For those that thought the extreme market volatility was behind us, think again. Last week, another burst of volatility was brought on by concerns about the U.S. economic recovery and a second wave of COVID-19. This week, however, U.S. stocks recovered some lost ground thanks to strong retail sales data. There’s a lot going on in the markets, and the only certainty is uncertainty.

Against this backdrop, we turned our attention to defensive stocks in the healthcare sector. In general, these stocks provide stable earnings regardless of the stock market’s state due to the constant demand for their products or services.

With this in mind, we used TipRanks’ database to identify three defensive healthcare stocks with upside potential north of 20%. Not to mention each of these companies has earned a “Strong Buy” consensus rating from the analyst community.

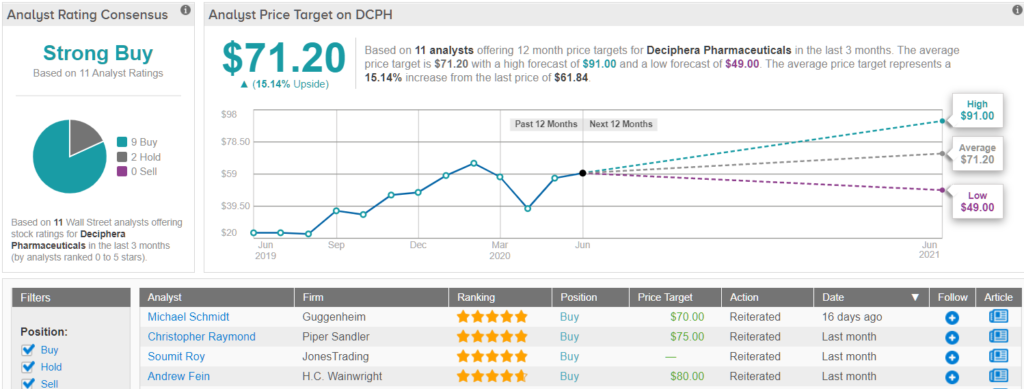

Deciphera Pharmaceuticals (DCPH)

We will start with Deciphera, a biopharmaceutical company which develops cancer medications. On May 15, the company received FDA approval for its QINLOCK™ therapy. The drug is used for the treatment of fourth-line gastrointestinal stromal tumor (GIST), a type of tumor that originates in the gastrointestinal tract.

The good news didn’t end there. On June 8, Deciphera announced that The Lancet Oncology (a medical journal) published positive results from the INVICTUS Phase 3 study of QINLOCK, which featured patients who have been previously treated with anticancer therapies. Data from the study showed a statistically significant improvement in the progression free survival in patients randomized to QINLOCK, compared with patients receiving a placebo.

5-star analyst Christopher Raymond, of Piper Sandler, expressed enthusiasm for QINLOCK. Soon after the company received the FDA’s stamp of approval, the analyst said he expects “meaningful upside in coming months as the setup for the launch of QINLOCK remains quite positive.”

As a result, Raymond rates DCPH an Outperform (i.e. Buy). The analyst believes the stock has more room to run, as he maintains a $75 price target. This implies upside potential of 21% from current levels. (To watch Raymond’s track record, click here)

Like Raymond, other analysts are also bullish on the stock. The 11 ratings on the stock include 9 Buys, only 2 Holds and no Sells, adding up to a Strong Buy consensus rating. The average price target of $71.20 represents a possible 15% increase from the share price of $59.50. (See Deciphera stock analysis on TipRanks)

Laboratory Corporation of America (LH)

Up next is Laboratory Corporation of America, which operates two divisions, LabCorp Diagnostics (LCD) and Covance Drug Development. LCD provides clinical laboratory services such as blood, urine, and COVID-19 tests, while Covance offers services that help clients manage the drug development process.

