Love it or hate it, blockchain-based cryptocurrencies are not going anywhere. Whether or not they’ll make a permanent mark on the way we conduct our online business – using currency for trades and purchases – is still up in the air, but there can be no doubt that crypto has brought blockchain mainstream and introduced a new trading asset to our portfolios.

Deutsche Bank, in a broad-based, end-of-year survey looking at a market trends heading into 2022, included a section on crypto, with some fascinating results. Research analyst Brian Bedell tells us that a large majority of respondents on the crypto section “expect to increase their cryptocurrency usage which amounts to 70% or higher whether than [sic] be trading, investing, or transacting.”

This makes sense, given the concluding point, “that 60% agree that cryptocurrencies have some form as a store of value, which has been a topic of debate as the product has gained more acceptance.”

All of this brings us to the point of crypto-related stocks. There are plenty of companies out there involved in the crypto craze, and investors can usually find a way into crypto through the stock market. Bitcoin mining, digital currency financing, online trading — all provide unique sets of attributes.

With this in mind, we’ve dipped into the TipRanks database to pull the details on three crypto stocks, to find out what’s making them tick. The platform revealed that these are Strong Buy tickers, and, more importantly, all three offer considerable upside potential. Let’s take a closer look.

Stronghold Digital Mining (SDIG)

Let’s start with Stronghold, a bitcoin mining company with a twist. Stronghold has based its power usage – which in bitcoin mining is always substantial – on an ‘environmentally beneficial coal refuse power generation facility,’ giving it a Tier II alternative energy system classification in the state of Pennsylvania. Stronghold boasts that it is using 21st century bitcoin mining and energy tech to help clean up the environmental messes of previous eras.

The cleanup is big. Stronghold has two power generation facilities in Pennsylvania, putting out 80 megawatts and 85 megawatts respectively. Both use the environmentally dangerous coal refuse as fuel, permitting cleanup in older coal mining areas, safe disposal of the pollutant coal piles, and plenty of power for bitcoin miners to tap.

Stronghold this month entered into an agreement to acquire 9,080 bitcoin miners with a combined capacity of 826 petahash per second. These will be housed on-site with the power facilities, for maximum efficiency. Delivery of the first 4,800 miners is expected to be complete in early January, with the remainder coming in 1H22. The first 4,800 miners have a total cost to the company of $35.7 million, or $84 per terahash per second.

These new miners will join Stronghold’s existing bitcoin mining infrastructure, which totals 54,000 miners installed or contracted, and boasts a hash rate of 5.2 exahash per second.

Stronghold entered the public trading markets in October of this year, through an IPO. The company put 6.68 million shares on the market, $19 each, above the expected pricing of $16 to $18. The IPO raised over $127 million, instead of the $90 million initially filed for. Trading began on October 20, and the stock closed that day above $28. It has since fallen 61%.

In coverage for Compass Point, analyst Giuliano Bologna acknowledges Stronghold’s major point of differentiation with its peers – that it combines power generation and bitcoin mining on site. He adds, “The combination is expected to result in one of the lowest costs of electricity in the sector at ~$18 per MW. The company’s goal is to build out ~300 MW of aggregate hosting capacity by the end of FY22 which supports SDIG’s target of ~8 EH/ s of hash power with a fleet of ~85,000 miners by the end of FY22. We estimate SDIG’s miners and order book total ~3.76 EH/s of hash power by the end of FY22 which is likely an overhang on the company’s valuation looking at an 8 EH/s FY22 target; securing additional definitive orders for miners would be a significant positive catalyst for SDIG shares, in our view.”

Everything that Stronghold has going for it prompted Bologna to rate the stock a Buy along with a $35 price target. This target implies shares could climb ~209% higher in the next twelve months. (To watch Bologna’s track record, click here)

While there are only three analyst reviews on this new stock, they all agree that it’s a Buy proposition, making the consensus rating a Strong Buy. Stronghold shares are priced at $11.31 and the $35 average price target matches Bologna’s, with its 209% upside. (See SDIG stock analysis on TipRanks)

Silvergate Capital (SI)

Next up, Silvergate, is a California-chartered commercial bank that specializes in providing financial services for the digital currency industry. Silvergate has a 21-year history of profitability, and boasts a $4.7 billion market cap. The company has over 1,300 digital currency and fintech clients in its customer base.

During the third quarter of 2021, the company saw strong sequential gains in its digital currency business. Total digital currency customers grew from 1,224 to in Q2 to 1,305, while average digital currency customer deposits expanded from $9.9 billion to $11.2 billion. Fees related to the digital currency segment were more volatile; the $8.1 million brought in was down from the Q2’s $11.3 million but still up 145% yoy.

Overall, the company’s earnings came in at 88 cents per share. This was up 10% from the 80 cents recorded in Q2, and up 137% from the 37 cent EPS print in 3Q20.

Looking at Silvergate for B. Riley, 5-star analyst Steve Moss is attracted to the leading crypto bank for a number of reasons.

