strong R&D and sales teams as well as attract Key Opinion Leaders (KOLs). “Combined with a highly differentiated product portfolio, we think Alphatec is now positioned for significant growth,” he commented.

Looking at its product portfolio, the company has given it a major face-lift during this transformational period. Wittes points out that 12 products were unveiled in 2019 alone, with each being designed around specific spinal fusion approaches.

“SafeOP, the Company’s novel nerve monitoring platform is unique in its ability to monitor nerve health in real time, not just position, for improving safety and reproducibility—especially with minimally invasive lateral procedures, where there is no direct visualization of the nerves,” the analyst added.

The good news doesn’t end there. ATEC plans to launch its Prone Transposes (PTP) lateral procedure at the North American Spinal Society (NASS) annual meeting in November. Reflecting a new approach to lateral fusions, PTP involves placing the patient in a prone position (stomach) versus on their side.

Calling PTP a “game changer for lateral and ATEC,” Wittes noted, “This approach increases the natural lordotic curvature of the spine for better alignment and cage placement, but also saves time by eliminating the need for patient repositioning when following up with decompression and/ or posterior fixation after the cage is placed (at least 45 minutes of OR time). This is a significant improvement over traditional lateral approaches, including NUVA’s recently launched X360, which attempts to save time by keeping the patient on their side.”

Everything that ATEC has going for it prompted Wittes to rate the stock an Outperform (i.e. Buy) along with a $9 price target. This target implies shares could climb 100% higher in the next twelve months. (To watch Wittes’ track record, click here)

Do other analysts agree with Wittes? They do. Only Buy ratings, 4, in fact, have been issued in the last three months, so the consensus rating is a Strong Buy. At $8.38, the average price target indicates shares could appreciate by 85% in the year ahead. (See Alphatec stock analysis on TipRanks)

Axovant Gene Therapies (AXGT)

With its innovative gene therapies, Axovant wants to transform the way in which neurodegenerative diseases are treated. Trading for $3.14 per share, several members of the Street believe that its price tag and technology platform make it a must-watch name.

Part of the excitement surrounding AXGT is related to its lead asset, AXO-LENTI-PD. The company recently revealed that the enrollment of the higher-dose cohort of its Phase 2 SUNRISE-PD trial for the candidate in Parkinson’s disease has been completed, with the data readout slated for Q4 2020. Speaking to the likelihood of success, the results from the lower-dose cohort were impressive, to say the least.

Among AXGT’s fans is Cantor analyst Kristen Kluska. Highlighting that there aren’t many players using gene therapy to target Parkinson’s disease, she argues that its use of a lentiviral vector also sets it apart. Thanks to the large payload capacity, this vector could potentially include three genes that encode enzymes needed for the endogenous dopamine synthesis (TH, CH1 and AADC).

Expounding on this, Kluska stated, “As it relates to durability, we think there is evidence from ProSavin, where follow-up data has been published up to eight years for some patients (as a reminder ProSavin is considered part of a single development program with AXO-LENTI-PD, as the company has discussed with the agency)… While early (and in small patient numbers), Axovant has established greater improvements from the highest dose of ProSavin in AXO-LENTI-PD.” As a result, the readout in Q4 could serve as a major catalyst for shares.

More than 2 million people suffer from the disease in the U.S. and the EU, and thus, Kluska thinks the candidate has blockbuster potential. “We think that this program remains the largest market opportunity for a gene therapy product that is unpartnered… Even with other competing gene therapies, given the market size we believe there is room for many players,” the analyst explained.

To this end, Kluska rates AXGT an Overweight (i.e. Buy) along with an $11 price target, which implies nearly 250% upside potential from current levles. (To watch Kluska’s track record, click here)

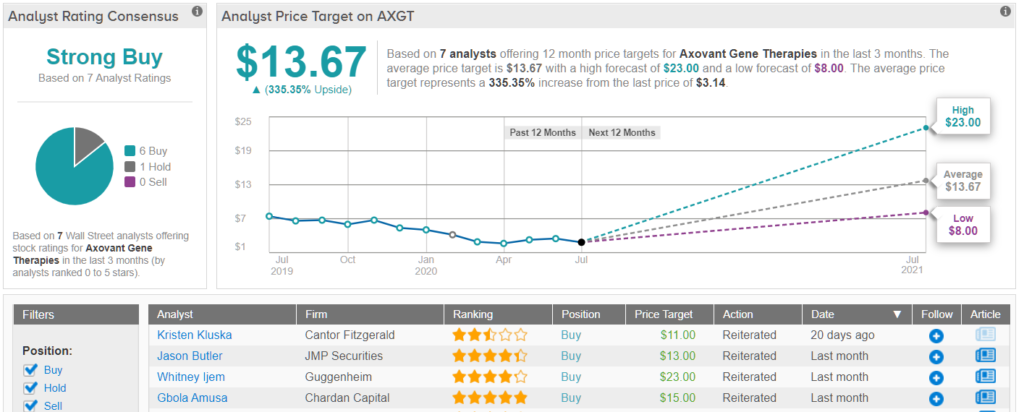

Most other analysts also take a bullish approach. AXGT’s Strong Buy consensus rating breaks down into 6 Buys and a lone Hold. Additionally, the $13.67 average price target, which is more aggressive than Kluska’s, puts the upside potential at a whopping 375%. (See Axovant stock-price forecast on TipRanks)

To find good ideas for penny stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.