The company’s sales were only slightly affected by the COVID-19 pandemic. Revenue for the first quarter of 2020 was $2.8 billion, an increase of 1.2% from the prior-year quarter. The increase in revenue was due to acquisitions, partially offset by the negative impact from COVID-19. However, earnings took a bigger hit thanks to the public health crisis, as the operating loss for the quarter was $193 million, compared to operating income of $318 million in the first quarter of 2019.

J.P. Morgan analyst Lisa Gill believes Laboratory is better positioned than the competition because of its income diversity, with it also less exposed to upcoming Medicare cuts. To provide additional support for her bullish thesis, the 5-star analyst cites improving trends in the company’s core business.

To this end, Gill rates LH an Overweight (i.e. Buy), while raising her price target from $118 to $223. The new figure implies upside potential of 31% from current levels. (To watch Gill’s track record, click here)

Turning now to the rest of the Street, most other analysts are on the same page. Laboratory has a Strong Buy analyst consensus rating comprised of 10 Buys, 3 Holds and no Sell ratings. The average price target on the stock is $213.27, which suggests 25% upside potential. (See LH stock analysis on TipRanks)

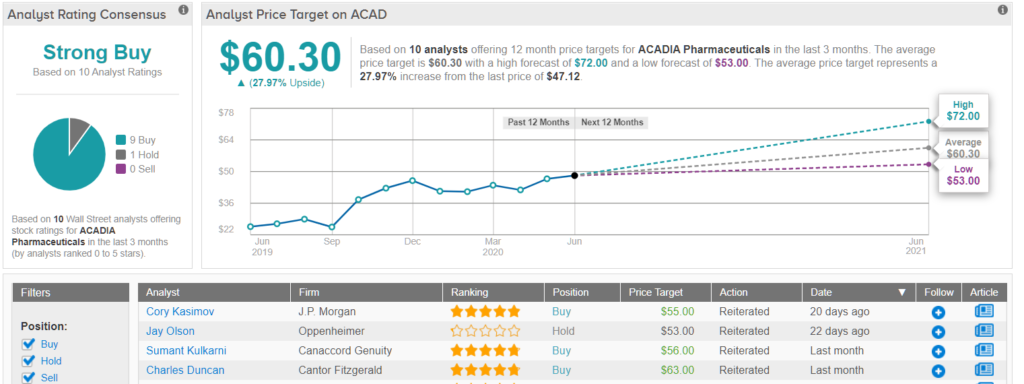

ACADIA Pharmaceuticals (ACAD)

Last on our list is ACADIA, a biopharmaceutical company that designs medications for central nervous system disorders. ACADIA has developed the only approved therapy for the treatment of hallucinations and delusions associated with Parkinson’s disease psychosis, NUPLAZID.

Despite COVID-19, sales of NUPLAZID increased 43% to reach $90.1 million for the three months ended March 31, 2020, compared to $63 million in the first quarter of 2019.

In addition, management announced it completed a pre-sNDA meeting (a meeting between a company and the FDA to ensure the submission of a well-organized NDA), and is on-track to submit a supplemental NDA this summer for NUPLAZID as a potential breakthrough therapy for DRP (drug related problems) and MDD (major depressive disorder).

5-star analyst Charles Duncan, representing Cantor Fitzgerald, viewed management’s announcement positively. In a recent research note, he cited the company’s positive outlook as a major component of his bullish thesis. “Pipeline driven potential is more than additive to our view that NUPLAZID is continuing to gain traction on volume growth by increasing penetration and persistence,” he stated.

To this end, Duncan has an Overweight (i.e. Buy) rating on the stock. Along with his rating, the analyst gave the price target a lift, from $58 to $63, implying 34% upside potential. (To watch Duncan’s track record, click here).

Other analysts on the Street agree with Duncan and also have high expectations for the stock, with 9 Buys and 1 Hold resulting in a Strong Buy consensus rating. The average price target is $60.30, which implies upside potential of 27%. (See ACADIA stock-price forecast on TipRanks)

To find good ideas for healthcare stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.