Which stocks are leading the pack out on Wall Street? Biotechs. Understandably, investors have taken a more cautious approach when navigating the confused financial environment, but focus is locking in on the biotech sector as it has been able to withstand the COVID-19-induced pressure on the market. Proving to be relatively defensive, the biotech indexes, XBI and IBB, have outperformed the broader market year-to-date, with each gaining over 10% compared to the S&P 500’s 8% decline.

The space’s resilience combined with a limited impact on Q1 fundamentals and the elimination of macro headwinds regarding drug legislation, has caused sentiment surrounding 2H20 performance to swing strongly positive.

While there certainly are exciting opportunities at play, biotech stocks aren’t for the faint of heart. Seasoned market watchers know that they are notoriously volatile, prone to huge movements on account of a single update. This makes them riskier investments, but it also enables them to deliver massive returns.

Taking all of this into consideration, we used TipRanks’ database to search the Street for compelling, yet affordable names housed in the biotech space. We found three stocks trading for less than $5 that are backed by enough Wall Street analysts to earn a “Strong Buy” consensus rating. If that wasn’t enough, each boasts explosive upside potential.

BioLineRx Ltd. (BLRX)

Primarily focused on oncology, BioLineRX in-licenses cutting-edge compounds, develops them through clinical stages and then partners with pharmaceutical companies for further clinical development.

Tuesday was a rough day for BioLineRx investors. Shares tumbled nearly 30% following the announcement of an equity offering. The company priced 5,142,859 shares at $1.75 apiece, which was well below the $2.39 per share where the stock had been trading.

Yet, with significant potential catalysts slated for 2020 and a share price of $1.60, several members of the Street believe that now is the time to snap up shares.

In spite of COVID-19, its upcoming data readouts remain on track for this calendar year, including top-line results from the Phase 3 GENESIS trial. The study is looking at its BL-8040 candidate as a stem cell mobilization agent for multiple myeloma patients undergoing autologous transplant, with the trial specifically comparing motixafortide and G-CSF versus G-CSF alone.

With the trial’s patient accrual progressing according to plan and no material protocol deviations witnessed to date, Oppenheimer’s Mark Breidenbach believes the data release, which is slated for 2H20, will be a “large-impact catalyst.”

Expounding on this, the 5-star analyst stated, “Assuming positive data, management would likely engage with a partner to assist with the registrational filing and potential launch of motixafortide in stem cell mobilization… Based on prior data from a lead-in cohort, we remain confident that GENESIS can hit its primary endpoint, which could help attract a strategic collaboration to support commercialization.”

On top of this, motixafortide is being evaluated across several indications, and PFS/OS data from the COMBAT/ KEYNOTE-202 trial in pancreatic cancer is scheduled for a mid-year release, with it aiming to publish interim results from the randomized Blast trial in AML in 2H20.

Additionally, PFS/OS results from the COMBAT/KEYNOTE-202 triplet regimen (motixafortide, pembro and chemo) could be presented at a medical conference early this summer. Breidenbach pointed out, “The triplet previously yielded a 32% ORR and 77% disease control rate as of December 19 data cutoff. If the triplet combination suggests a PFS/ OS benefit, we would expect BioLineRx to seek a strategic partner for continued development.”

To this end, Breidenbach left an Outperform (i.e. Buy) rating and $11 price target on the stock. Based on this target, shares could soar 567% in the next twelve months. (To watch Breidenbach’s track record, click here)

Like Breidenbach, other analysts also take a bullish approach. BLRX’s Strong Buy consensus rating breaks down into 3 Buys and no Holds or Sells. Given the $11.33 average price target, a possible twelve-month gain in the shape of 587% could be on the horizon. (See BioLineRx stock analysis on TipRanks)

Aldeyra Therapeutics (ALDX)

Hoping to develop medicines capable of improving the lives of patients with immune-mediated diseases, Aldeyra’s pipeline focuses on inhibiting inflammatory cells linked to ocular and systemic conditions that aren’t sufficiently addressed by available treatments. Currently going for $4.11 apiece, several members of the Street recommend that investors pull the trigger.

Recently, ALDX has found itself on investors’ radar as a result of its potential COVID-19 treatment, ADX-629. Writing for Laidlaw, analyst Yale Jen points out that the urgency of the pandemic and the likely MOA of TH1, TH2 and TH17-related cytokines reduction prompted the company to design three Phase 2 studies looking at ADX-629 in COVID-19 respiratory compromise (reducing impact from cytokine storm), autoimmune disease (associated with TH1 cytokines) and allergy (associated with TH2 cytokines). The first’s initiation is slated for Q3 2020, and the others should start in 2H20.

“With this arrangement, ALDX could gain substantial insights into the anti-inflammatory effects ADX-629 might have in the clinic. We estimate the COVID-19 trial could be a placebo study for gaging the therapeutic impact of reducing or mitigating the disease worsening after the initial infection,” Jen commented. Additionally, the study could help the company design or adjust trial designs for the other two indications.

