Optimism is on the rise, and investors are wondering if stocks are heading towards recovery territory. So, what does this mean for one industry that has largely outperformed the broader market amid the pandemic?

Just in time for summer, J.P. Morgan strategists looked at the biotech sector’s average summertime performance over the last 19 years, versus the S&P 500, to gain insights regarding what the next few months have in store for the space. Contrary to popular belief, the biotech indexes, NBI and IBB, bested the S&P 500 during the summer season in 12 out of 19 years, including 7 of the last 10.

Not to mention for the 11 years that the NBI was up going into summer, the space rounded out the year in the green 8 times. While COVID-19 could impact summer results, historically, this could bode well for the NBI, which is up 11.7% year-to-date.

Bearing this in mind, focus has narrowed in on the biotech space. That said, seasoned veterans of the Street know that these names come with a significant amount of risk due to the industry’s nature. For biotech companies, indicators like data readouts or regulatory verdicts are used to gauge the health of long-term growth narratives rather than financial results, and thus, any update can act as a catalyst capable of sending shares in either direction.

Acknowledging the risk involved, we used TipRanks’ database to take a closer look at three biotech stocks currently trading for under $5 apiece ahead of upcoming catalysts. All three tickers boast massive upside potential and have earned overwhelmingly bullish support from analysts, enough so to score a “Strong Buy” consensus rating.

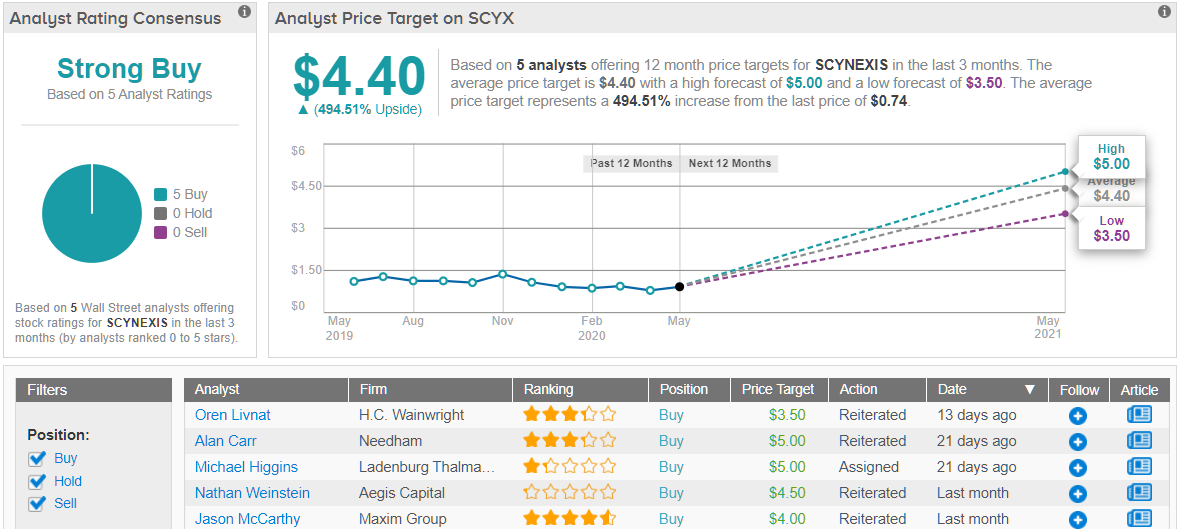

SCYNEXIS, Inc. (SCYX)

Working on a cutting-edge anti-fungal asset, oral and IV ibrexafungerp (SCY-078), SCYNEXIS hopes to address the unmet medical needs of patients with difficult-to-treat and life-threatening fungal infections. With the candidate’s NDA submission slated for Q3 2020, several members of the Street believe that at $0.75 per share, investors should pull the trigger.

In a recent update, SCYX announced positive results from both the VANISH-306 trial and the FURI study, which are evaluating ibrexafungerp in vulvovaginal candidiasis (VVC) and severe fungal infections, respectively.

Marking the successful completion of the VANISH program, VANISH-306 saw the therapy demonstrate superior rates of resolution of symptoms at day 10, which was the test of cure, compared to the placebo.

Weighing in for Ladenburg, analyst Michael Higgins argues that because it has been 20 years since the only drug, Diflucan (fluconazole, “FLU”), was approved to treat VVC, the market should be very open to a new solution.

Higgins added, “In acute VVC, we believe ibrexa’s mid-70% rate of efficacy at day 25 will impress physicians when pared to FLU’s mid-50% rate (per its label)… And finally, we believe ibrexa has a key, >one-year lead, over any competitor and its one-day regimen (300mg BID) to secure its leading position among any branded competitor.”