“First-mover adoption of crypto and blockchain technology supports expansion into areas that create long-term franchise value. SI is recognized for its first-mover advantage and the network effect created by the SEN. We believe SI’s reputation is likely to result in expansion into other areas, some of which are unforeseen today. Significant opportunities likely include markets with high friction costs, such as payments, with SI as a potential competitor to Visa and Mastercard (combined market caps of $733B), or remittance ($13B market cap for the largest three),” Moss noted.

“As Silvergate continues to expand its SEN, or ultimately uses blockchain technology to form a competitive payments system, we believe the stock will be worth multiples above its current market cap,” Moss summed up.

Moss’ comments support his Buy rating on SI shares, and he sets a $260 price target which suggests an upside potential of ~69% for the coming 12 months. (To watch Moss’s track record, click here)

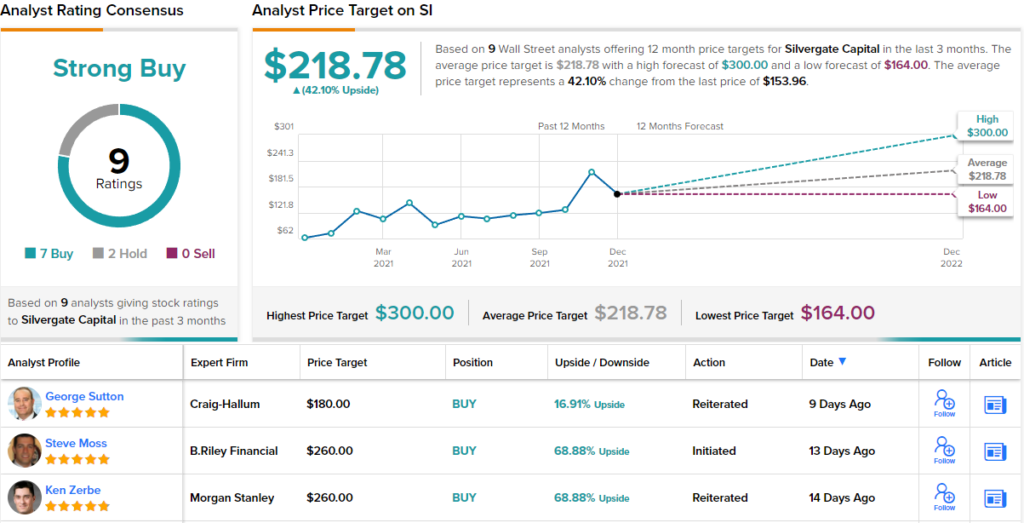

Overall, Silvergate has accumulated 9 reviews from the Wall Street analysts, and these break down to 7 Buys and 2 Holds — and support a Strong Buy analyst consensus rating. The shares are priced at $155.74 and their $218.78 average price target implies a one-year upside of 42%. (See Silvergate stock forecast on TipRanks)

Coinbase Global (COIN)

Last but not least is Coinbase Global, a major name in cryptocurrency exchange. The company operates an exchange platform with over 70 million verified users, trading more than $327 billion in crypto every quarter, across more than 100 countries. Coinbase boasts a market cap of $68 billion, and claims over $255 million in assets on its platform.

In April of this year, Coinbase went public on the NASDAQ through a direct listing. The stock closed its first day at $328 per share an seen a high level of volatility in the months since. Shares are now down 20% from their first day’s close.

The recent fall-off in share value came when the company missed expectations in its November Q3 financial report. Revenue came in at $1.3 billion, down 41% from Q2 – but also below the $1.6 billion that Wall Street had expected to see. Net income in the quarter dropped 75% to $406 million.

Digging deeper, Coinbase’s losses are coming hand-in-hand with price drops in Bitcoin. BTC makes up 42% of Coinbase’s assets, and so has a disproportionate effect on COIN’s fortunes. This issue should moderate, as the Bitcoin share of COIN’s assets is dropping; it was 57% a year ago. Other crypto coins are growing popular, and the diversification should be good for Coinbase.

Among the bulls is BTIG’s 5-star analyst Mark Palmer who sees plenty of reasons to buy into COIN stock, and in his note on the company he lays them out: “1) COIN is investing in brand marketing (i.e., in October, COIN became the exclusive crypto platform partner of the NBA). We believe these initiatives, while nascent, are prudent given data privacy changes pressuring performance marketing; 2) Direct deposit launch — aims to provide more onramps for the crypto economy (payroll in crypto) which should drive inflows and stickiness; 3) Coinbase Card – while volume metrics have not been disclosed, mgmt noted they are seeing strong retention and m/m activity. 4) MTUs beat expectations: 3Q21 MTUs were 7.4mn, ahead of consensus of 7.03mn and our 5.63mn…”

To this end, Repetto gives COIN shares an Overweight (i.e. Buy) rating, and his $440 price target indicates room for ~68% share growth in the year ahead. (To watch Repetto’s track record, click here)

Wall Street has learned to pay attention to crypto, and Coinbase has 15 analyst reviews. The reviews include 13 Buys, 1 Hold, and 1 Sell, for a Strong Buy consensus rating. The current trading price is $268.15, and the average price target of $406.33 suggests that COIN will gain 55% by the end of 2022. (See COIN stock analysis on TipRanks)

To find good ideas for crypto stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.