Adding to the good news, ALDX is expected to have a meeting with the FDA to finalize the study design of part two of the RENEW trial, with it potentially kicking off the pivotal study in 2H20 after the COVID-19 situation improves.

As for the Phase 3 ALLEVIATE trial data readout, it will most likely come in 1H21 due to the unexpected extended allergy season this year that increased the number of patients with red eye, which makes them ineligible for the study. Jen also acknowledges that COVID-19 has reduced the availability of doctors and patients able to participate in clinical studies. However, he argued, “Together, with ADX-629 taking the center stage, while other studies being slowing down, we do not view the fundamental of ALDX has been eroded in anyway… We think ALDX shares remain under-exposed and under-valued.”

Based on all of the above, Jen stayed with the bulls. Along with a Buy rating, he kept a $30 price target on the stock. This implies upside potential of a massive 630%. (To watch Jen’s track record, click here)

What does the rest of the Street think about ALDX? It turns out that other analysts also have high hopes. Only Buy ratings have been received in the last three months, 4 to be exact, so the consensus rating is a Strong Buy. In addition, the $26 average price target suggests 533% upside potential. (See Aldeyra stock analysis on TipRanks)

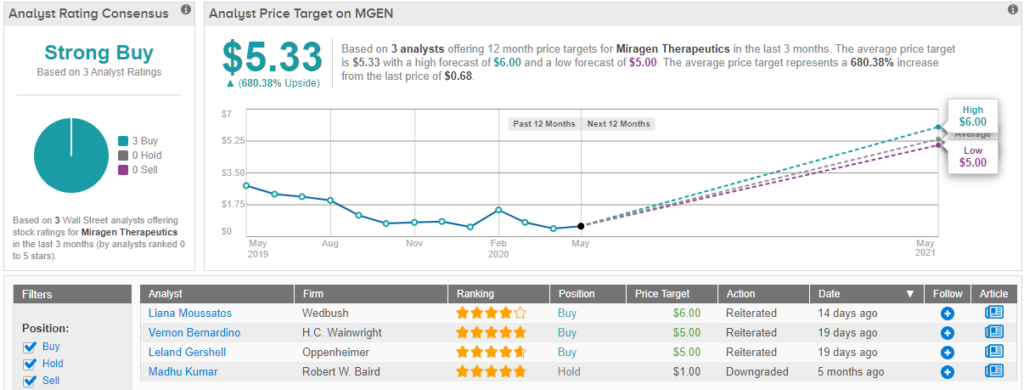

Miragen Therapeutics Inc. (MGEN)

Offering a compelling microRNA pipeline led by its cobomarsen asset, Miragen believes its therapies could potentially address the unmet needs in cancer and other diseases. At only $0.68 per share, the analyst community thinks that even though COVID-19 has presented headwinds, the share price reflects an attractive entry point.

When it comes to MGEN’s SOLAR trial, it has come under pressure. While the trial is progressing with a modified design, the execution is facing challenges as patients have been missing doses and site visits due to COVID-19. Up to one month of medication can be missed per protocol and the implementation of home infusions has been lessening, but on-site evaluations are essential because they are required for mSWAT measurements and can’t be performed remotely. The implications? A data readout will most likely come later than previously expected.

Representing Oppenheimer, 5-star analyst Leland Gershell remains unphased by the delay. “Following encouraging observations of prolonged disease stabilization with cobomarsen as seen in patients with residual disease post-chemo/other treatment, MGEN is exploring an expedited path to a label for this aggressive malignancy. It plans to soon request an FDA meeting to discuss, and while hopeful that this will occur in 3Q, cautioned on delay given agency prioritization of COVID-19-directed initiatives,” Gershell said.

That said, there is a bright spot for MGEN, in Gershell’s opinion. According to the analyst, there’s a significant opportunity for its MRG-229 candidate in IPF because similar to remlarsen, “this candidate is an miR-29 mimic and hence may offer utility to address fibrotic conditions (in which miR-29 is profoundly deficient).”

Gershell explained “MGEN’s program has NIH/Yale grant support, and recent progress triggered additional funding. MRG-229 represents a differentiated approach to IPF, a progressive and fatal lung disease poorly met by current options.” He added, “With just a $12 million EV, we believe any pipeline progress could spark interest in MGEN.”

All of this led Gershell to reiterate an Outperform (i.e. Buy) rating on MGEN along with a $5 price target, which suggest an explosive upside potential of 632%. (To watch Gershell’s track record, click here)

Looking at the consensus breakdown, other analysts are on the same page. With 3 Buys and no Holds or Sells, the word on the Street is that MGEN is a Strong Buy. At $5.33, the average price target puts the upside potential at 680%. (See MGEN stock analysis on TipRanks)

To find good ideas for biotech stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.