Looking at the second interim efficacy analysis of the Phase 3 open-label FURI study, the data also impressed. In-line with the first interim readout in January 2019, 17 out of 21 additional patients, who had untreatable, refractory fungal infections, also experienced a complete or partial response, or even stable disease.

Higgins points out that two FURI abstracts will be presented at the European Congress of Clinical Microbiology and Infectious Diseases (ECCMID) conference this year. “The FURI abstracts show that Candida glabrata is the most common fungi among FURI’s refractory patients. More important, is that ibrexa successfully treated the C. glabrata infections, as this is a pathogen that is becoming more common and is currently highly resistant to azoles,” he commented.

All of this combined with its two additional studies of ibrexafungerp that could give the asset even more commercial opportunities prompted Higgins to remain squarely in the bull camp.

To this end, the analyst reiterates a Buy rating and $5 price target, indicating 575% upside potential from current levels. (To watch Higgins’ track record, click here)

Do other analysts agree with Higgins? As it turns out, they do. With 100% Street support, or 5 Buy ratings to be exact, the message is clear: SCYX is a Strong Buy. At $4.40, the average price target puts the upside potential at 494%. (See SCYNEXIS stock analysis on TipRanks)

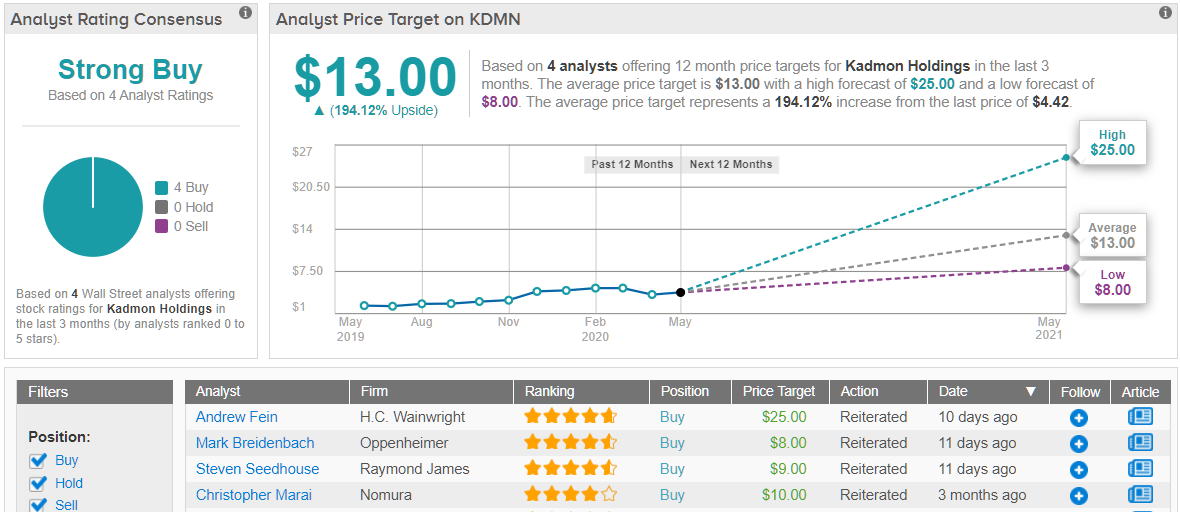

Kadmon Holdings Inc. (KDMN)

With the goal of providing effective solutions for autoimmune, inflammatory and fibrotic diseases as well as immuno-oncology, Kadmon develops and commercializes innovative therapies. Currently going for $4.44 apiece, the analyst community thinks the share price reflects an attractive entry point.

On May 21, the company updated investors on its pivotal ROCKstar study of KD025 (belumosudil) in chronic graft-versus-host disease (cGHVD), releasing data from the study’s primary analysis at six months post-enrollment completion. This data revealed that response rates got even deeper compared to the data from the interim analysis at two months post-enrollment completion, with ORR rates between 73-74% in the 200mg QD and BID arms, versus 64-67% as of the last update.

Commenting on the results for Cantor, analyst Eliana Merle said, “Importantly, we think the safety profile continues to look strong with no increased rate or risk of infections reported by the investigators, which we think will be a major commercial differentiator. From a stock perspective, although we think investors expected this data to be positive and for the response rates to improve with time, we think this strong update could serve as a clearing event for shares ahead of potential near-term commercial opportunity (NDA filing guided for 4Q20).”

Ahead of this key catalyst, Merle estimates that peak sales could reach $500 million, versus $700 million cap, with this large market opportunity potentially causing interest levels among market watchers to spike.

The good news kept on coming. KDMN also announced that it plans on submitting the NDA under the FDA’s pilot Real-Time Oncology Review (RTOR) program. Even though Merle notes that it’s unclear exactly how this will impact review timelines, she believes it makes 2021 approval likely.

As the candidate has also received breakthrough designation, the deal is sealed for Merle. Along with a Buy rating, she reiterated a $10 price target. This target conveys her confidence in KDMN’s ability to soar 125% in the next twelve months. (To watch Merle’s track record, click here)

What does the rest of the Street think about KDMN? It turns out that other analysts also have high hopes. Only Buy ratings have been received in the last three months, 4 to be exact, so the consensus rating is a Strong Buy. More aggressive than Merle’s, the $13 average price target suggests 194% upside potential. (See Kadmon stock analysis on TipRanks)

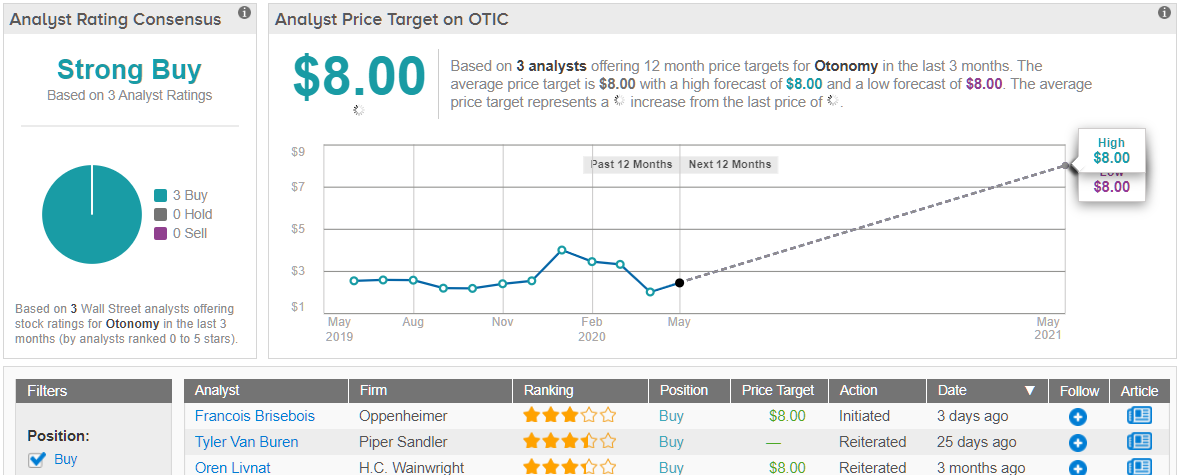

Otonomy, Inc. (OTIC)

Primarily focused on developing treatments for disorders of the ear that disrupt hearing, balance and connection, Otonomy wants to improve the lives of people impacted by the debilitating effects of these conditions. While COVID-19 has weighed on the company, some analysts believe that at $2.56, its share price presents investors with a unique buying opportunity.

Given the significant pandemic-induced slowdowns, OTIC was forced to withdraw trial timelines. That being said, H.C. Wainwright’s Oren Livnat remains optimistic based on the strength of Otividex, its sustained exposure dexamethasone intratympanic (IT) injection for Meniere’s disease (MD).

It should be noted that the candidate previously had one positive European Phase 3 study (AVERTS-2) but failed in one U.S. Phase 3 study (AVERTS-1), with the company currently conducting a third global study. Originally, the data readout for the study was expected to come by the end of Q3, but now Livnat predicts a one-quarter delay.

“We have no reason to think the integrity of the study is compromised as the primary endpoint was always collected via daily telephone diaries (not visits), and compliance apparently remains high. We remain optimistic that the final Phase 3 will replicate successful results seen in AVERTS-2 and the earlier Phase 2b… bolstered by more careful site selection and patient screening, not advertising, and improved communication and training to limit placebo response. Assuming a manageable delay, assuming success, we project 2022 launch and peak of $300 million sales for this underserved condition with no approved therapies,” Livnat explained.

On top of this, management stated it hopes to release top-line results from the Phase 1/2 of OTO-313 (IT gacyclidine) in tinnitus and that it has resumed the enrollment for the Phase 1/2 program evaluating OTO-413 (IT BDNF) in cochlear synaptopathic speech-in-noise hearing loss.

Also exciting, Livnat highlights the fact that OTIC and its partner, Applied Genetic Technologies, presented preclinical results for their AAV-based gene therapy for congenital hearing loss associated with GJB2 deficiency, with the data demonstrating that novel capsids are generating targeted gene expression in support cells throughout the cochlea. For at least twelve-weeks after one injection, no signs of cellular toxicity were witnessed.

Based on all of the above, it’s no wonder Livnat reiterated his bullish call. Given the $8 price target, shares could skyrocket 213% in the next twelve months. (To watch Livnat’s track record, click here)

Turning now to the rest of the Street, other analysts also like what they’re seeing. 3 Buys and no Holds or Sells have been assigned in the last three months, making the consensus rating a Strong Buy. Additionally, the $8 average price target matches Livnat’s. (See Otonomy stock analysis on TipRanks)

To find good ideas for biotech stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.